Global

Design drill down #3

In this design drill down, we’re looking at products and services that have gone back to the drawing board to solve a problem in a new innovative way.

Building a bank? Here’s why you should use Kotlin

Backend development for greenfield banking requires a special set of needs. We use Kotlin as our programming language. Here’s why.

Org design isn't a people chart, it's the foundation of a good company culture

2017 is drawing to a close, it’s been an amazing year for fintech and banking, there’s been so many changes, new companies, products, services and innovation across the industry. For a full rundown of the best (and worst) stories from 2017, listen to our After Dark Christmas Special where we recap the whole year. However, as 2018 is fast approaching, we’re looking ahead and getting some predictions in for the next year. We asked the 11:FS co-founders and team and our Fintech Insider News community what they thought would be the big themes of 2018. The biggest topics were as follows:

11:FS wins the three-peat at the British Bank Awards

I am a big basketball fan. It was my love, my passion, before I really even knew what financial services was. Back then my life was focused on how good my crossover was, how clean my kicks were and whether I could dunk rather than whatever it is I do today as the CEO of 11:FS!

Forget agile, ethics is the new battleground

After a decade of intense innovation, the mood across global financial services has turned sharply. Optimism has given way to fear and long-term ambition has been shelved for short-term survival.

Why we decided to build an operating system

Up until recently, if you wanted to launch a financial product, you either had to work directly with the deep financial infrastructure yourself or use a core banking system, which has all sorts of rules and parameters, to interact with the financial infrastructure.

I’ve incentivised innovation, why aren’t my employees innovating?

At one of our Truly Digital After Dark events, Anne Boden said “if you call yourself digital, you’re not digital”.

When creating frictionless experiences isn’t the best option

Making a user's experience seamless is the goal of every designer, but with real life implications for customer financial health, is it time we rethink our approach?

Want to build better customer solutions? Ask better questions

With 11:FS Pulse you can.

What does effective growth marketing look like for B2B in the 2020s?

We’re now a week on from one of the most exciting events of the year for us; the 11:FS Awards. It’s the one (and only) time we get dressed up snazzy and come together to celebrate some of the most impactful businesses and people who are changing the fabric of financial services.

Design drill down #2

In our third design drill down, we’re looking at how new approaches to insurance can bring innovative uses of technology, turn claim making into an enjoyable experience and bring a fresh perspective to big life decisions.

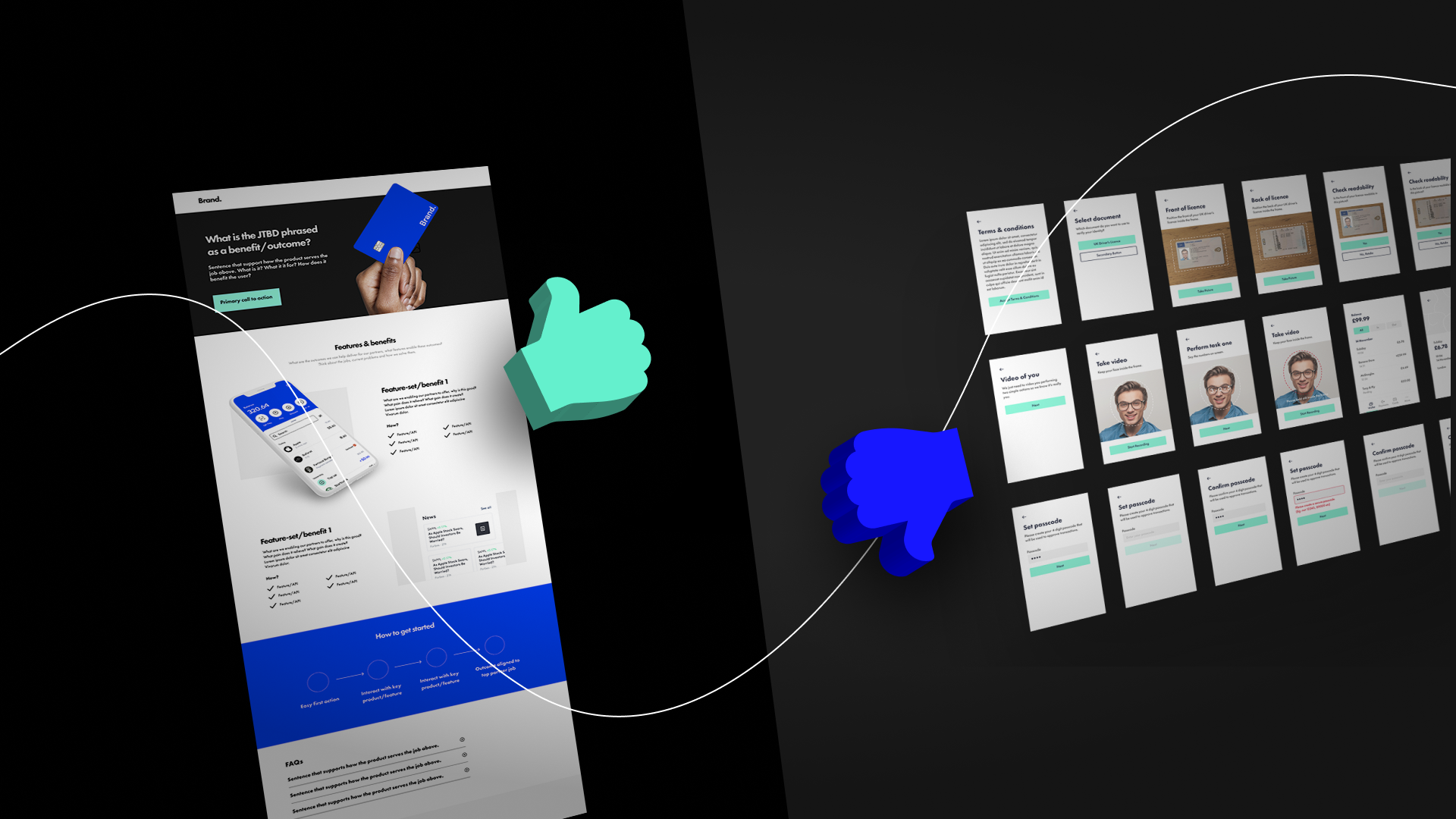

Are you producing prototypes too early?

There is a popular belief that you have to 'make it real' as quickly as possible – “come on, just f*****g build the thing - it's the only way to learn!”. In many scenarios this belief is a dangerous myth, and here's why...

What FS companies are getting wrong with their cloud based solutions

After a busy year in crypto, 11:FS co-founder Simon Taylor checks in on his 2019 predictions to see what he got right and what he missed.

Diversity and inclusion at 11:FS

GDPR, MiFID II, Solvency II, SCA, PSD2, Brexit… The past decade has been pretty hard on Compliance teams if not only for all the acronyms they need to remember.

Privacy and security are not optional in MVPs

Over the past few months, 11:FS Ventures has seen a spike in interest from clients in private banking and wealth management.

221

221. Fintech Insider: Live at TCF2018

David, Simon and Sarah lead a bevvy of insightful guests through a jam-packed, fast paced live show from Temenos' TCF2018 event in Dublin.

220

220. Fintech Insider Insights: Dirty Data

On the day GDPR becomes law, we bring you a story about data. Who has it? What do they do with it? Are we being listened to? Find out how GDPR will affect all our lives..

47

47. Circle the Bitcoin Unicorn with R3 CTO Richard Brown

Colin G. Platt and Pete Townsend are joined by Richard Brown, from our Lead Sponsor, R3.

219

219. Digital Asset Management

In a special episode of Fintech Insider, Pete Townsend entered the funds industry for two days at two events and hosted two separate panels.

218

218. News: From Loot To Hoot

In this week's episode, Laura Watkins, Sarah Kocianski, and David M. Brear are joined by Charlie Wood from Capco and Simon Vans-Colina from Monzo.

217

217. Interview: Frederic Nze, Oakam

Sarah sits down with Frederick Nze to discuss what makes Oakam different from other lending services.

46

46. A General Consensus

Sarah sits down with with Oscar Williams-Grut to discuss the latest in blockchain news. Meanwhile, Simon gets interviewed for a change by Pete Rizzo at Consensus.

216

216. Interview: Alison Rose, CEO, Commercial and Private Banking RBS

In this episode, David M. Brear speaks to Alison Rose, CEO, Commercial and Private Banking at RBS.

15

Insurtech Insider Episode 15: Deep Tech and Data Models

On the latest episode of Insurtech Insider, Sarah meets with insurtech experts to give you the very latest in insurance technology. Our guests joining Sarah are Ruth Foxe-Blader, Venture Capital Investor at Anthemis Group and Chris Sandilands, Partner at Oxbow Partners.We also bring you a great interview with Jason Futers, CEO of Insurdata

215

215. News: Insta-Pay

In this week's news episode, Sarah Kocianski and Ross Gallagher are joined by guests, Daniel Hegarty from Habito and Nina Mohanty from Bud.

214

214. Interviews: Andy Maguire, Group COO, HSBC

David sits down with Andy Maguire to talk about what the future of digital banking means for HSBC.

45

45. Taylor-Copeland Lawsuits Send Ripples Through XRP’s Security Status

Sarah and Sara sit down to discuss the latest in blockchain news.

213

213. Interviews: Jeff Nicholson & Patrick Givens, VaynerMedia

David and Simon sat down with Jeff Nicholson and Patrick Givens to talk about the uniqueness of VaynerMedia.

212

212. News: Debutantes and Diversity

In this week's news episode, Ross Gallagher and Sarah Kocianski are joined by guests, Sameer Gulati from Innovate Finance, Kathryn Harris from Lloyds, and James Hurley from The Times.

14

Insurtech Insider Episode 14. Travel Insurance: Meaningful Disruption

On the latest episode of Insurtech Insider, Sarah and Nigel are joined by insurtech experts to give you the very latest in travel insurance. Joining our hosts are James Gibson from Revolut, and Oke Elazu, COO at Bought by Many. Sarah also has an insightful interview with Parul Green from Axa

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)