Global

Banking APIs Aren't about Tech or Banking

I’m sure that you’ve seen the same presentations that I have. An expert from a large consultancy stands up and his first slide says “API stands for Application Programming Interface”. He continues with a description of new regulations (PSDII / CMA) and describes the technology that will let customers give third parties to access their banking data and trigger new transactions. That’s all true, but it’s a mistake to start there, it leads in the wrong direction.

Monzo: A Peek inside the Playbook of the World's First Truly Digital Bank

Fintechs can’t hire product marketers quick enough at the moment. If you’re new to the marketing game and looking to become a specialist rather than a generalist, then it’s probably one of the most interesting areas to specialise in right now.

11 Things Your CIO Needs to Know About Blockchain Today

Blockchain and DLT are in the labs of most large banks and have been useful from a PR perspective. But what next? What the hell should we actually be doing with this technology? Here are 11 things your CIO needs to know about blockchain / DLT so your organisation doesn’t get left behind.

Garanti: The banking app that isn't on your radar

For Season 2 of Connection Interrupted we’re kicking off in style with a super star of media, social media, podcasting and much much more: Gary Vaynerchuk! I had the pleasure of meeting Gary at the Vaynermedia offices in NYC with one mission: to try and get to know him, to find out who the real Gary is behind brand Gary V: the man who loves his family (and the Jets). Listen to the episode here or below and read on for my personal highlights.

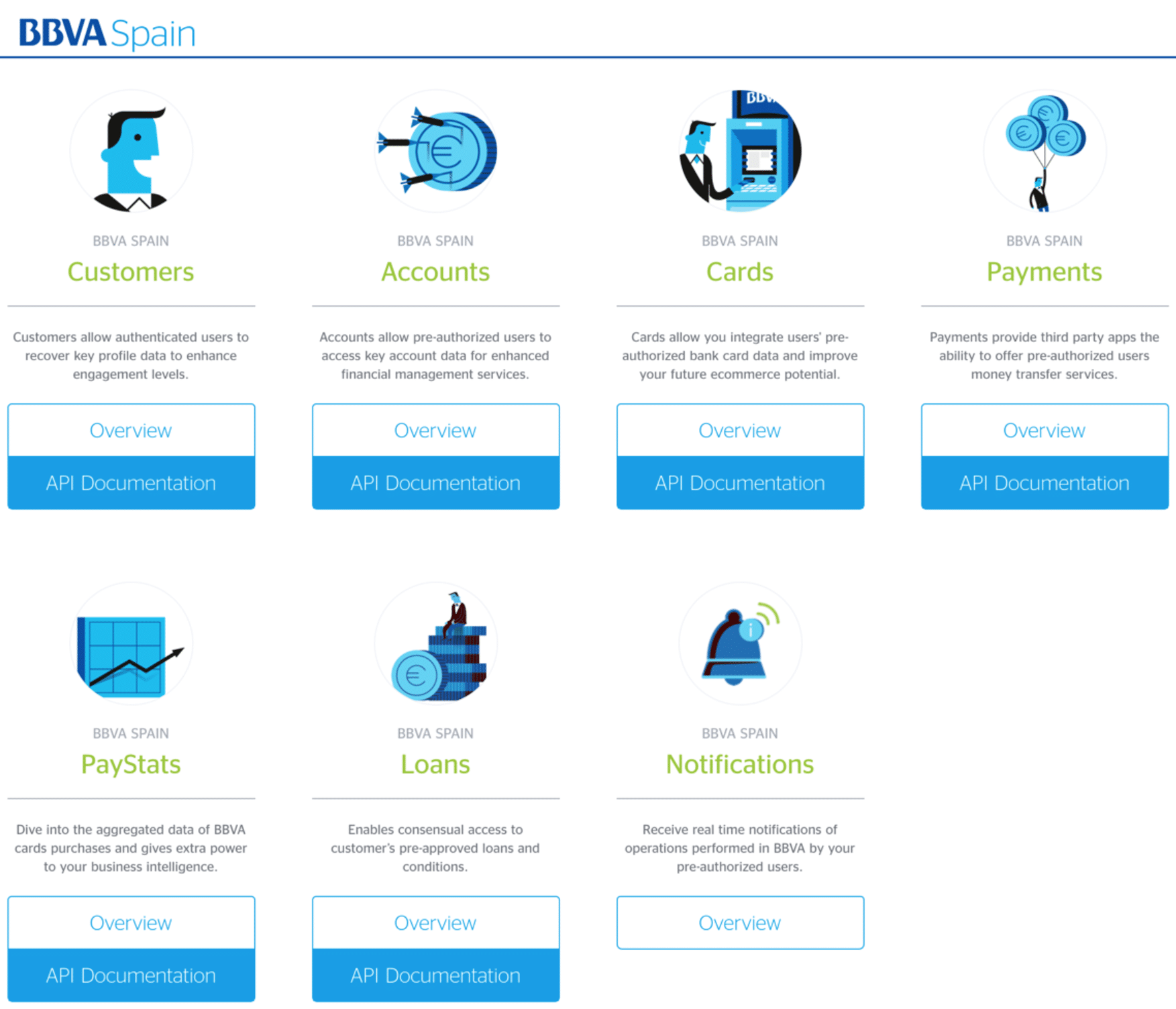

11 Banks and FinTechs Doing APIs Better Than You

In its final report, the Competition and Markets Authority has formally implemented reforms aimed at giving people more control of their money. By Q1 of 2018, European banks have to completely open up their data through full APIs. But some banks aren’t prepared to wait that long. Read on to see which ones have taken the lead.

4 Blockchain Macro-Trends: Where to Place Your Bets

The challenges (and opportunities) ahead for enterprise applications of distributed ledger tech.

The 11 FinTech and Banking Trends You Need to Follow

The arrival of a new year is often a time for reflection and an opportunity to look ahead. In design it’s no different.

The Death of Omnichannel Banking

Lately I’ve noticed a few banks and fintechs wanting to “get started designing screens right away”. It seems great, but building the wrong thing is worse than building nothing at all.

FinTech Legend Leda Glyptis: If You Choose Who You Are, What You Do Will Follow

Over the past eight years, as a fintech founder who happens to be gay, I’ve met with 100+ corporate and institutional investors around the world.

Xero: Giving 800,000 Business Owners Their Lives Back

Gary Turner is Co-Founder and Managing Director of Xero, which Forbes described as the “World’s Most Innovative Growth Company.” Xero provides small- to medium-sized businesses (SMBs or SMEs) with ‘beautiful’ online accounting software. Gary helped take Xero from a 3-person startup to a company that will have £150 million in revenue this year.

Swish: 3 Takeaways for Every Bank

How do we stay ahead of fraud and financial crime without compromising the speed, ease, and trust that make instant payments so compelling? In this article, Mastercard's Bryan Sharkey explores it all.

Digital Wealth Management: It’s All about the Offense

When people start explaining how technology can be used to modernise financial services their language instantly becomes fraught with acronyms, buzzwords, and idioms that can make little sense to those both inside, and especially, outside the industry.We have a hunch sometimes people do this to appear smart but we need to do more research!

‘Nicest Guy in Fintech’ on 'Golden Age of Finance'

Sam Maule, Director of Digital & Fintech at NTT DATA Americas, talks to us about how a kid from Detroit became a fintech leader, his new podcast, femtech, and Silicon Valley’s rude awakening.

Going Native: Force Touch, Siri, and Messages Payments

Goldman Sachs broke the fintechnet this week when it launched its developer portal, intentionally allowing companies to ‘embed finance’ within their organisation using their Banking as a Service (BaaS) offering. Hari Moorthy, Goldman’s Global Head of Transaction Banking, referred to it as “the financial cloud for corporates.” Cue a flurry of emails inside every large bank from CEOs wondering how seriously they should take this. Take it seriously. Take it very seriously.

It’s Blockchain, Not Bitcoin, That’s Relevant to Finance

Let’s start by calling Buy Now Pay Later (BNPL) what it is - debt. Debt, of course, has many faces. But ‘credit, pay in instalments, pay nothing today, etc.’ are all just debt. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

813

813. Insights: Fintech's biggest stories of 2023

As we wrap up another rollercoaster year in fintech, 11:FS CEO David M. Brear is joined by some a panel of colleagues to talk about the biggest, best, and most outrageous happenings of 2023.

812

812. News: CaixaBank's GenAI revolution and our fintech naughty or nice list

Benjamin Ensor and Rachel Pandyan are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: CaixaBank investing in 100-person team to work exclusively on GenAI, TikTok acquire Tokopedia following new social media laws, and Canapi launch a $750m VC fund to support fintechs.

202

202. Insights: Tokenised deposits, stablecoins and when best to use them

L.F.G. Mauricio and Catherine bring you a deep dive into tokenised deposits on the blockchain. What they are, how they work and how they differ from CBDCs and stablecoins and the different ways to utilise each one. All this and much more on today's Blockchain Insider!

810

810. News: Robinhood is coming to the UK and Wise help SMEs with Allica Bank

David Barton-Grimley is joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Robinhood are coming to the UK... no, seriously this time, and Wise partner with Allica Bank to make cross-border payments easier for SMEs. Plus, if you're looking for a new family board game this year, head to your local Natwest branch.

Bonus: David M Brear on the Wharton Fintech Podcast

David M. Brear is joined by financial services veteran, Ashok Vaswani, to discuss how he draws on his experience going forward and why he continues to put learning first.

808

808. News: JP Morgan eye growth in Abu Dhabi and Check tackle payroll fraud

Kate Moody is joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Chase announce the launch of new payroll tools, J.P. Morgan upgrade their licence in Abu Dhabi, and BNPL fuels a record-breaking Cyber Monday.

807

807. Insights: Managing regulation without compromising innovation

David M. Brear is joined by some great guests to take a closer look at that tricky balance between managing regulation without compromising innovation in financial services.

201

201. Insights: How to manage your identity on web3 and blockchain

L.F.G. Today we bring you a deep dive into identity on the blockchain - how it differs in web3 from web2, the benefits and challenges and how you can own your own identity online. All this and much more on today's Blockchain Insider!

806

806. News: Alphabet's mega Monzo deal and The Rock's Mighty Oak

Ross Gallagher and Rachel Pandyan are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Alphabet could be investing in Monzo, Revolut open bond trading to millions of customers, and The Rock has launched a debit card.

805

805. Insights: One year of ChatGPT

David M. Brear joined by some great guests to talk about the one year anniversary of ChatGPT, how banks is utilising AI in its products and services, and how fintech can support the continued innovation of AI in finance.

804

804. News: Exits for HSBC, Chip reaches profitability and is Klarna taking on Shopify?

David M. Brear and Rachel Pandyan, are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: HSBC pulls out of new markets in a bid to double down in Asia; Chip reach first monthly profit, and is Klarna taking on Shopify as it changes up its business model.

200

200. Insights: The future of bitcoin

L.F.G. Today we bring you our 200th episode!! For this very special landmark we will be taking a look at the future of bitcoin; the developments on the Lightning Network; and the impact building on the bitcoin infrastructure will have for the future of cryptocurrency and how we interact with it. All this and much more on today's Blockchain Insider!

802

802. News: Crowdcube acquire Semper and OakNorth do business banking

Ross Gallagher is joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Crowdcube acquires Semper, Adyen and Plaid team up in the US, OakNorth move into business banking, and N26 pulls out of Brazil.

801

801. Insights: How does climate change impact fintechs?

Kate Moody is joined by some great guests to talk about how climate change is impacting fintechs, and how fintechs are supporting other businesses to achieve their climate goals.

800

800. News: US big banks team up to launch Paze, and Atom Bank raise £100m in equity funding

David Barton-Grimley and Kate Moody are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: A joint venture from the biggest US banks launch digital wallet Paze, Atom Bank raise £100m in equity funding, Railsr are making a comeback, and Deutsche are closing nearly half of their branches.

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

Fintech Marketing Podcast Season 2 Preview

Fintech Marketing Podcast Season 2: Coming soon

Fintech Insider Presents: After Dark - Open Finance: fact or fantasy?

After Dark - Open Finance: fact or fantasy?

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)