Articles

First UK high street bank to jump into the world of mobile savings goals. - 11FS

Yesterday we saw Nationwide launch a new Savings Goal feature within its mobile banking app. It takes a different approach to savings, prompting customers to set a goal of the total amount of their savings account at a particular date.

Gates Foundation Interview - What Banks Can Learn from the Frontline of Financial Inclusion

Over the past twelve months, we’ve been seriously busy here at 11:FS. Now we’re announcing arguably the most exciting project we’ve ever taken on.

Regulation Sandbox Changes the Rules of Fintech Playground

Sarah Kocianski should be familiar to all of you now, she has hosted our three podcasts: Fintech Insider, Blockchain Insider, and Insurtech Insider, as well as penned many of our blog posts and reactions to major news in the fintech space. I had a chance to sit down with Sarah and talk to her about what makes her most passionate about fintech and what she believes needs to happen most in business.

"My Bank Already Has An App!"

That’s what 11:FS bank building guru Jason hears when he tells people that he’s just spent the last two years building a new digital bank, and they’re right!

Top 10 Things To Know About Blockchain This Week

The Pulse team spends their time trawling through the world of banks and fintech apps, sorting the good from the bad so you don’t have to.

Why Should a Central Bank Issue a Digital Currency?

In this blog post Simon Taylor explores the concept of a Central Bank Digital Currency and why you would want a DLT (or “Blockchain”) like architecture for such a system.

Bank Innovation – Why are the most innovative banks outside the UK? Case Study: @HellenicBank

I hope I am not about to shatter anyone’s egos here but this is something that has puzzled me for a long time; Why are most innovative banks outside the UK? So what’s the deal? The UK is the center of the FinTech world, on most people’s listings. We have the regulator who supports innovation and we have a blossoming design and technology pool to pluck talent from. So why I ask are UK banks the “also rans” of European banking innovation fronts? How can this be the case?

BaaP (Banking as a Platform) Part 2 - How could banks develop their platform levers?

If you missed Part 1 of this 2 part piece then you can catch it here and catch up with the rest of the class: BaaP (Banking as a Platform) Part 1 – Why haven’t we seen a banking platform play?

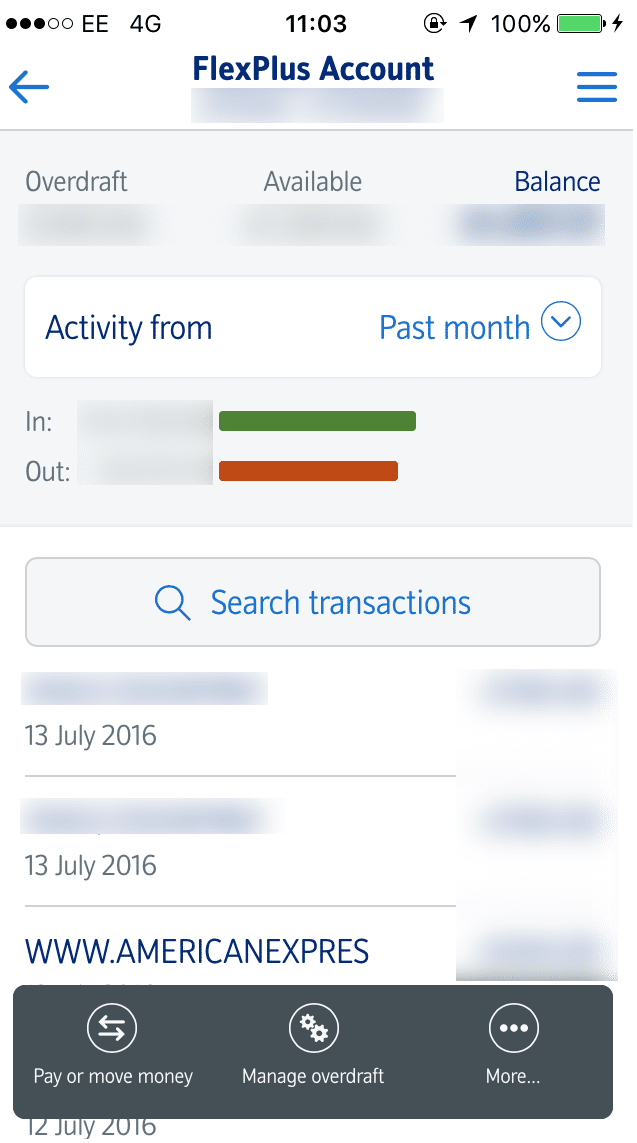

Nationwide's New App - A great example of how the little things add up.

Do you remember where you were when you first spotted that hot coral card in the queue at a coffee shop? For me, it was early 2016. A short while after they’d changed their name from ‘Mondo’ but still early enough to feel like I was an ‘early adopter’. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

How will Brexit impact banks and FinTech in the UK?

11:FS CEO David M. Brear reached out to his followers on LinkedIn to ask for their thoughts on the following conundrum: what do you think the future operating model looks like for financial services and why?

The Rebundling of UK Financial Services

Death. It's inevitable. It's also a financial nightmare most don't see coming. But what if you could save tens, if not hundreds of thousands of dollars during this grim process?

Jurassic Bank – Why banks will have to go the way of the dinosaurs

The landscape for fintech and banking is evolving more rapidly than ever, and in case you weren’t aware, there’s a war going on for your customers. With challengers attacking from left, right, and centre, it’s never been more important to stay on top of the latest and greatest UX innovation. Pssst – click here to go straight to the goods and request a demo of 11:FS Pulse.

BaaP Part 1 - Exploring Banking as a Platform (BaaP) Model

The opportunity to change the way we deliver financial services is changing as new channels, products and partnerships are being explored. Banking as a Platform (BaaP) is one of the alternatives.By me, David M. Brear, CEO and Co Founder at 11:FS and Pascal Bouvier, Venture Partner at Santander InnoVentures

2016 Predictions - Expert FinTech panel predicts the biggest winners and losers in 2016 banking. - 11FS

While 2015 was just awesome on nearly all fronts, I think the close of the year has left us with a cliff hanger that George RR Martin would be rather proud of. For the curious among you, the question remains what’s next? What will 2016 bring? Across the actors and audiences, we feel there are the 9 questions we need to answer to be able to gauge who the winners and losers in 2016 banking will be. To get to the bottom of these questions, we have given our opinion, have asked a panel for their inputs and have asked a few expert friends of Think Different Group also for theirs.

AI in Banking: We got it wrong. Bank customers should be talking to a something not a someone. - 11FS

“Hey Siri – Are you the bank of the future?”… “No comment, David” – Sometimes when someone says no comment that means no but when the thing saying it is a computer assistant then “no comment” means someone has taken the time to think about it and decide upon a snarky comment rather than nothing at all! For years AI has been a good idea without real world application or the processing power, connectivity or interface intelligence to maximize the opportunity. In the last 6 months, and ever increasingly, those restrictions are being removed unlocking huge potential.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)