Global

Vadim Toader - Proportunity: mortgage innovation putting homes within reach

Creating a successful new venture is not easy. There are many pitfalls and risks involved from funding to technology. The biggest challenge though is designing something customers love.

Q&A with Urban Jungle: building an insurtech offering

Banking no longer has the luxury of getting up to speed with new technology. If you can’t adapt on the fly you’ll be left behind.

Leda Writes for Fintech Futures: humanity 101

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she's defending bankers.

Ethical is the new luxury; why trust is slipping through the banks' fingers

Open banking payments are already a fact of life in Europe. In the US, not so much. But new infrastructure and the right approach could lead to a sea change stateside. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

What does Libra from Facebook mean for banks?

Rumours emerged a fortnight ago that Revolut was near to closing a $250 million round at a valuation of over $1 billion. The company confirmed the news this morning, saying its valuation had increased 5x since it raised $66 million in the middle of last year and now stands at $1.7 billion. The round was led by Hong Kong based DST Global and the cash injection will be used to fund global expansion, starting with the US, Canada, Hong Kong, Singapore, and Australia this year alone.

Getting people management right: the burden of proof

Fintech sandboxes have been a huge success both home and away with the FCA having just opened applications for the fifth cohort in the UK and exporting the concept globally. Now the FCA is looking to go beyond the sandbox to create the Global Fintech Innovation Network (GFIN).

Leda Writes for Fintech Futures: Caffeine and angry bankers

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to career tips for optimists, curious cats and rebels…and auntie Mabel.

Why have regulators reacted so strongly to Libra by Facebook?

It didn't take long. Within hours of Libra being announced the global regulatory system had plenty of opinions on what it meant and how it needed to be governed.

Is Libra from Facebook a ploy to get your data?

To say it’s been a busy month for Libra would be a massive understatement.

Leda Writes for Fintech Futures: dispatches from industry conferences

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to why diversity and inclusion shouldn’t be a standalone activity and why you shouldn’t just protect your stars, you should protect everyone.

Engaging the FS community to redefine what ‘best’ really means

Driving growth and building your brand is tough. Everyone has a voice. But that means working harder, and smarter, as our new CMO Eric Fulwiler knows only too well.

Mutually beneficial: banking lessons from the industrial revolution

The 5th of April 2021 signified 5 years since we started 11:FS. 5 years since we were all stupid enough to quit well paid jobs to start a business with no capital, no brand and no reputation. Taking on competitors with tens of thousands of people and hundreds of millions to invest... This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Leda Writes for Fintech Futures: core banking and core principles

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week, she discusses how core banking is changing her life for the better.

Authenticity: keeping it real

There's something borderline intangible about the 11:FS tone of voice; it's iconoclastic. It's different.

11 most interesting things about Facebook’s Libra cryptocurrency

What is Facebook coin / Libra? Is this a game-changing moment and what should we do about it?

26

Insurtech Insider Episode 26: More news you need to know

On the latest episode of Insurtech Insider, Sarah and Nigel sit down with Dylan Bourguignon, shaking up our usual topic-based format we take a look at all the insurtech news that's happened in the past week.

261

261. News: Reinventing retail

On this week's episode, Simon and Ross sit down with Bill Gajda and Sian Lewin to discuss the latest and greatest news in fintech.

260

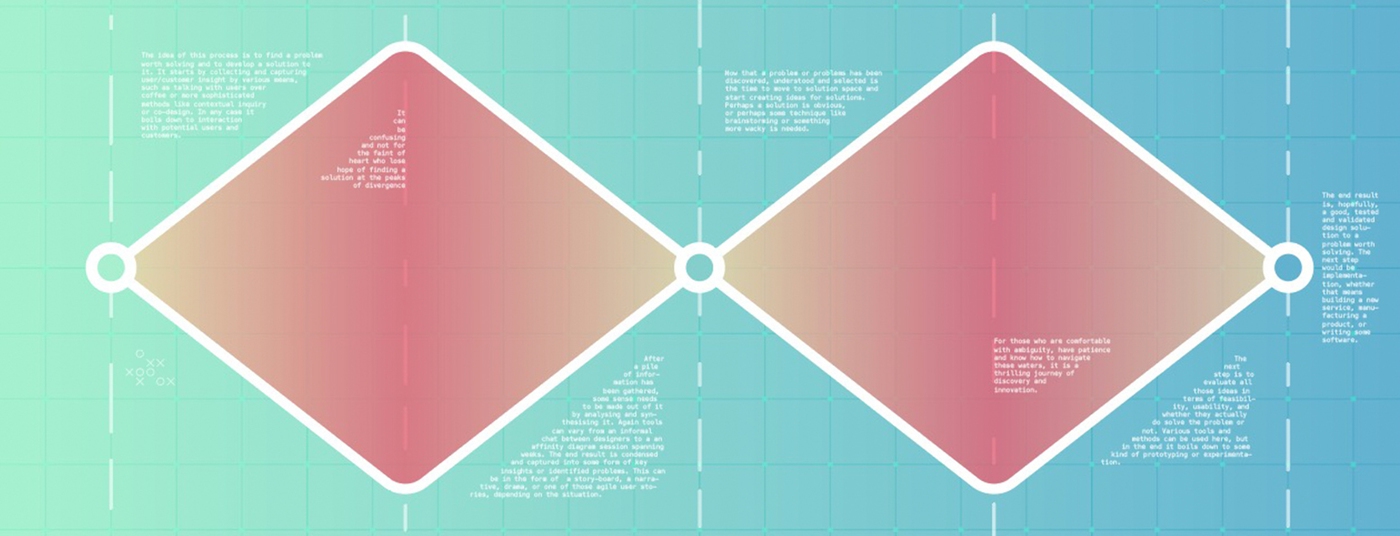

260. Insights: Product Design in fintech and banking

On today’s show, our host Jason Bates is going to take a bit of a deep dive into the world of product design for digital products in fintech and banking. We're using the classic double diamond of design to explain just what matters most in designing products and how to deliver products that matter to customers.

67

67. The CEO of Binance is [so] hot right now

We. Are. Here. Simon's joined by three great guests: Joon Ian Wong, Claire Wells and Aman Kohli to discuss the latest and greatest news in blockchain.

259

259. News: We are the news

On this week's episode, Simon and Ross sit down with Nina Mohanty, Lianna Brinded and Lesley-Ann Vaughan to discuss the latest and greatest news in fintech.

258

258. Insights: Healthtech

On today's show, David and Simon are with a great roundtable of health experts to take a look at what's happening in Healthtech.

66

66. Blockchain Live: Interviews (featuring Blockchain.com & Chorum)

We. Are. Here. Live from Olympia London at Blockchain Live! We were actually there last week. But we interviewed so many great people we're releasing a bumper episode filled with great insights. We interview Garrick Hileman and Xen Baynham-Herd from Blockchain as well as many more great guests.

25

Insurtech Insider Episode 25: Art Insurance

On the latest episode of Insurtech Insider, Sarah sits down with James Garthwaite and Luke Mullett to discuss all things Art Insurance.

65

65. Blockchain Live

We. Are. Here. Live from Olympia London at Blockchain Live! Simon and Colin are joined by a great guest, Teana Baker-Taylor to discuss the latest and greatest news in blockchain in front of a great live audience. We also have an exclusive interview with Dan and Brendan from Block.one.

256

256. Insights: PensionBee takeover

On this special episode, we're buzzing to be taken over by PensionBee. At their offices on Southwark street, we're with some of the top tier of PensionBee's team to bring you an insight into pensions.

255

255. News: Really great at charts

On this week's episode, David, Sam and Simon are sit down with Ahmed Zaidi and Kathryn Harris to discuss the latest and greatest news in fintech.

254

254. Interviews: Shamir Karkal, Co-Founder of Simple Bank

Sarah Kocianski interviews Co-Founder of Simple Bank, Shamir Karkal. They take a look at what it means to create a product that actually helps customers achieve their goals.

24

Insurtech Insider Episode 24: The news you need to know

On the latest episode of Insurtech Insider, Sarah and David sit down with Lea Nonninger and James York, shaking up our usual topic-based format we take a look at all the Insurtech news that's happened in the past week.

Bonus: Interview with Richard Brown and Mike Hearn at CordaCon

Today we’re bringing you a special bonus episode of Fintech Insider. Ross sits down with Richard Davies, Commercial Director, TSB to discuss their new design competition. Collaborating with 11:FS, the competition aims to bring in more innovative tools for small businesses to thrive.

252

252. Insights: Islamic Fintech

On today's show, Sarah Kocianski is with a great roundtable of guests to celebrate Islamic Finance week and drill down on what Islamic Fintech really is.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)