Global

Leda Writes for Fintech Futures: Diversity absolutes and the absurdity of decency by design

Each week, Leda Glyptis, CEO of 11:FS Foundry creates #LedaWrites. This week her attention turns to failing and terrible advice.

Don’t bother saying you are sorry: How VCs hurt me and the industry

If you look at the Trustpilot reviews for Plum (the UK savings app), one thing stands out. People don’t talk that much about the product; instead, they proudly declare how much they’ve saved.

Leda Writes for Fintech Futures: Banking reality checks and other fables

Every Thursday, Leda Glyptis, CEO of 11:FS Foundry creates #LedaWrites. This week, she tells us the best way to avoid frustrated ambition and missed opportunities.

Platformification: Taking your bank to the next level

Software has been around for some time, but it was the explosion of mobile phones that changed the dynamic and timeline of building new products. In Europe alone, fintech app usage is up 72% since the start of the pandemic. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Crappy data is why we can’t have nice things

If all the bits of your car lived in different countries, and you had to ship them to your house and assemble them every time you wanted to drive somewhere – it would get a bit annoying right? You would question why anyone thought this was an acceptable way of building something so critical.

Leda Writes for Fintech Futures: Career tips for optimists, curious cats and rebels

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to dudes and core banking.

Rethinking regulation: How to get it right

Jason Bates interviewed Rishi Khosla, CEO of OakNorth for Fintech Insider, the under the radar fintech unicorn in the SME lending space. They discuss OakNorth’s origin story, how they reached profitability within 24 months, the social impact of the SME lending space and what the future holds for this little-big company with deep roots. Listen to the interview in full on the podcast here or stream it below.

From Enemies of Innovation to Patron Saints: A Modern C-Suite Fairy Tale, Complete with Happy Ending

China’s currently the second biggest hub for fintech in the world. In 2018 the nation managed to secure $15.1BN in funding for fintechs. A great deal of that reputation for success is down to the power and growth of Ant Financial.

Leda Writes for Fintech Futures: Digital transformation beyond the real estate

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to industry conferences and forgetfulness.

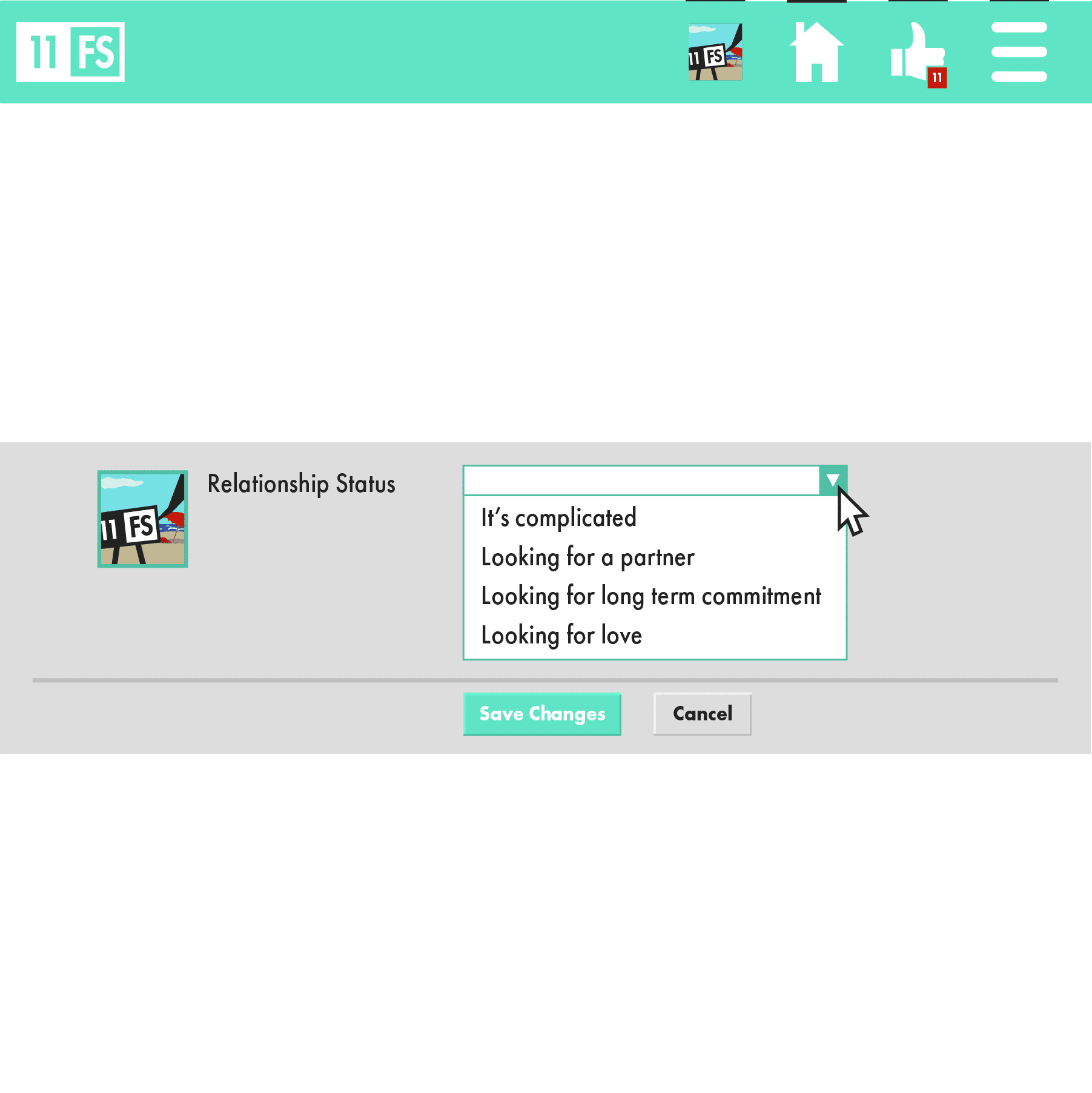

Relationship status: It (should not be) complicated Partners vs Vendors

It’s Valentine’s Day. Obvious opening statement for a blog published on February 14th but on the off chance you forgot, you might want to bookmark this blog, run and buy a card. I’ll be here when you get back.

How Banks Are Driving The Evolution Of Personal Financial Management

Big business is dying. But you already know that from my previous discussion with Jeff Tijssen last week. I digged a little deeper into the issue with him to find out how big businesses need to transform to stay alive.

Quantum leaps, or why I am looking forward to the future

Despite the global fintech boom, a lot of people in the Middle East remain unbanked, and there is plenty of work to do.

Leda Writes for Fintech Futures: Curiosity, impatience and weird premonitions

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she’s thinking about how fintechs can survive doing business with big banks.

Fintech and the gig economy

A couple of months ago our 11:FS CEO David Brear was invited to be a judge of Tech City UK’s Fintech for All competition. This was a nationwide competition in 2017 to find fintech startups that make financial services work for everyone. As well as some fantastic entrants and eventual winners, this event got us thinking about the wider implications of financial inclusion. Therefore we felt we really needed to do a podcast to delve into the issues raised and what this competition really highlighted, and how best the problems of financial inclusion and serving the underbanked can be solved in the UK.

Leda Writes for Fintech Futures: What we mean when we talk about legacy

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to diversity in financial services.

727

727. Insights: Is debt the last taboo of financial services?

Ross Gallagher is joined by some great guests, from the Aspen Institute, GoCardless, and Lowell, to discuss how innovations can improve the reputation of the industry of debt.

184

184. News: First zkEVM live on Ethereum, the USDC depegging, and Coinbase’s SEC Wells Notice

EL. EF. GEE. Today we bring you: First zkEVM goes live on Ethereum, a recap on USDC/SVB, and Coinbase’s SEC Wells notice. All this and much more on today's Blockchain Insider!

725

725. News: Has Apple missed the Buy Now Pay Later boom?

Crowdcube and Octopus Investments opening up retail investments, Apple Pay Later is finally launching, and Twitter changes logo to Dogecoin cryptocurrency image – Ross Gallagher is joined by some great guests, from Crowdcube, Fintech Business Weekly, and The Fintech Times, to talk about the most interesting stories in financial services over the last 7 days.

724

724. Insights: Are SMEs being served globally?

Benjamin Ensor is joined by some great guests, from Global Ventures, Novo, OakNorth Bank, and Spiralem, to look at the business banking options and challenges for small and medium-sized businesses across the world.

723

723. News: After Dark: Silicon Valley Bank bought by US rival and Klarna embraces ChatGPT

Silicon Valley Bank bought by rival, Klarna plugs ChatGPT into its platform, and Latitude Financial records stolen in cyber attack – David M. Brear and Kate Moody are joined by some great guests, from CFIT and first direct, live on stage in London to talk about the most interesting stories in financial services.

722

722. Insights: How do you choose the right investment path for your business?

David M. Brear is joined by some great guests, from Stonehaven LLC, National Bank of Canada, and Anthemis, to discuss the various funding options for fintechs and startups.

720

720. News: UBS snaps up Credit Suisse, while Stripe breaks the down round stigma

UBS is buying Credit Suisse in bid to halt banking crisis, FCA warns payment firms over ‘unacceptable risk of harm to customers’, and Stripe now valued at $50B following $6.5B raise – Ross Gallagher and Kate Moody are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days.

719

719. Insights: Is FinOps the key to ride out the economic storm?

David M. Brear is joined by some great guests, from 11:FS, Google, and Weavr, to discuss how cloud services and FinOps as a practice can help financial services in these economically difficult times.

183

183.Insights: What is the current state of crypto, and what is fostering adoption?

EL. EF. GEE. Today we bring you: a closer look at the global state of crypto, exploring how the past few years have shaped this sector, what developments are currently fostering adoption, and as always - what we hope to see in the near future!. All this and much more on today's Blockchain Insider!

718

718. News: The ultimate Silicon Valley Bank explainer

Silicon Valley Bank closed by regulators, HSBC buys Silicon Valley Bank's UK unit for £1, and Succession's Logan Roy comes to the London Stock Exchange – Kate Moody and Benjamin Ensor are joined by some great guests, from Innovate Finance and Fintech Takes, to talk about the most interesting stories in financial services over the last 7 days.

Bonus: Why should governments embrace new payment technologies?

EL. EF. GEE. Today, Mauricio Magaldi joins David M. Brear and some great guests, from Chamber of Progress and the House of Lords, for this Fintech insider and Blockchain Insider crossover episode!

717

717. Insights: Why should governments embrace new payment technologies?

David M. Brear and Mauricio Magaldi are joined by some great guests, from Chamber of Progress and the House of Lords, for this Fintech insider and Blockchain Insider crossover episode!

715

715. News: Abound raises $601m for AI lending and Griffin levels up with banking licence

Abound raises to supercharge AI-powered consumer lending, BaaS platform Griffin secures UK banking licence with restrictions , and people are posting their failed Monzo applications on TikTok –Ross Gallagher and David Barton-Grimley are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days.

714

714. Insights: Has financial services only been built for half the population?

Kate Moody is joined by some great guests, from Dawn Capital, JP Morgan Chase, and Your Juno, to discuss if financial services is currently doing enough for women.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)