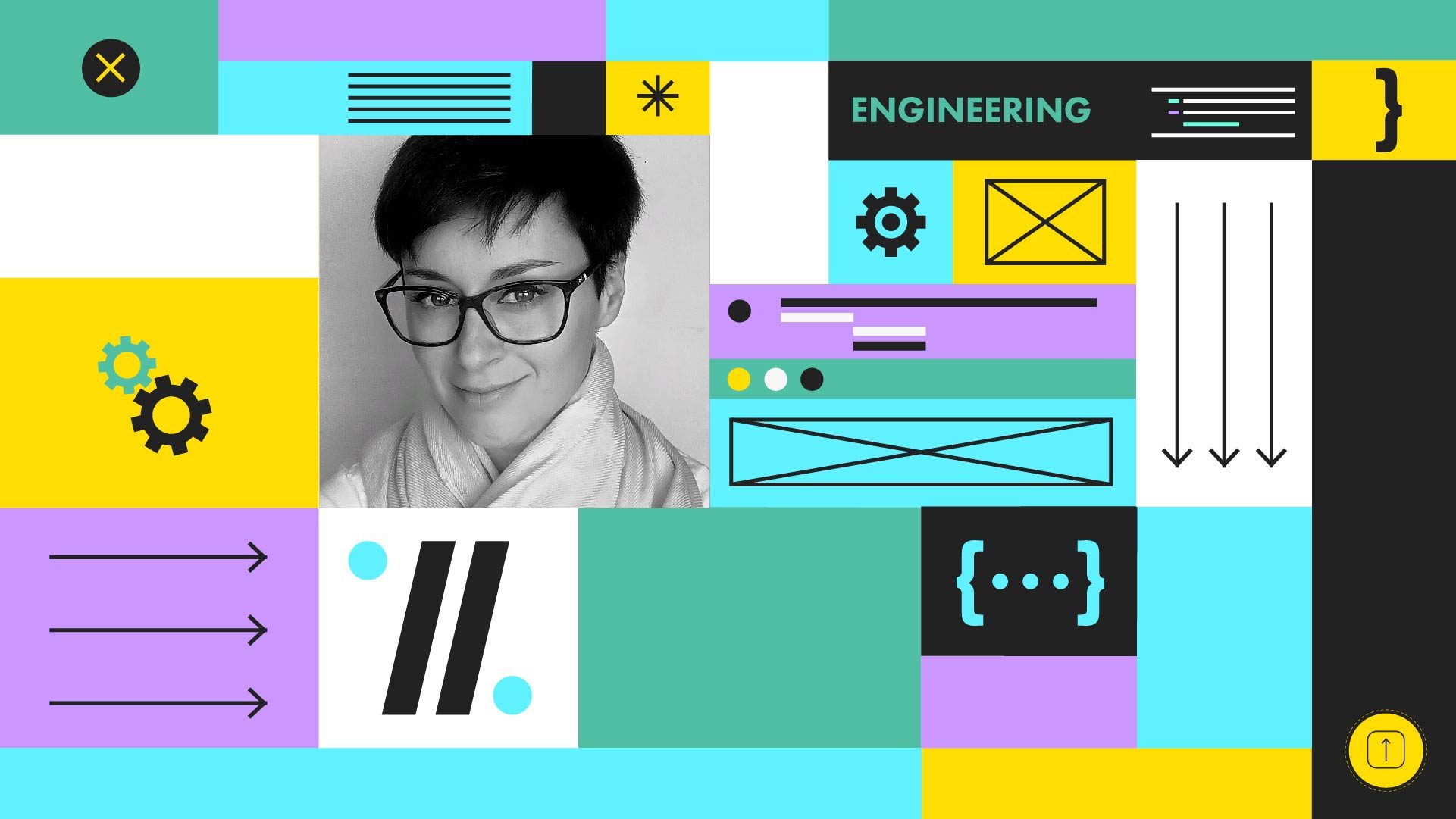

The engineering principles used across financial services.

What have 11:FS Pulse subscribers been viewing in 2021?

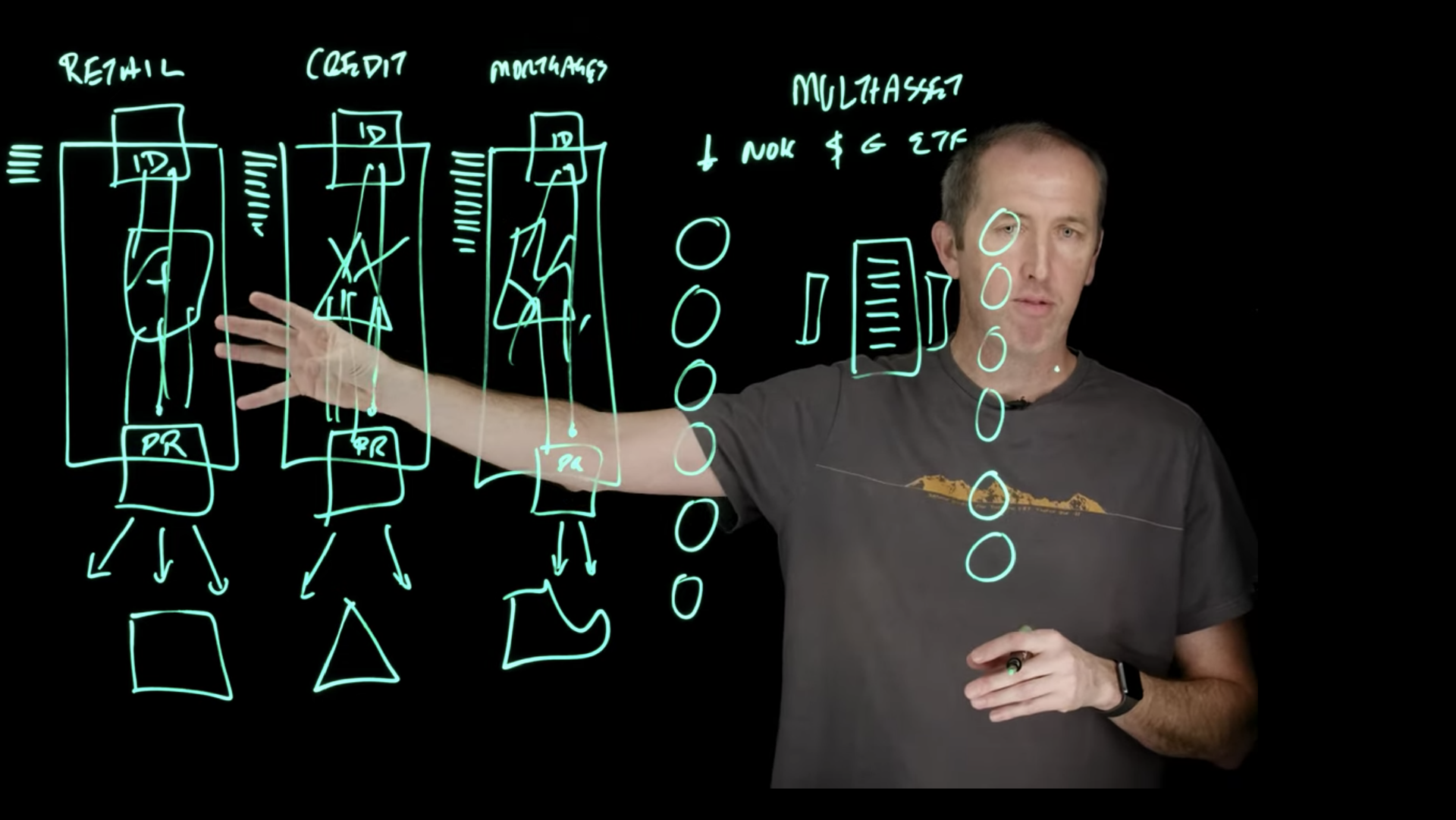

The second episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

Banking as a Service accelerates Open Banking adoption

This article was originally published in The Paypers’ ‘Open Banking Report 2021: Open Finance and the Race for Relevance and New Business Models in Banking'.

What we’ve learned from 4 years of building fintechs

Four years doesn’t sound like much but in the rapidly changing world of fintech it feels like forever. It’s hard to say for sure when the phenomenon started.

Why we partnered with Google

So. We’ve partnered with Google. Hasn’t everyone? Well, for us this is more than a press release. Sure, 11:FS Foundry is already hosted on Google Cloud Platform (GCP). But let's look at why we wanted to partner more deeply.

Why it's time to take microservices to the next level

If you’ve ever worked with engineers, you’ll have heard them talk about microservices. A few years ago, you might’ve been left with the impression that they were ‘The Answer’ - the thing that would solve all your problems.

Building a bank? Here’s why you should use Kotlin

Backend development for greenfield banking requires a special set of needs. We use Kotlin as our programming language. Here’s why.

Why we decided to build an operating system

Up until recently, if you wanted to launch a financial product, you either had to work directly with the deep financial infrastructure yourself or use a core banking system, which has all sorts of rules and parameters, to interact with the financial infrastructure.

What FS companies are getting wrong with their cloud based solutions

After a busy year in crypto, 11:FS co-founder Simon Taylor checks in on his 2019 predictions to see what he got right and what he missed.

Privacy and security are not optional in MVPs

Over the past few months, 11:FS Ventures has seen a spike in interest from clients in private banking and wealth management.

Stop using risk as an excuse for taking the safe route

We’re all busier than ever. Not even the most efficient human can cope with the trials we all face and the tasks we all have to do on a daily basis. There just aren’t enough hours in the day. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

The value of quality in tech

Do you remember when you first saw a newspaper app on an iPad? It was as though a physical newspaper had been trapped under the black glass. There was even a page turning animation that you probably showed your friends. It was magical. It was digitised news. Ditto for buying albums on iTunes and ordering a traditional taxi; amazing experiences, but we just took what had come before and translated it directly to the new medium.

Senior people need to understand technology

So. Let’s talk about DAO, baby.

Tech debt in banking, how did we get here?

Simon interviewed the husband and wife team Arthur and Kathleen Brietman, the co-founders of Tezos, about their recent token sale for the very first episode of Blockchain Insider.

The case for integrated QAs in tech teams

You would think that with all the ‘digital transformation’ in banking, the CIO would be king. And yet it doesn’t feel that way from within the CIO’s office.

Why is BaaS so hot right now?

The first episode of our brand-new video series, Decoding: Banking as a Service, is live! If you missed it, catch up here. Here’s a rundown of the episode if you prefer reading to watching 📖

138

138. Bitcoin halvening approaches as China and Libra battle for supremacy

We. Are. Here. Today we bring you: Libra seeks regulatory approval, China trials its digital yuan and Andreessen Horowitz deepens its commitment to crypto. All this and much more on today's Blockchain Insider!

420

420. Insights: How the COVID-19 pandemic will accelerate digital financial services

11:FS's David Brear, Simon Taylor, Sarah Kocianski and Benjamin Ensor come together to talk about the impact of the COVID-19 pandemic on the financial services industry.

Fintech Insider USA: New York Fintech Week (S1E1)

Welcome to a brand new show brought to you by 11:FS! This is Fintech Insider USA where our host Sam Maule will be joined by the movers and shakers in the US fintech industry. Stay tuned for some incredible interviews with some of the brightest and the best from the New York Fintech Scene.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

It's not the technology - Why banking is broken ft. Ewan Silver

When people discuss 'banking being broken', they often refer to the technology itself. However, that isn't necessarily the case.

Microservices architecture - Asynchronous systems ft. Vaughan Sharman

Minimum Lovable Brand | 11:FS Explores

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)