Global

Gates Foundation Interview - What Banks Can Learn from the Frontline of Financial Inclusion

Over the past twelve months, we’ve been seriously busy here at 11:FS. Now we’re announcing arguably the most exciting project we’ve ever taken on.

"My Bank Already Has An App!"

That’s what 11:FS bank building guru Jason hears when he tells people that he’s just spent the last two years building a new digital bank, and they’re right!

Top 10 Things To Know About Blockchain This Week

The Pulse team spends their time trawling through the world of banks and fintech apps, sorting the good from the bad so you don’t have to.

Why Should a Central Bank Issue a Digital Currency?

In this blog post Simon Taylor explores the concept of a Central Bank Digital Currency and why you would want a DLT (or “Blockchain”) like architecture for such a system.

BaaP (Banking as a Platform) Part 2 - How could banks develop their platform levers?

If you missed Part 1 of this 2 part piece then you can catch it here and catch up with the rest of the class: BaaP (Banking as a Platform) Part 1 – Why haven’t we seen a banking platform play?

Jurassic Bank – Why banks will have to go the way of the dinosaurs

The landscape for fintech and banking is evolving more rapidly than ever, and in case you weren’t aware, there’s a war going on for your customers. With challengers attacking from left, right, and centre, it’s never been more important to stay on top of the latest and greatest UX innovation. Pssst – click here to go straight to the goods and request a demo of 11:FS Pulse.

BaaP Part 1 - Exploring Banking as a Platform (BaaP) Model

The opportunity to change the way we deliver financial services is changing as new channels, products and partnerships are being explored. Banking as a Platform (BaaP) is one of the alternatives.By me, David M. Brear, CEO and Co Founder at 11:FS and Pascal Bouvier, Venture Partner at Santander InnoVentures

2016 Predictions - Expert FinTech panel predicts the biggest winners and losers in 2016 banking. - 11FS

While 2015 was just awesome on nearly all fronts, I think the close of the year has left us with a cliff hanger that George RR Martin would be rather proud of. For the curious among you, the question remains what’s next? What will 2016 bring? Across the actors and audiences, we feel there are the 9 questions we need to answer to be able to gauge who the winners and losers in 2016 banking will be. To get to the bottom of these questions, we have given our opinion, have asked a panel for their inputs and have asked a few expert friends of Think Different Group also for theirs.

AI in Banking: We got it wrong. Bank customers should be talking to a something not a someone. - 11FS

“Hey Siri – Are you the bank of the future?”… “No comment, David” – Sometimes when someone says no comment that means no but when the thing saying it is a computer assistant then “no comment” means someone has taken the time to think about it and decide upon a snarky comment rather than nothing at all! For years AI has been a good idea without real world application or the processing power, connectivity or interface intelligence to maximize the opportunity. In the last 6 months, and ever increasingly, those restrictions are being removed unlocking huge potential.

What Differentiates Banking and Fintech? - 11FS

We asked some of the 11:Mamas what they think we do. Here's how that went.

Banking’s 38mm and 42mm ‘Branch of the Future’ - 11FS

As consumers order the new Apple Watch, could this eventually be the missing piece of banking’s ‘branch of the future’? With secure digital payments, facilitated through the iPhone and Apple Watch, is this the potential game changer everyone has been waiting for? This article was first published on the Financial Brand in April 2015.

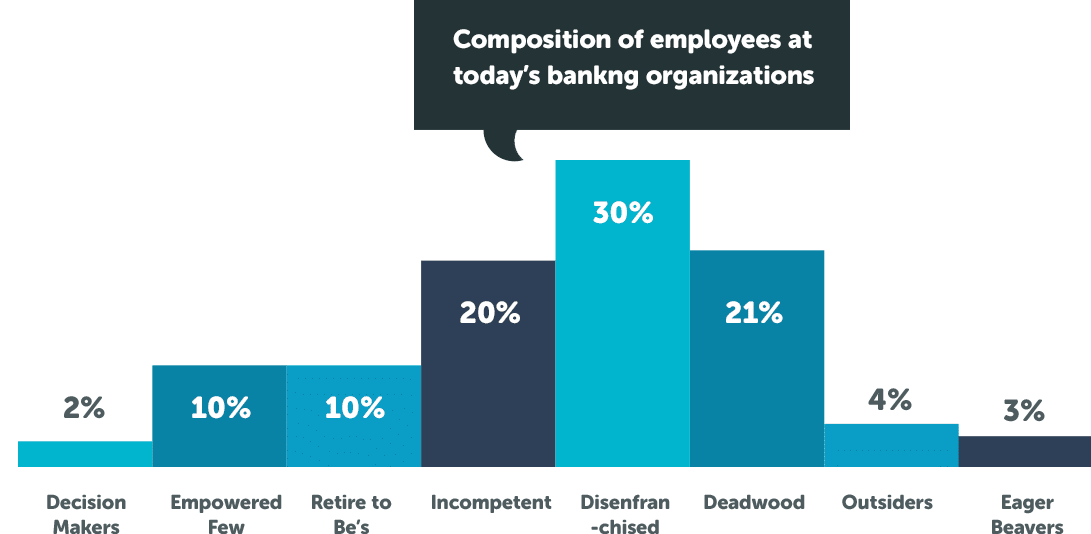

Career Bankers Are The Industry’s Biggest Threat?

Legacy banking organizations are filled with career bankers who are set in their ways and naturally resist change. These managers can stifle the creativity and innovative spirit of others, impacting the ability for the organization to make needed transitions and remain competitive. What type of banker are you? Banks have been talking about a legacy holding them back for decades, but usually this discussion revolves around IT, core banking systems, distribution channels and traditional operation processes. This article was first published on the Financial Brand in July 2015.

351

351. News: Keep calm and carry on investing

David Brear and Will White are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Apple Card Launches For Everyone, Global fintech investment falls sharply and NatWest hid a data breach from customers. All this and much more on today's Fintech Insider News.

110

110. Crypto doesn't sit still

We. Are. Here. Today we bring you: When Bakkt? September actually, Barclays ends partnership with cryptocurrency exchange Coinbase and Crypto Exchange Binance Announces New Stablecoin Initiative. All this, and so much more on todays Blockchain Insider.

47

47. News: The value chain of insurtech

Nigel Walsh is joined by a host of fantastic guests to talk about the latest and greatest news in the insurtech sphere!

349

349. News: Get rich quick!

Simon Taylor and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Remedies Pool C winners are revealed, Goldman Sachs dips into subprime lending with the Apple Card and NatWest trials voice banking with Google Home! All this and so much more on today's Fintech Insider News.

348

348. Interviews: Nick Ogden, Founder of ClearBank and WorldPay

David Brear is joined by Nick Ogden, fintech "founding father" and co-founder of Worldpay, to talk about some great topics, including the businesses Nick's founded and run, where he sees fintech in 5 years, what are the most important things he's learnt during his successful career and so much more!

109

109. Not crypto, but cryptography

We. Are. Here. Today we bring you: China’s Digital Currency, Mastercard make more blockchain moves, Kakao go Cuckoo for Crypto, and so much more!

347

347. News: Illegal fintech loansharks?

Jason Bates and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: America to get real-time payments by 2024, Klarna’s multi-billion dollar valuation, and Taiwan joins Asia's digital banking push with three new virtual licenses!

346

346. Insights: Jobs to be Done - The future of product design

Today's host, Ryan Garner is joined by some expert guests to bring you the latest episode of Fintech Insider Insights! Today we'll be focusing on everything JTBD, with insights from guests that know all about this space.

108

108. Who's Been Using Bitcoin?

We. Are. Here. Today we bring you: A $120m ‘Digital IPO,' Crypto Catches Mastercard’s Eye, 98% of Bitcoin is used for legal things, and so much more!

46

46. Q2 Insurtech review

Sarah Kocianski and Nigel Walsh are joined by 11:FS newly appointed Chairman, Shaun Meadows to talk about the newly published report Quarterly InsurTech Briefing Q2 2019!

345

345. News: This is how you make money.

Jason Bates and Simon Taylor are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Nubank’s $400 MILLION mega-round pushes their valuation to $10 billion, US women pay 18% more in banking fees than men and noel edmonds reaches compensation deal with Lloyds over scam! All this, and so much more on today's episode!

344

344. Insights: US Digital Transformation Special

In today’s show, Sam Maule is joined by some awesome guests from Fifth Third Bank in their offices in Cincinnati to talk about all things digital transformation in the US!

107

107. Libra causing a regulatory Ripple

We. Are. Here. Today we bring you: The IRS are coming for your crypto, Russian Bitcoin Thief Sued, Could China Rival Facebook’s Libra, and so much more!

343

343. News: Trump’s gonna shut this down!

David Brear and Simon Taylor are joined by some great guests to talk about some of the most interesting stories of the last 7 days. Including: Robinhood’s 7x unicorn valuation following a new funding round, Alibaba eyes US domination, how do you tally up your gold and so much more!

342

342. Insights: Atom Takeover ft. will.i.am.

In this weeks episode, David Brear and Leda Glyptis are joined by Atom Bank, and their Strategic Board Advisor, will.i.am, for a takeover show. They talk about all things Atom, AI, trust and data as commodities, as well as so much more!

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)