Mortgages

How building societies can own the homebuying space

Looking to crypto and seeing it simply as a speculative asset class is a common mistake for financial institutions and even regulators. But if you start to look beyond the headlines, you can see there’s untapped potential for banks to better serve the SMB market.

Banks: Fix your mortgage process by becoming truly digital

This article was originally published in February 2021. In light of a looming cost-of-living crisis, soaring inflation and spiralling interest rates, we feel it’s more relevant now than ever. So, after a bit of tinkering, we’ve republished it. Enjoy.

7 companies changing the UK mortgage landscape

The financial services industry has faced an enormous amount of disruption in recent years. We’ve seen significant changes everywhere from payments to current accounts and investments accounts to modern credit products.

What is embedded finance?

While FinTech folk salivate – and the big banks bloviate – about PSD2 and the open banking reforms coming our way in 2018, we wondered whether those outside of this bubble will actually notice? What does PSD2 actually mean for customers?

Leading a bank through a pandemic

Guest author Richard Davies gives his thoughts on the importance of scaling agile to all functions of an organisation, and some key factors on how to get there.

How are consumer lenders responding to the coronavirus pandemic?

Until 2018 Australia hadn’t had a new, homegrown bank for decades. The Australian banking industry had been dominated by four huge banks who, facing no competition, rested on their laurels.

Vadim Toader - Proportunity: mortgage innovation putting homes within reach

Creating a successful new venture is not easy. There are many pitfalls and risks involved from funding to technology. The biggest challenge though is designing something customers love.

Why are mortgages broken and confusing?

It’s no secret that mortgages are a broken process. Research by Habito revealed that 62% of those who go through the process felt stressed out. And from personal experience, I can tell you that remortgaging is a hugely difficult and opaque process. How can this be the case in 2019?

764

764. Insights: Can the UK avoid a mortgage market meltdown?

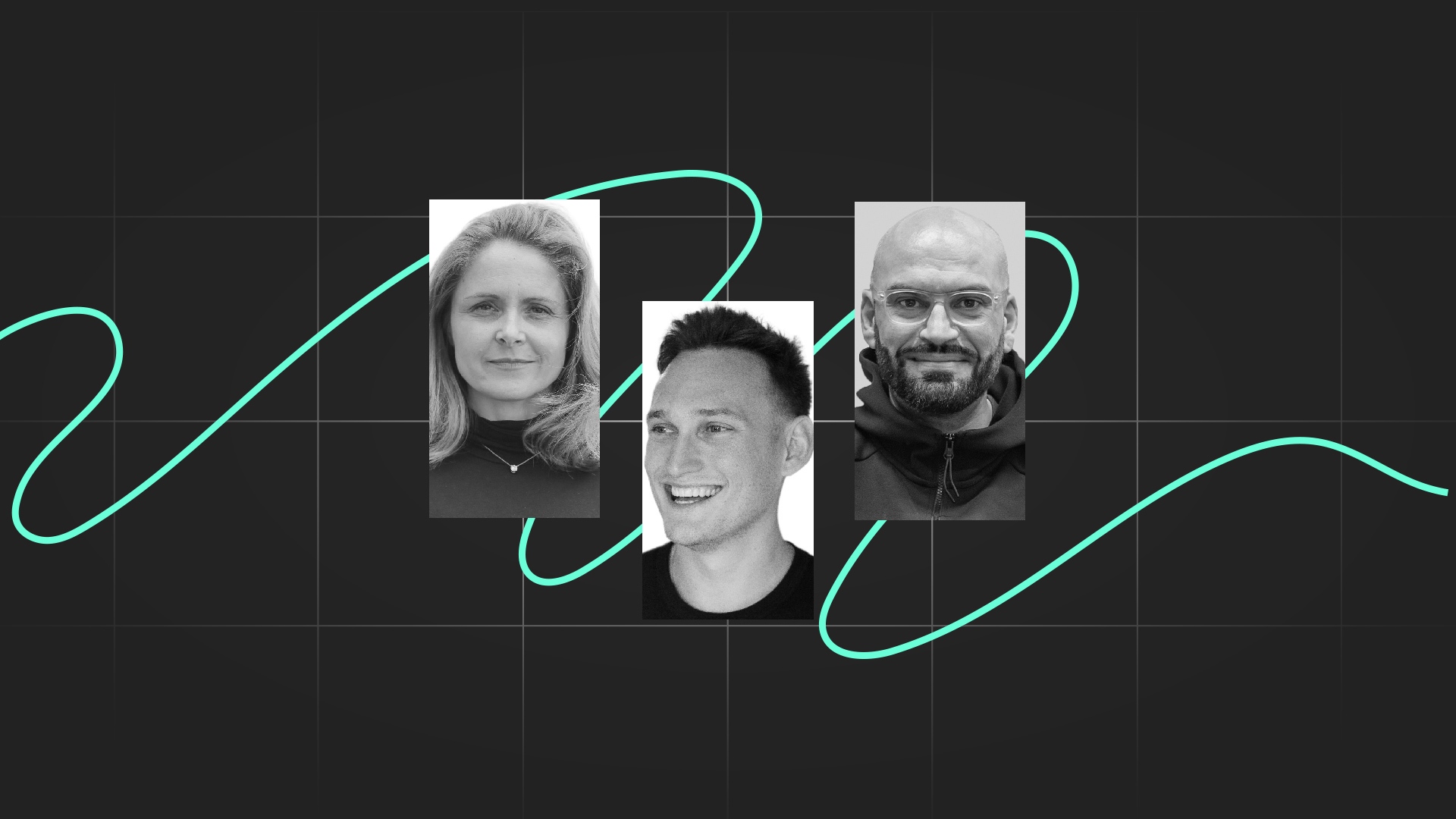

David M. Brear is joined by some great guests, from Digital Cat Consultancy, Mortgage Advice Bureau, and Sprive, to look at the current crisis facing the UK mortgage market and homeowners.

739

739. Insights: Could 'mortgages as a service' mark the future of homebuying?

Benjamin Ensor is joined by some great guests, from 11:FS, Molo Finance, Pexa UK, to discuss the possibilities of mortgages services embedded at the point of need.

738

738. News: Skipton's no-deposit mortgage raises eyebrows and Apple banks a billion!

Skipton launches deposit-free mortgage aimed at renters, Apple attracts $1 billion in deposits in a week, and WhatsApp allows Singapore businesses to pay within app – Kate Moody and Ross Gallagher are joined by some great guests, from Thunes and Redpoint Ventures, to talk about the most interesting stories in financial services over the last 7 days.

707

707. Insights: Would you buy a home through a Super App?

David Barton-Grimley is joined by some great guests, from Pine, Proportunity, and Digital Cat Consultancy, to discuss the current struggles for first-time homebuyers and whether a Super App could ease the whole experience.

673

673. Insights: How to make home-buying more inclusive

Kate Moody is joined by some great guests, from Maxwell and UnidosUS, to discuss home-buying and inclusivity in the US and beyond.

668

668. News: UK mortgage market in meltdown

Benjamin Ensor and Ross Gallagher are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: UK mortgage lenders halt some deals after pound falls, DoorDash partners with JP Morgan Chase on credit card, and we dive into the Fintech Insider mailbag!

650

650. News: Peter Thiel backs European investment app Shares

David M. Brear and Nicole Perry are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: European investing app Shares snaps up $40m financing round, Plaid launches Variable Recurring Payments, and we dip into the Fintech Insider mailbag!

643

643. Insights: How do you put together the perfect mortgage offering?

David M. Brear is joined by some great guests, from Bunq, Maxwell and Molo Finance, to help put together the perfect mortgage offering taking aspects from across the world.

638

638. News: Allica bank raises for SMEs and Backbase raises to transform the back end of banking

Benjamin Ensor and Gwera Kiwana are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: SME lender Allica Bank secures £55m in equity and debt round, Backbase earns a €2.5bn valuation, and Deadmau5 is launching his own online bank

533

533. Insights: People don't want a mortgage, they want to buy a house

David Brear is joined by some great guests to revisit mortgages, and how the industry has developed on in the last couple of years. From stamp duty holiday, to new help to buy scheme, there is a lot to talk about in this space.

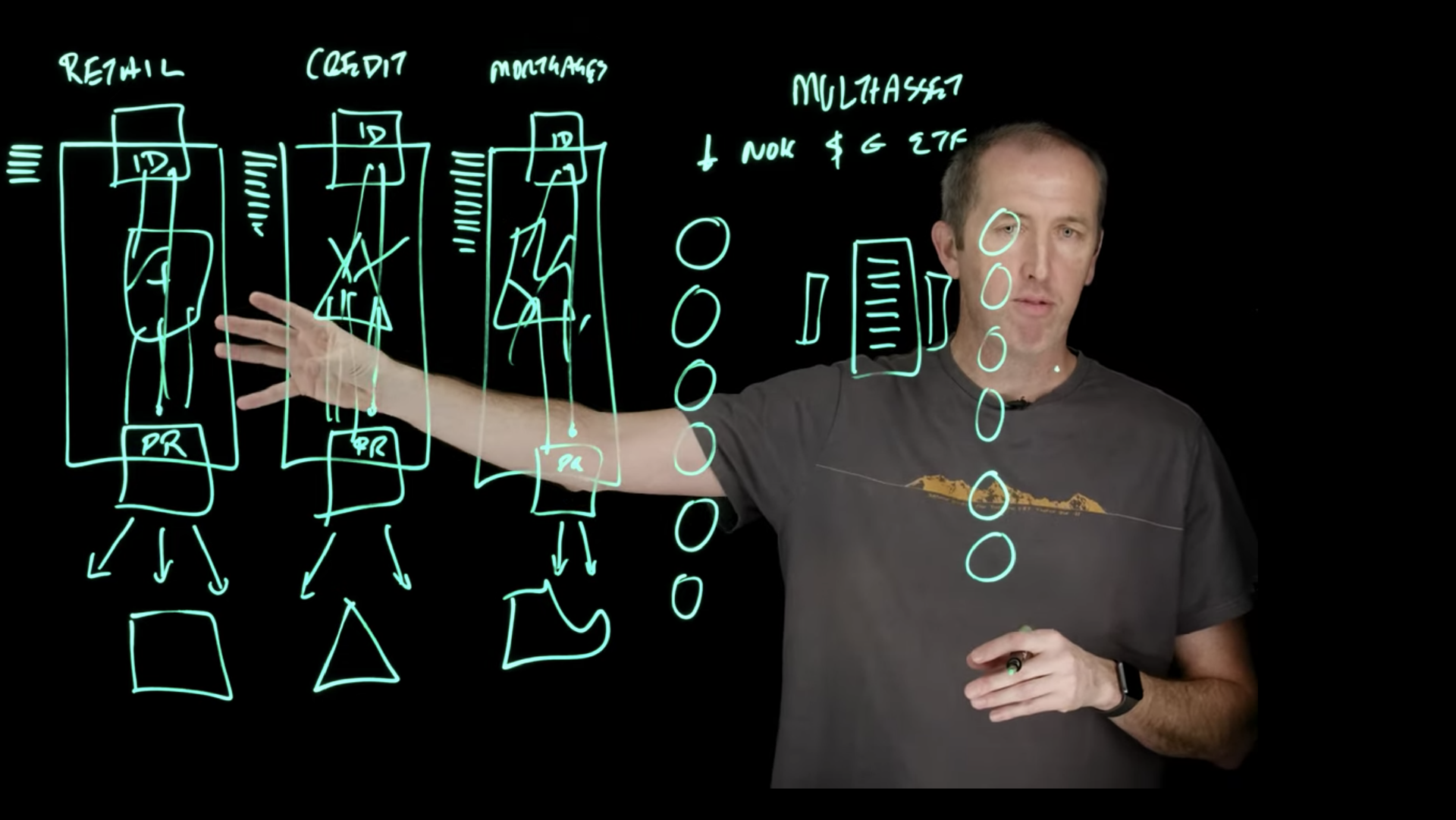

It's not the technology - Why banking is broken ft. Ewan Silver

When people discuss 'banking being broken', they often refer to the technology itself. However, that isn't necessarily the case.

Why Homebuying is broken and how to fix it | 11:FS Explores

There are one billion people globally who can't prove their identity. That's a big problem for accessing financial services.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)