How are banks and fintechs planning for a digital future.

7 takeaways from the final episode of Decoding: Banking as a Service

The final episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

How BaaS has fuelled neobanking in the US

In the last few weeks Wells Fargo’s Control Tower, a set of tools designed to give customers better oversight over their financial lives, has been made available to all digital customers.

6 takeaways from the latest episode of Decoding: Banking as a Service

The fifth episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

Who can BaaS provide the most value to right now?

Guest author Roy Ng, CEO and Co-Founder of Bond, shares his thoughts on how Banking as a Service (BaaS) has the potential to benefit pretty much everyone, but a few select groups in particular.

The next big BaaS battleground? Customer experience

Hopefully, by now you’ve had a chance to digest some, if not all, of our inclusive design series.

Buy Now Pay Later: Love it or hate it, you can’t ignore it

Buy Now Pay Later (BNPL) is one of the hottest trends in fintech. The concept of 0% finance has been around for decades, but it’s caught fire in the last 3 years with new market entrants like Affirm, Afterpay and Klarna transforming how this works for consumers in an e-commerce setting. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

What is embedded finance?

While FinTech folk salivate – and the big banks bloviate – about PSD2 and the open banking reforms coming our way in 2018, we wondered whether those outside of this bubble will actually notice? What does PSD2 actually mean for customers?

The future of banking: all paths lead to lending

A Black-owned bank is defined as one in which at least 50% of voting shares are owned by African-Americans. They’re a dwindling force in the States today.

7 reasons Banking as a Service is a game changer

We now live in a world where almost anyone can build and launch innovative, regulated financial products as easily as they can create a Shopify page - that’s the magic of Banking as a Service (BaaS).

Goldman Sachs is leaning into embedded finance: other banks should take note

As 11:FS wraps up its 5th year in business, we can’t help but think about what the next 5 will look like. And our ambitions are big. It’s only just on the right side of scary.

Jobs to be Done: Helping US SMBs make smart and proactive decisions based on their finances

This is the second instalment of a 6 part series that explores the Jobs to be Done (JTBD) for US SMBs that we identified in our recent research. Each blog post explores one of the jobs and how we examined it with a JTBD canvas. If you missed the first post that explains JTBD and the canvas, check it out before reading this.

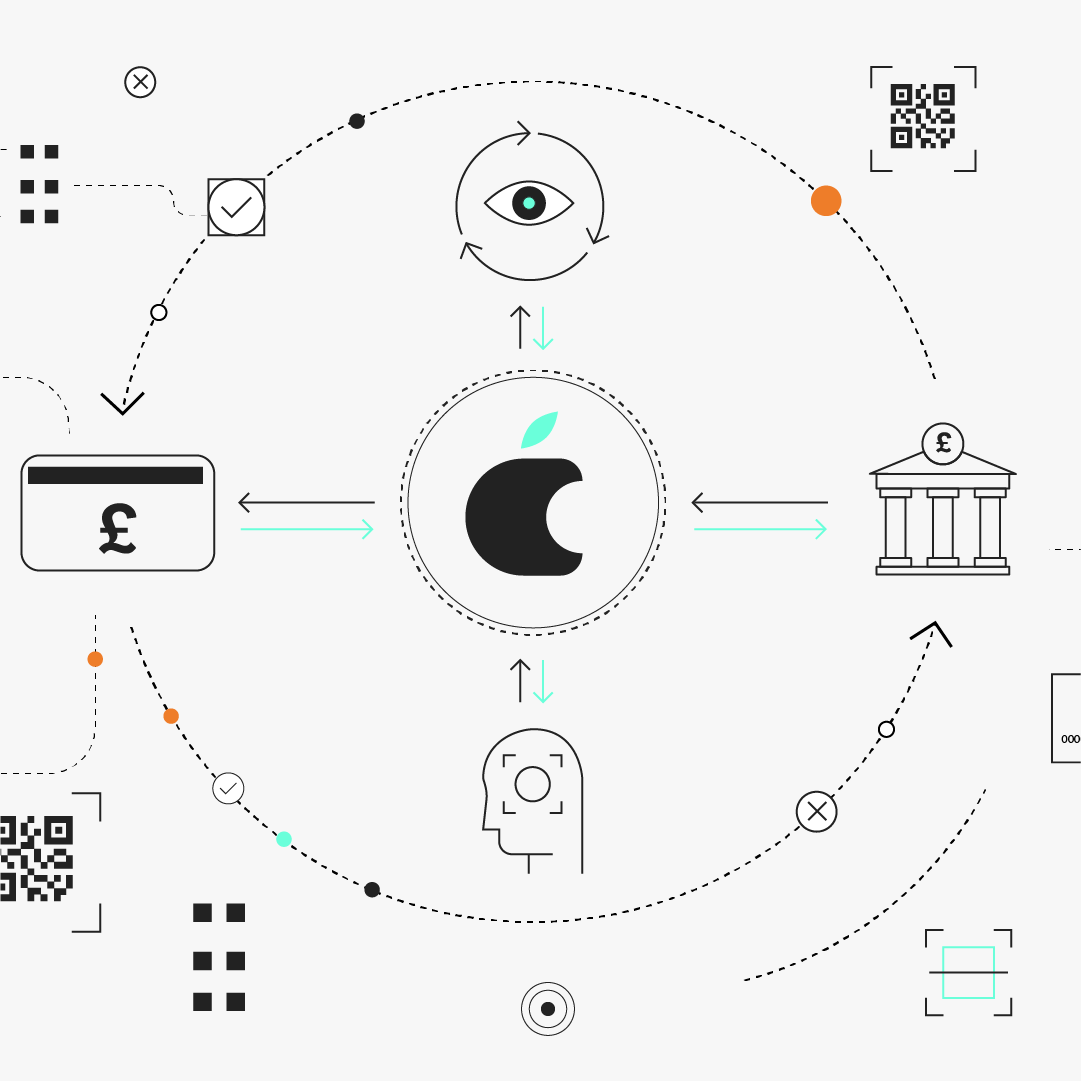

How Apple is leading the charge for brands embedding finance

Cyber attacks are hardly new, so why are banks putting renewed energy into combating them? 11:FS Market Research Analyst Joanne Kumire explains.

11 observations from remote working during lockdown

Pre-COVID, you could’ve called me a globe-trotter. And you wouldn’t have been wrong. As an author, commentator and public speaker, I’m rarely in one place for too long. So getting used to working from home for the past six months has been a revelation, to say the least. In light of World Mental Health Day 2020 (arguably the most important one yet) I thought I’d share some of the observations I’ve made since being thrust into 24/7 remote working. While some of them might be trivial, it’s fair to say I’ve experienced a rollercoaster of emotions. Mental health isn’t a static creature, and it’s bound to fluctuate thanks to the blows we’ve been dealt by the pandemic - I’m sure you can relate.

Jobs to be Done: Helping US SMBs build credibility and legitimacy in order to access funding

This is the final instalment of a 6 part series that explores the Jobs to be Done (JTBD) for US SMBs that we identified in our recent research. Each blog post dives into one of the jobs and how we examined it with a JTBD canvas. If you missed the first post that explains JTBD and the canvas, check it out before reading this.

Seedrs and Crowdcube merger: hot takes

It's a truism that the hardest job in engineering is that of 'Tech Lead'. You're the person who's not only writing code, but simultaneously leading a small group of other engineers and spending large amounts of time talking to stakeholders and the Product Manager (or, ten years ago, *Project* Manager). This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

650

650. News: Peter Thiel backs European investment app Shares

David M. Brear and Nicole Perry are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: European investing app Shares snaps up $40m financing round, Plaid launches Variable Recurring Payments, and we dip into the Fintech Insider mailbag!

648

648. News: Starling pulls back from Ireland while Stori becomes Mexico's latest fintech unicorn

Kate Moody and Amy Gavin are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Starling pulls Irish bank application, Stori becomes Mexico’s latest fintech unicorn, and ‘Eat The Rich’ popsicles are selling fast!

643

643. Insights: How do you put together the perfect mortgage offering?

David M. Brear is joined by some great guests, from Bunq, Maxwell and Molo Finance, to help put together the perfect mortgage offering taking aspects from across the world.

638

638. News: Allica bank raises for SMEs and Backbase raises to transform the back end of banking

Benjamin Ensor and Gwera Kiwana are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: SME lender Allica Bank secures £55m in equity and debt round, Backbase earns a €2.5bn valuation, and Deadmau5 is launching his own online bank

633

633. Insights: Will embedded finance make or break the fintech industry?

Gwera Kiwana is joined by some great guests, from NovoPayment, Treasury Prime and Anthemis, to find out who are the winners and losers of the embedded finance revolution.

632

632. News: Klarna announces big layoffs while Chase bags UK customers

Benjamin Ensor and Sim Rai are joined by some great guests, from Tranch and Anthemis, to talk about the most interesting stories in financial services over the last 7 days, including: Klarna lays off 10% of its workforce via video message, Chase marks 500,000 UK customers, and our panel answers your questions!

630

630. News: Griffin goes for banking licence and InDebted looks to disrupt UK debt collection

Gwera Kiwana and Benjamin Ensor are joined by some great guests, from Griffin, Indebted and Redpoint Ventures, to talk about the most interesting stories in financial services over the last 7 days, including: Griffin applies for UK banking licence, Digital debt collection agency InDebted looks to shake up the UK market, and Goldman Sachs offers senior staff unlimited holiday!

629

629. Insights: Can Egypt’s young population push through a fintech revolution?

Kate Moody is joined by some great guests, from Lucky and Global Ventures, to talk about the rise of fintech in Egypt!

481

481. News: All about that BaaS - did Wirecard collapse at a good time?

Sarah Kocianski and Kate Moody joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Santander buys Wirecard’s core European business for €100m, PNC buys BBVA USA and the FCA says no, as Lanister launches its new polymorphic payment card.

480

480. Insights: Path to profitability: are fintech business models sustainable?

David Brear is joined by some great guests to discuss the fintech path to profitability.

78

78. Does anyone buy travel insurance anymore?

Sarah Kocianski and Nigel Walsh are joined by a panel of guests to talk about travel insurance, and how Covid-19 has changed the face of the industry. All this and much much more on today's Insurtech Insider!

475

475. News: Ant’s record-breaking IPO - they’re 1% done!

Ross Gallagher and Simon Taylor are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Ant Group and the biggest IPO of all time, cryptocurrency initiatives amongst industry giants PayPal and JP Morgan, and raccoons break into California bank.

473

473. News: Stripe acquires Paystack - are they taking over the world?

Simon Taylor and Mel Stringer are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Stripe acquires Nigeria’s Paystack, Marqeta’s research discovers Covid-19 has forced three-quarters of banks to change their future strategy, and ESG funds forecast to outnumber conventional funds by 2025.

77

77. News: Lloyd's post-pandemic product review & Cover Genius' raise

Sarah Kocianski and Nigel Walsh are joined by a panel of guests to talk through the most interesting news from the insurance and insurtech sphere!

470

470. Insights: Middle East fintech - revolutionising the region's financial landscape

Ross Gallagher is joined by some great guests to discuss how fintech and digital transformation is shaking up the financial landscape of the Middle East.

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

Why Homebuying is broken and how to fix it | 11:FS Explores

There are one billion people globally who can't prove their identity. That's a big problem for accessing financial services.

What Griffin are going to do now they have their banking licence with CCO Adam Moulson | Spotlight

Inclusive design is a mindset and a process that suggests that you should bring as many people as possible - and the most diverse of voices that you can - into your product design product process, so that you're being truly inclusive. It's designing with people rather that just at them. Charlotte Fereday, Product Director, Ventures, explains what inclusive design is, why it's important, how you can design more inclusively, and answers - how possible is truly inclusive design?

Unleashing creativity! A case study on sparking innovation with Bidyut Dumra from DBS | Spotlight

On this episode of Spotlight, 11:FS Crypto Global Strategy Director, Mauricio Magaldi is joined by Ramp Network Co-Founder and CEO, Szymon Sypniewicz. In today's chat, the pair discuss Szymon's career, the current regulatory landscape in crypto, and what the future might hold when it comes to widespread crypto adoption.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)