Global

What's brewing in web3 during the crypto winter?

At this point we can all agree that the financial market as a whole has gone through a period of lows. Paired with increased inflation (even in developed countries), and the US confirming a recession, things seem to have really taken a turn for the worse - the so-called bear market.

Why is instant access to money still a myth?

They say time is money, right? Well, what about time to money – how long it takes for money to be available for you to use.

Fintech's climate fight starts with changing consumer behaviour

This week on Fintech Insider News David, Jason and Simon were joined by Innovate Finance’s Sophie Winwood and making his Fintech Insider debut, Banking Editior at The Economist, Patrick Lane, to tackle the latest news from the last week. Listen to the episode in full here or play and read below

ESG investing is broken. This is how fintechs can help fix it.

When I see headlines about “hipster” banks and “trendy” cards, it strikes me that the narrative is missing a huge shift about the consumer. Ethical is the new luxury. Private is the new showy. Transparent is the new trusted.

Why is competitor research so important?

I think I speak for a lot of people when I say - homework is crap. Evenings after school are for watching Takeshi’s Castle, not studying Pythagoras’ theorem.

Has fintech made us more resilient or vulnerable to economic shocks?

As part of the editorial process for Fintech Insider we review a lot of stories and see how media outlets report on challenger banks. Some recent pieces had the distinct feel of unhappy incumbent bankers lobbying hard to change the narrative.

Making inclusive design more inclusive

You may have heard of Marcus, it’s been kind of a big deal. But why and how? We recently sat down with Boe Hartman, CTO at Marcus by Goldman Sachs, to get the inside story.

Why are banks so scared of changing their tech?

Banks are having a midlife crisis. Their tech is at that stage where it’s old enough to gather regrets. Lots of them. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

How loyalty broke and why web3 can fix it

Fintechs regularly provide updates on how many customers they have. Motivations for doing so are varied — garnering headlines, proving naysayers wrong, or right, keeping investors happy and so on. More interestingly, they also have a variety of definitions of “customer” that are not always clear.

5 tips for designing purpose-first propositions in 2022

I think we can all accept that clear customer insight, the right business drivers, market opportunities, etc. should inform great proposition design.

Fintech VCs must do more to help the LGBTQ+ community

If there’s one region that’s been bookmarked by every 2024 predictions list in terms of innovation and investment, it’s the Middle East. And as the region emerges as a fintech hotspot, its unique commitment to Islamic finance is drawing attention.

What does the future hold for crypto regulation?

Everyone’s got a bike these days, right? How many bikes would you admit to owning? Is your ‘multi-bike’ strategy paying off? Now ask yourself the same questions about your use of cloud.

How the Buy Now Pay Later landscape is shifting

As financial services continues to ride the digital transformation wave, there is a big problem emerging: recruiting the tech talent required to achieve the scale of change needed.

Ignoring composability? Everyone’s paying the price

Brexit, GDPR, robo-regulation, fintech bridges, and envoys. Those were the big topics at the Treasury’s International Fintech Conference (IFTC) this year, held at Tobacco Dock.

675

675. Insights: Is the USA world-beating when it comes to payments?

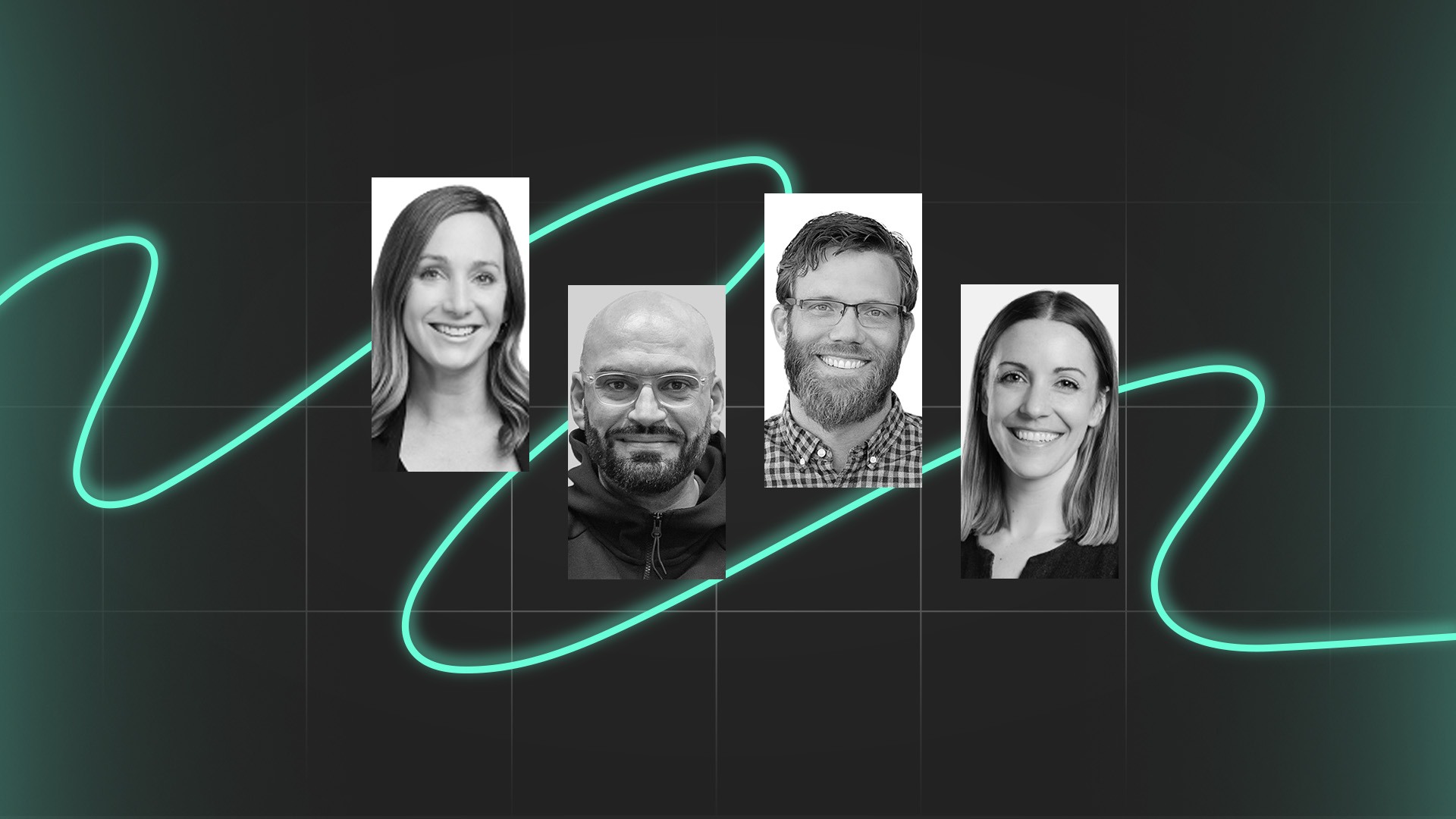

David M. Brear is joined by some great guests, from Moov, Catch, and Plaid, at Money20/20 in Last Vegas to discuss the strengths and weaknesses of payments in America.

672

672. News: Will Goldman Sachs call time on Marcus?

Ross Gallagher and Benjamin Ensor are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: wIll Goldman Sachs pull the plug on Marcus? PayPal backs away from fining people $2,500 for 'misinformation', and Damien Hirst burns artworks after collectors pick their NFTs instead.

671

671. Insights: What does the perfect pension offering look like?

Ross Gallagher is joined by some great guests, from Pensionbee, Wealthify and Common Wealth, to discuss what makes the perfect pension offering.

670

670. News: BaaS partnerships for Chetwood and HSBC and Adyen taps Tink for Open Banking payments

Kate Moody is joined by some great guests, from Tink, HSBC, and Chetwood Financial, to talk about the most interesting stories in financial services over the last 7 days, including: Mumsnet teams up with Chetwood to launch family-focused financial products in 2023, HSBC teams up with Oracle Netsuite for Embedded Banking Services in the US, and SEC charges Kim Kardashian for Instagram crypto promotion.

127

127. Insights: What could open insurance look like?

Benjamin Ensor and David M. Brear are joined by a panel of guests from Bright Blue Hare and Swiss Re Solutions to talk through what open insurance could look like. All this and much, much more on today's Insurtech Insider!

668

668. News: UK mortgage market in meltdown

Benjamin Ensor and Ross Gallagher are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: UK mortgage lenders halt some deals after pound falls, DoorDash partners with JP Morgan Chase on credit card, and we dive into the Fintech Insider mailbag!

667

667. Insights: Designing financial services for the mega-rich

David M. Brear is joined by some great guests, from 11:FS and Nucoro, to discuss designing financial services for high-net-worth individuals.

171

171. Insights: Understanding the world of developers

We. Are. Here. Today we bring you: a show dedicated to developers and their worlds. We take a look at what a dev actually does and how to break into their world, what opportunities are out there, and how important dev communities really are. All this and much more on today's Blockchain Insider!

665

665. Insights: Should everyone get paid when they need it?

Benjamin Ensor is joined by some great guests, from Zayzoon and PayMeNow, to discuss the earned wage access industry.

663

663. Insights: How have tech accelerators shaped fintech?

Benjamin Ensor is joined by some great guests, from Tech Nation, F10 and OakNorth, to explore the impact of tech accelerators on the fintech space.

170

170. News: Ripio launch prepaid crypto card and Netflix enters Decentraland

EL. EF. GEE. Today we bring you: Latin American crypto firm Ripio launches prepaid crypto card in Brazil, Steven Bartlett’s web3 creator platform Thirdweb raises £20m, and Netflix enters Decentraland metaverse promoted by Ryan Gosling. All this and much more on today's Blockchain Insider!

662

662. News: Shopify and Amazon's Cold War heats up

Kate Moody and Benjamin Ensor are joined by some great guests, from Betakit and Silicon Republic, to talk about the most interesting stories in financial services over the last 7 days, including: Shopify is picking a fight with Amazon, UBS scraps $1.4 billion deal to buy Wealthfront, and Japan decides it's time to stop using floppy disks.

661

661. Insights: Can embedded finance bank the unbanked?

Ross Gallagher is joined by some great guests, from 11:FS, Spiralem, and The Aspen Insitute, to discuss how embedded finance could be the trojan horse of financial inclusion.

125

125. News: Insurtech funding bounces back, while cyclists could soon require registration plates and insurance

John Bean and Benjamin Ensor are joined by a panel of guests from e-Zee Insurance and Snapsheet to talk through the biggest news of the month. Hear about: Insurtech funding bounces back after global downturn, Lloyd’s to end insurance coverage for state cyber attacks, and cyclists could be made to have registration plates and insurance. All this and much, much more on today's Insurtech Insider!

660

660. News: Shoppers globally turn to Buy Now Pay Later for groceries

Benjamin Ensor and Nicole Perry are joined by some great guests, from Anthemis and Lightyear, to talk about the most interesting stories in financial services over the last 7 days, including: UK and US consumers using Buy Now Pay Later to purchase groceries, Pezesha raises $11m from Women’s World Banking, and the PayPal story could be coming to a screen near you.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)