Get the latest news and insights from the business banking space.

Tech debt in banking, how did we get here?

Simon interviewed the husband and wife team Arthur and Kathleen Brietman, the co-founders of Tezos, about their recent token sale for the very first episode of Blockchain Insider.

Do you have enough technology understanding in your Compliance team?

In today's globalized business environment, the discussion around offering alternative payment methods (APMs) to end users continues to grow. APMs can provide businesses with improved cost efficiency, better user experience, broader access to various user segments, and thus increased conversion rates. However, it is essential to carefully consider the challenges and potential drawbacks that come with adopting APMs before fully embracing them.

AML is the world's most ineffective policy experiment...

AML is the world’s most ineffective policy experiment. Imagine if you have a car that didn’t work 99.9% of the time. That would be annoying right? This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Pace of change is a power law

Dutch directness, failing fast and innovating endlessly are the three common themes in the interview Simon did with Benoit Legrand, CIO of ING. And they’re what drives his approach to delivering success at ING.

The next big BaaS battleground? Customer experience

Hopefully, by now you’ve had a chance to digest some, if not all, of our inclusive design series.

Why is BaaS so hot right now?

The first episode of our brand-new video series, Decoding: Banking as a Service, is live! If you missed it, catch up here. Here’s a rundown of the episode if you prefer reading to watching 📖

7 reasons Banking as a Service is a game changer

We now live in a world where almost anyone can build and launch innovative, regulated financial products as easily as they can create a Shopify page - that’s the magic of Banking as a Service (BaaS).

Goldman Sachs is leaning into embedded finance: other banks should take note

As 11:FS wraps up its 5th year in business, we can’t help but think about what the next 5 will look like. And our ambitions are big. It’s only just on the right side of scary.

Jobs to be Done: Helping US SMBs make smart and proactive decisions based on their finances

This is the second instalment of a 6 part series that explores the Jobs to be Done (JTBD) for US SMBs that we identified in our recent research. Each blog post explores one of the jobs and how we examined it with a JTBD canvas. If you missed the first post that explains JTBD and the canvas, check it out before reading this.

11 US fintechs on our watchlist right now

There’s a reason counties often refer to their tech hubs as “the Silicon Valley of [insert country name here].” The Bay Area is the proud birthplace of some of the world’s biggest technological triumphs, home to global powerhouses like Apple and Visa. Every year the Valley also attracts a host of fintech start-ups - such as Credit Karma, Chime and Varo Bank, to name a few. But it’s not just California driving the future of financial services. We’ve done our research to see which companies across the 50 states are leading the fintech charge. (Did you miss our first blog? See who’s doing awesome things on the other side of the pond with our list of the hottest European fintechs.)

Why the Middle East could be the next fintech hotspot

Back at the end of 2019, we dived into the perfect fintech storm that was brewing in the Middle East. Diversification had already started in the region, but financial inclusion was reluctant to follow. So where are we now? It’s 2020, and things have been hotting up in the region with opportunities continuing to surface. But what does the region hold for fintech and why is the Middle East where the real gold lies?

Jobs to be Done: Helping US SMBs build credibility and legitimacy in order to access funding

This is the final instalment of a 6 part series that explores the Jobs to be Done (JTBD) for US SMBs that we identified in our recent research. Each blog post dives into one of the jobs and how we examined it with a JTBD canvas. If you missed the first post that explains JTBD and the canvas, check it out before reading this.

Seedrs and Crowdcube merger: hot takes

It's a truism that the hardest job in engineering is that of 'Tech Lead'. You're the person who's not only writing code, but simultaneously leading a small group of other engineers and spending large amounts of time talking to stakeholders and the Product Manager (or, ten years ago, *Project* Manager). This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

11 European fintechs we’re excited about right now

London’s been at the centre of the fintech bubble for over a decade now, and the rest of Europe isn’t far behind. One of the few silver linings of the coronavirus pandemic could be that it might act as a catalyst for a tonne of investment into fintech, as more and more people recognise the need to go digital. Despite the trend for falling investments in 2020, the UK fintech sector is still looking flush thanks to investments of over $1.84 billion. To give you a heads up on the next big companies on the scene, we’ve rounded up the hottest startups on our watch list 🔥

Using the cloud to fly sky high above the competition

As we roll into 2018 thoughts inevitably turn to the big themes that we might expect (and hope) to see for user experience in the financial services industry this year.

432

432. Insights: How could open finance shape the future of financial services?

Adam Davis and Sarah Kocianski are joined by some great guests to discuss open finance - what it is, how is could work and what learnings it could take from open banking, with an expert panel of guests from Plaid, RBS and the OBIE.

431

431. News: Shopify’s stratospheric rise and foray into fintech

Sam Maule and David Brear are joined by some great guests to talk about some of the most interesting US news stories of the last 7 days, including: Shopify’s many new announcements and move into fintech; Bank of America leak exposes business details of PPP relief applicants as applications across the board decline; and Animal Crossing offers new ways for people to make money in lockdown.

429

429. News: Is it tough to be a challenger bank right now?

David Brear and Simon Taylor are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: The challenges facing challenger banks in the current climate, Freetrade’s record-breaking raise and PayPal sees a rise in 'silver tech' as older generations test digital payments for the first time. All this and much more on today's episode!

427

427. News: Mobile Wallet Wars? SoFi and Samsung Pay team up

Sarah Kocianski and Adam Davis are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: A round up of the pandemic and financial aid stories on both sides of the pond; Sofi and Samsung Pay team up for a debit card; and Mastercard's massive new pledge for financial inclusion.

426

426. Insights: How to design digital financials services for US SMBs

Sam Maule is joined by some great guests to talk about US SMBs - not specifically about their fight for funding in the wake of Covid-19 this time - but their options when it comes to banking more broadly, and how to design digital financial services that work for them.

425

425. News: RBS close Bó - Why is building a new bank so hard?

Simon Taylor and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: RBS closes Bó, big banks book $50bn against bad loans in the wake of corona, and a round-up of the more international stories of the week.

424

424. Plaid: customer driven innovation, data access and US open banking

Sam Maule is joined by John Pitts, Policy Lead, and Niko Karvounis Product Lead at Plaid to talk all things data, customer driven innovation, their European expansion and much more.

424

424. Interviews: Plaid on customer driven innovation, data access and US open banking

Sam Maule is joined by John Pitts, Policy Lead, and Niko Karvounis Product Lead at Plaid to talk all things data, customer driven innovation, their European expansion and much more.

423

423. News: Global bank profits tumble as US deposits grow

Simon Taylor and Adam Davis are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: 100% backed business loans; big banks results are in and corona is hitting their profit margins hard and even Animal Crossing's Bank of Nook is slashing its interest rates in an unwelcome reflection of the real world.

422

422. Insights: the impact of coronavirus on US SMB Financing

Sam Maule is joined by some great guests in the US SMB space, to discuss the impact of the coronavirus crisis on US small businesses - at the time in which all the stimulus funding had already been given out.

421

421. News: US SMEs await new stimulus funds as fintech valuations soar

Sam Maule and Simon Taylor are joined by some great guests to talk about some of the biggest global stories of the last 7 days, including: new stimulus funding in the US; new fundraises and valuations for Stripe and Robinhood; and ShackShack give back their $10million stimulus.

420

420. Insights: How the COVID-19 pandemic will accelerate digital financial services

11:FS's David Brear, Simon Taylor, Sarah Kocianski and Benjamin Ensor come together to talk about the impact of the COVID-19 pandemic on the financial services industry.

64

64. Covid-19: Who will come out stronger?

Sarah Kocianski and Nigel Walsh are joined by a panel of guests to talk through Covid-19 and what this might mean for the insurance industry going forward! All this and much much more on today's Insurtech Insider!

419

419. News: Fintechs step up to distribute relief funding

Sarah Kocianski and Simon Taylor are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Starling and OakNorth join coronavirus loan programme, US fintechs to help distribute coronavirus aid, and a women-only neobank is coming to Brazil.

418

418. Insights: Coronavirus and the impact on SME Financing

In this highly topical episode, Sarah Kocianski and Simon Taylor, dig into the impact COVID-19 is having on SME financing, and their access to government funding. They are joined by expert guests from Coconut, Quotevine and 1pm PLC.

Decoding: Banking as a Service - Episode 5

Welcome to episode 5 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 4

Welcome to episode 4 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 3

Welcome to episode 3 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 2

Welcome to episode 2 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 1

Welcome to episode 1 of our new video series, Decoding: Banking as a Service!

It's not the technology - Why banking is broken ft. Ewan Silver

When people discuss 'banking being broken', they often refer to the technology itself. However, that isn't necessarily the case.

Microservices architecture - Asynchronous systems ft. Vaughan Sharman

Minimum Lovable Brand | 11:FS Explores

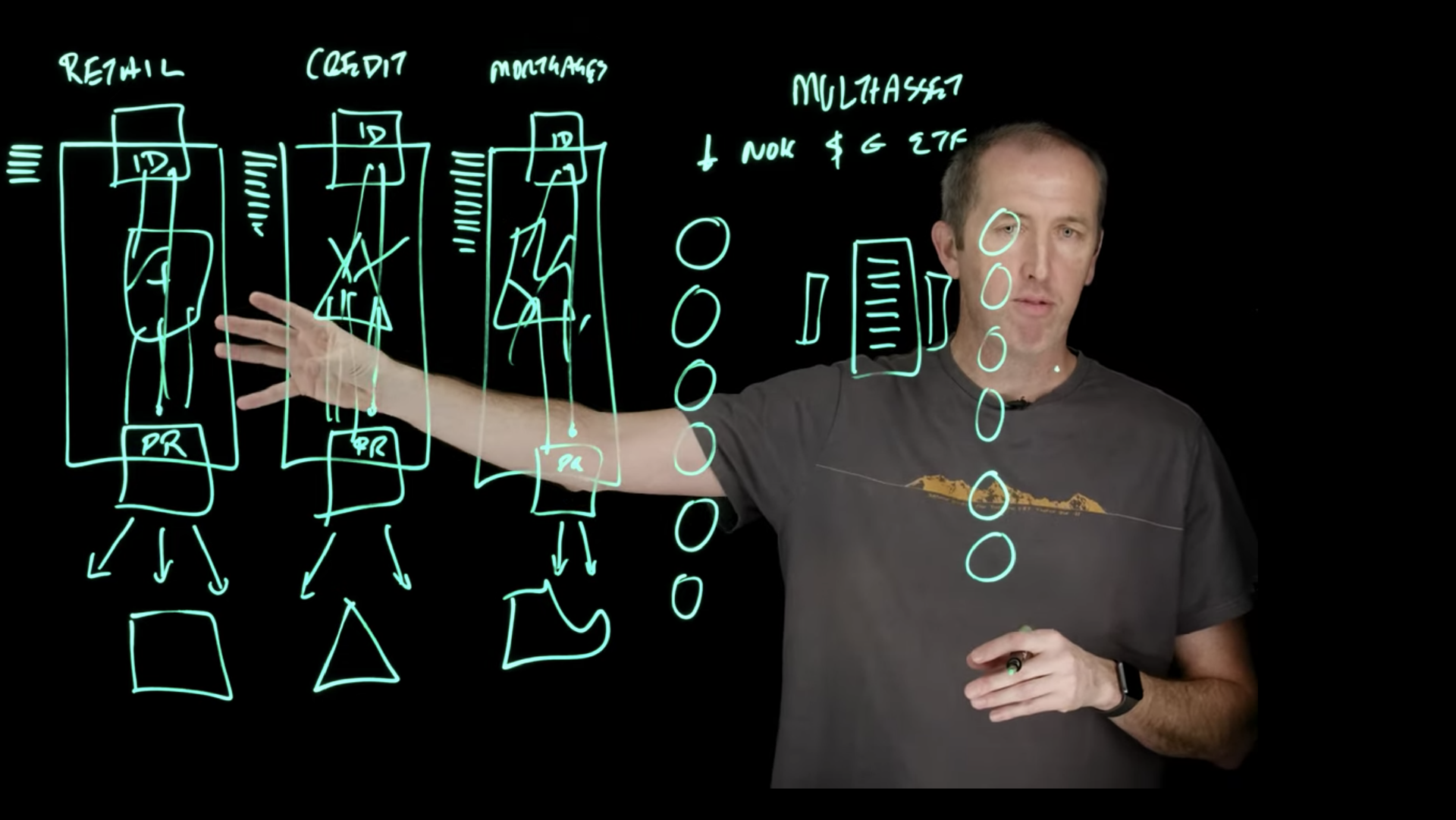

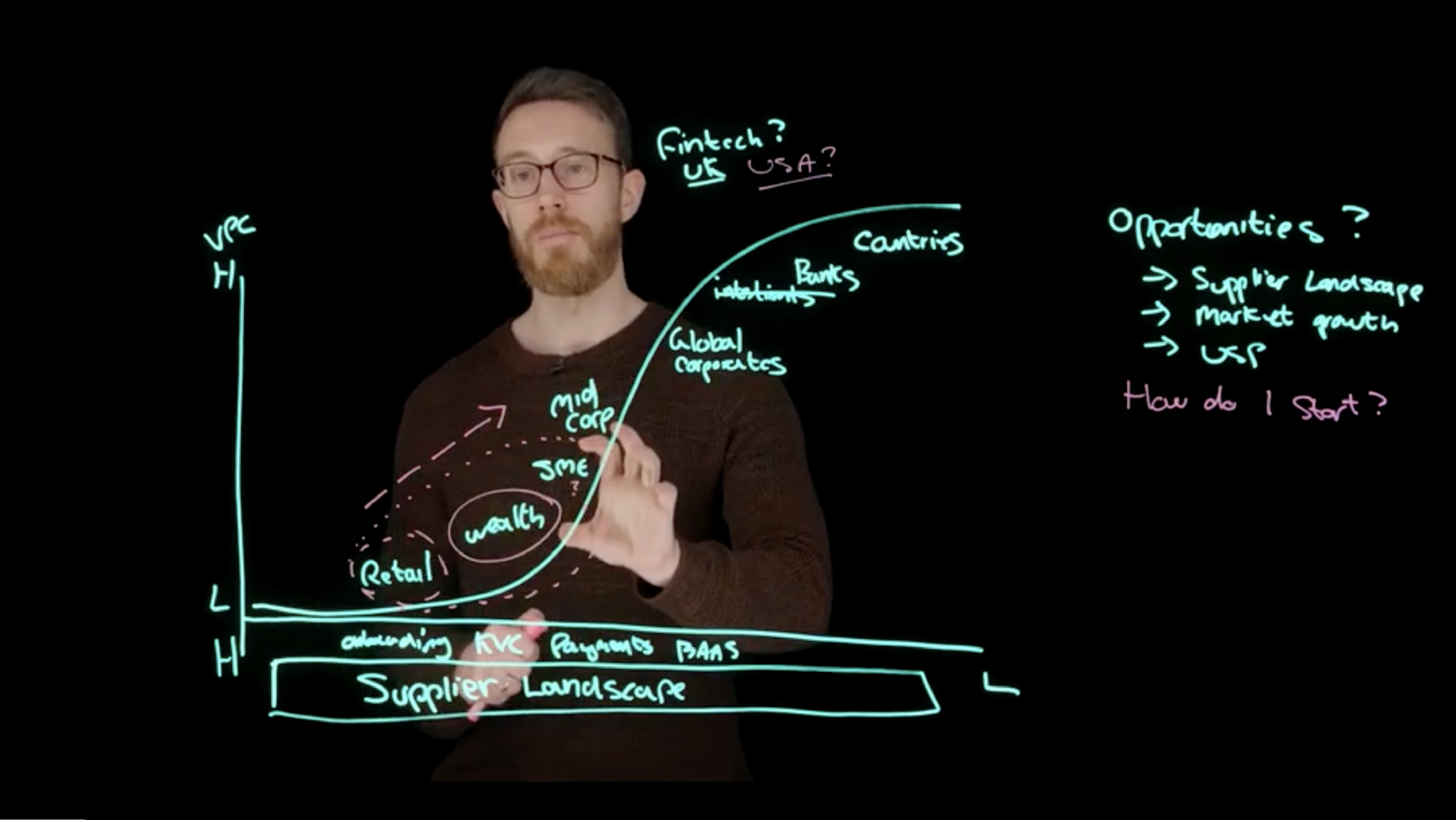

Fintech is only 1% finished - The fintech market ft. Simon Taylor

Fintech is only 1% finished. But what do we mean by that? Simon Taylor, Head of Ventures at 11:FS takes us through the landscape of financial technology in this Lightboard edition of 11:FS Explores.

What Griffin are going to do now they have their banking licence with CCO Adam Moulson | Spotlight

Inclusive design is a mindset and a process that suggests that you should bring as many people as possible - and the most diverse of voices that you can - into your product design product process, so that you're being truly inclusive. It's designing with people rather that just at them. Charlotte Fereday, Product Director, Ventures, explains what inclusive design is, why it's important, how you can design more inclusively, and answers - how possible is truly inclusive design?

Using Jobs to be Done to revolutionise SME Banking | 11:FS Explores

It's not just a buzzword.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)