Global

Leda Writes for Fintech Futures: Diversity absolutes and the absurdity of decency by design

Each week, Leda Glyptis, CEO of 11:FS Foundry creates #LedaWrites. This week her attention turns to failing and terrible advice.

Don’t bother saying you are sorry: How VCs hurt me and the industry

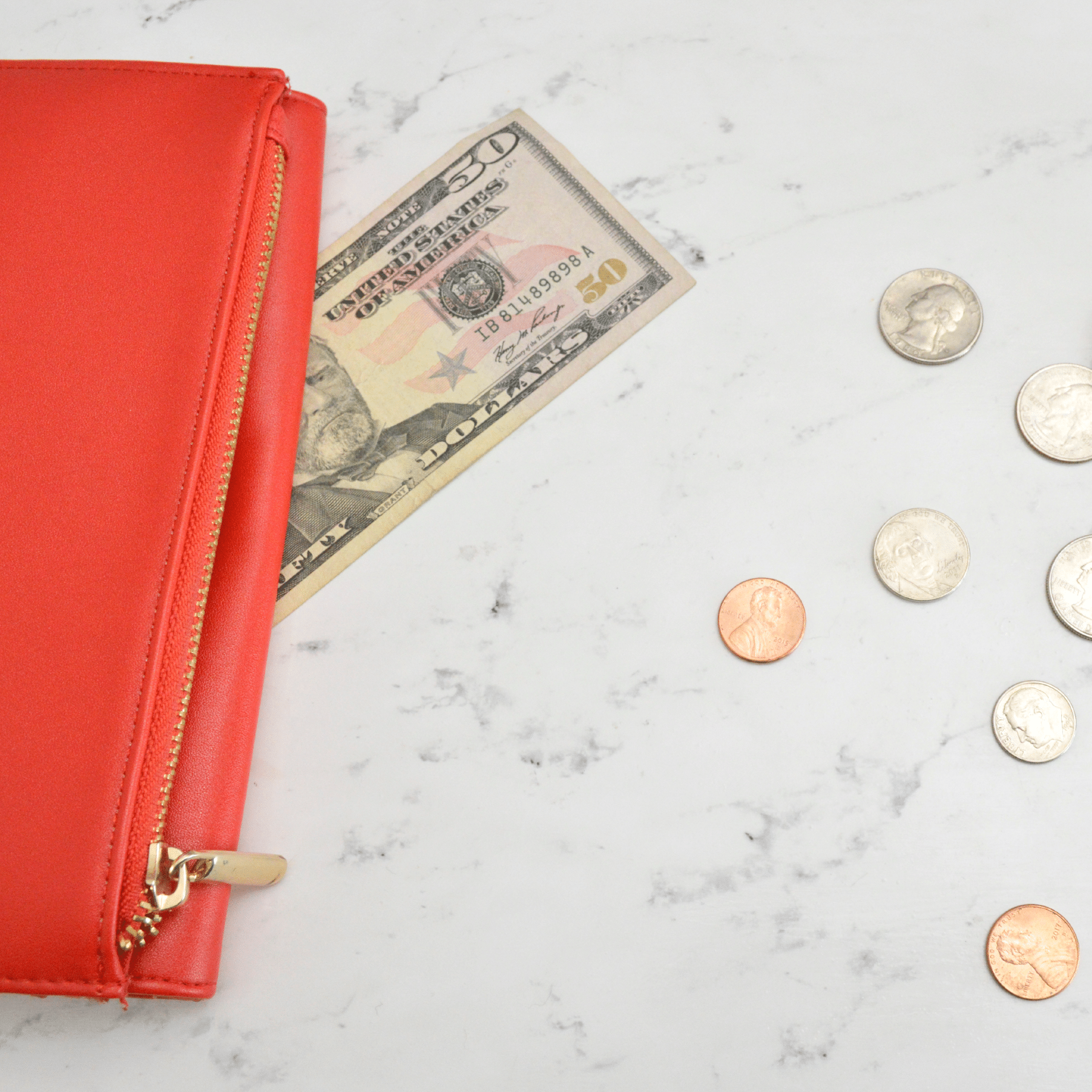

If you look at the Trustpilot reviews for Plum (the UK savings app), one thing stands out. People don’t talk that much about the product; instead, they proudly declare how much they’ve saved.

Leda Writes for Fintech Futures: Banking reality checks and other fables

Every Thursday, Leda Glyptis, CEO of 11:FS Foundry creates #LedaWrites. This week, she tells us the best way to avoid frustrated ambition and missed opportunities.

Platformification: Taking your bank to the next level

Software has been around for some time, but it was the explosion of mobile phones that changed the dynamic and timeline of building new products. In Europe alone, fintech app usage is up 72% since the start of the pandemic. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Crappy data is why we can’t have nice things

If all the bits of your car lived in different countries, and you had to ship them to your house and assemble them every time you wanted to drive somewhere – it would get a bit annoying right? You would question why anyone thought this was an acceptable way of building something so critical.

Leda Writes for Fintech Futures: Career tips for optimists, curious cats and rebels

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to dudes and core banking.

Rethinking regulation: How to get it right

Jason Bates interviewed Rishi Khosla, CEO of OakNorth for Fintech Insider, the under the radar fintech unicorn in the SME lending space. They discuss OakNorth’s origin story, how they reached profitability within 24 months, the social impact of the SME lending space and what the future holds for this little-big company with deep roots. Listen to the interview in full on the podcast here or stream it below.

From Enemies of Innovation to Patron Saints: A Modern C-Suite Fairy Tale, Complete with Happy Ending

China’s currently the second biggest hub for fintech in the world. In 2018 the nation managed to secure $15.1BN in funding for fintechs. A great deal of that reputation for success is down to the power and growth of Ant Financial.

Leda Writes for Fintech Futures: Digital transformation beyond the real estate

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to industry conferences and forgetfulness.

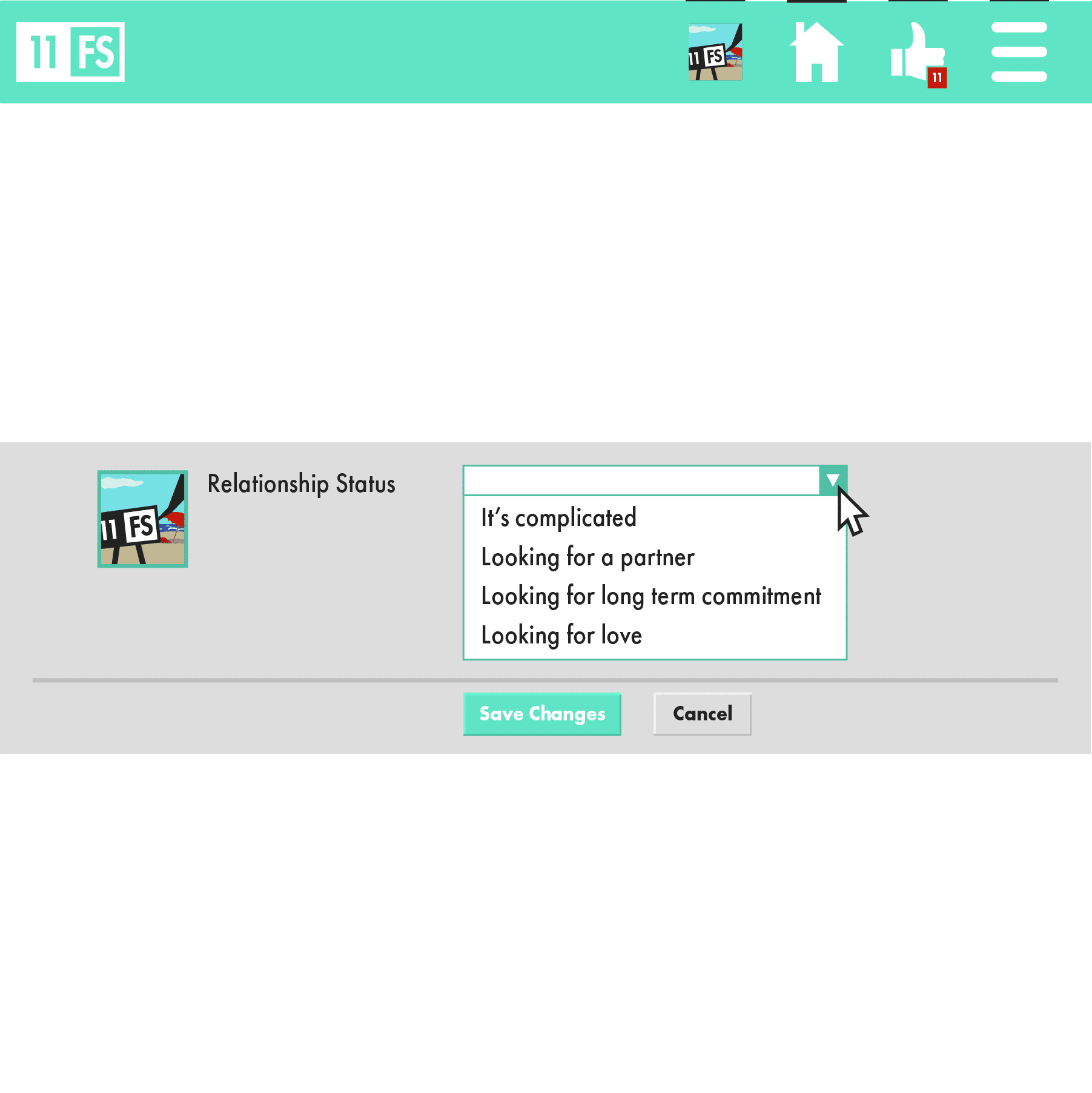

Relationship status: It (should not be) complicated Partners vs Vendors

It’s Valentine’s Day. Obvious opening statement for a blog published on February 14th but on the off chance you forgot, you might want to bookmark this blog, run and buy a card. I’ll be here when you get back.

How Banks Are Driving The Evolution Of Personal Financial Management

Big business is dying. But you already know that from my previous discussion with Jeff Tijssen last week. I digged a little deeper into the issue with him to find out how big businesses need to transform to stay alive.

Quantum leaps, or why I am looking forward to the future

Despite the global fintech boom, a lot of people in the Middle East remain unbanked, and there is plenty of work to do.

Leda Writes for Fintech Futures: Curiosity, impatience and weird premonitions

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she’s thinking about how fintechs can survive doing business with big banks.

Fintech and the gig economy

A couple of months ago our 11:FS CEO David Brear was invited to be a judge of Tech City UK’s Fintech for All competition. This was a nationwide competition in 2017 to find fintech startups that make financial services work for everyone. As well as some fantastic entrants and eventual winners, this event got us thinking about the wider implications of financial inclusion. Therefore we felt we really needed to do a podcast to delve into the issues raised and what this competition really highlighted, and how best the problems of financial inclusion and serving the underbanked can be solved in the UK.

Leda Writes for Fintech Futures: What we mean when we talk about legacy

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to diversity in financial services.

123

123. News: Data is the new oil

David and Chris are joined by Andrew Ellis, Strategy Lead at RBS; Sarah Kocianski, Business Insider reporter, and Sameer Chishty, founder of Streeton Partners for this week's news.

122

122. Interview - Phillip Keller & Harley Morlet, Tail

Meaghan Johnson interview Phillip Keller and Harley Morlet, CEO and co-founder of Tail

6

6. How to get a job in blockchain & Bitcoin Cash: week one roundup

In another packed episode Colin and Simon are joined by guests Chris Burniske and Zeth Couceiro.

2

2 Serial disruption

David and Nigel are back for episode two! They discuss the latest news and trends in insurtech, and also speak to Phoebe Hugh, CEO of Brolly.

2

2 Serial disruption

David and Nigel are back for episode two! They discuss the latest news and trends in insurtech, and also speak to Phoebe Hugh, CEO of Brolly.

121

121. News: Amazon is Everywhere

David is joined by fellow 11:FS co-founder, Meaghan Johnson, colleague and core banking guru Andra Sonea and Tanya Andreasyan, editor of Banking Technology for this week's news.

120

120. Interview: PwC Financial Wellness Report

David interviews Robert Churcher, Financial Strategy Lead at PwC Consulting and author of the Financial Wellness Report.

5

5. The Bitcoin Fork and Bitcoin Cash

This week we talk Bitcoin cash, BTC-e, Ethereum miners charting jumbo jets, and we hear from 3 fantastic guests.

118

118. News: Tokenaires and the Spiral of Complacency

Simon and David are joined by Sarah Kocianski to discuss the top stories of the last seven days.

4

4: The SEC verdict on ICOs, the Parity hack and bitcoin forks!

In a packed episode we talk about THAT Parity hack that unfolded last week, the upcoming bitcoin fork and we have an exclusive reaction to the SEC's verdict on ICOs and Tokens from Jeff Bandman, plus an interview with a very special guest: R3's CTO, Richard Brown.

116

116. Insights – Live from TNW 2017

In this episode: We bring you the highlights from The Next Web Conference 2017 in Amsterdam, where we spoke to […]

115

115. News: buying jewellery from a bank?

In this episode: David, Jason and Simon are joined for this week’s show by news show regulars Liz Lumley and […]

114

114. Interview – Mariano Belinky & Shachar Bialick

In this episode Jason Bates and David Brear interview Mariano Belinky, Managing Partner of Santander InnoVentures and Shachar Bialick, CEO of […]

InsurTech Insider 1. – InsurTech 101

InsurTech Insider is a new show in the 11Media network, hosted by David Brear and co-host Nigel Walsh, of Deloitte, dedicated […]

3

3: Bitcoin Signs & is Crypto a New Religion?

Simon is joined by special guests Ajit Tripathi, Jeff Bandman, Paul Gordon for the news and later he interviews Meltem Demirors, Director of Digital Currency Group.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)