Global

Design drill down #3

In this design drill down, we’re looking at products and services that have gone back to the drawing board to solve a problem in a new innovative way.

Building a bank? Here’s why you should use Kotlin

Backend development for greenfield banking requires a special set of needs. We use Kotlin as our programming language. Here’s why.

Org design isn't a people chart, it's the foundation of a good company culture

2017 is drawing to a close, it’s been an amazing year for fintech and banking, there’s been so many changes, new companies, products, services and innovation across the industry. For a full rundown of the best (and worst) stories from 2017, listen to our After Dark Christmas Special where we recap the whole year. However, as 2018 is fast approaching, we’re looking ahead and getting some predictions in for the next year. We asked the 11:FS co-founders and team and our Fintech Insider News community what they thought would be the big themes of 2018. The biggest topics were as follows:

11:FS wins the three-peat at the British Bank Awards

I am a big basketball fan. It was my love, my passion, before I really even knew what financial services was. Back then my life was focused on how good my crossover was, how clean my kicks were and whether I could dunk rather than whatever it is I do today as the CEO of 11:FS!

Forget agile, ethics is the new battleground

After a decade of intense innovation, the mood across global financial services has turned sharply. Optimism has given way to fear and long-term ambition has been shelved for short-term survival.

Why we decided to build an operating system

Up until recently, if you wanted to launch a financial product, you either had to work directly with the deep financial infrastructure yourself or use a core banking system, which has all sorts of rules and parameters, to interact with the financial infrastructure.

I’ve incentivised innovation, why aren’t my employees innovating?

At one of our Truly Digital After Dark events, Anne Boden said “if you call yourself digital, you’re not digital”.

When creating frictionless experiences isn’t the best option

Making a user's experience seamless is the goal of every designer, but with real life implications for customer financial health, is it time we rethink our approach?

Want to build better customer solutions? Ask better questions

With 11:FS Pulse you can.

What does effective growth marketing look like for B2B in the 2020s?

We’re now a week on from one of the most exciting events of the year for us; the 11:FS Awards. It’s the one (and only) time we get dressed up snazzy and come together to celebrate some of the most impactful businesses and people who are changing the fabric of financial services.

Design drill down #2

In our third design drill down, we’re looking at how new approaches to insurance can bring innovative uses of technology, turn claim making into an enjoyable experience and bring a fresh perspective to big life decisions.

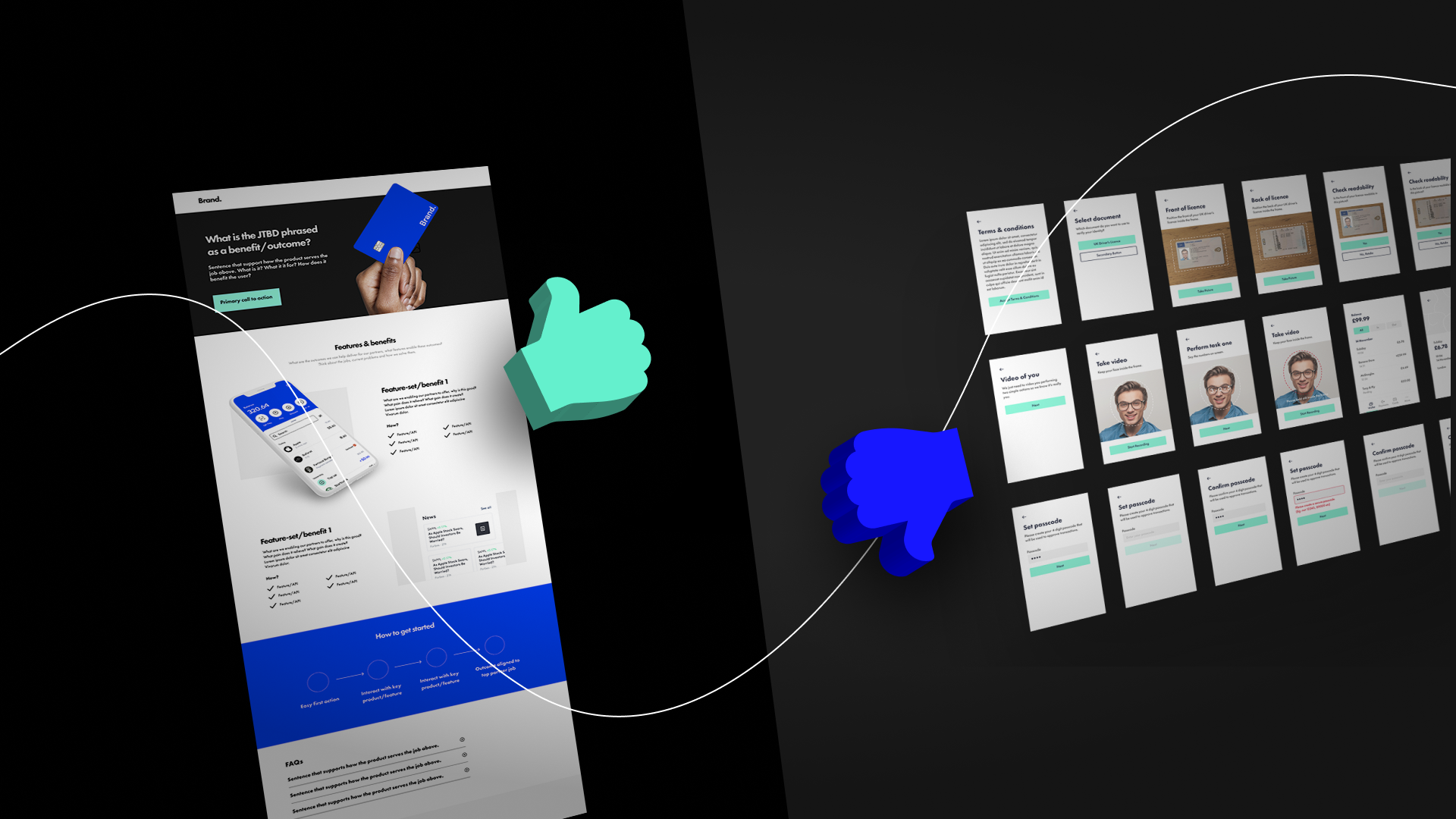

Are you producing prototypes too early?

There is a popular belief that you have to 'make it real' as quickly as possible – “come on, just f*****g build the thing - it's the only way to learn!”. In many scenarios this belief is a dangerous myth, and here's why...

What FS companies are getting wrong with their cloud based solutions

After a busy year in crypto, 11:FS co-founder Simon Taylor checks in on his 2019 predictions to see what he got right and what he missed.

Diversity and inclusion at 11:FS

GDPR, MiFID II, Solvency II, SCA, PSD2, Brexit… The past decade has been pretty hard on Compliance teams if not only for all the acronyms they need to remember.

Privacy and security are not optional in MVPs

Over the past few months, 11:FS Ventures has seen a spike in interest from clients in private banking and wealth management.

200

200. Transaction Banking: From Zero to Hero

In this episode Transaction banking has been defined as “the plumbing of international business. It ensures that salaries get paid, money […]

136

136. Leda Glyptis, Banking & FinTech Legend

Leda Glyptis (@LedaGlyptis) should be first on your list for any dinner party. Full of wit and wisdom, this banking and […]

135

135. Digital Banking is Only 1 Percent Finished

Happy New Year from FinTech Insider! Wow, 2016 was an incredibly busy year for us. In addition to doing this […]

134

134. FinTech Predictions for 2017

Time to make fintech predictions for 2017! Will PSD II be the biggest disappoint of the year? How big will the challenger […]

133

133. 2016 FinTech Review – What a Crazy Ass Year Part 2

And now for part 2 of our 2016 FinTech Review — What a Crazy Ass Hear This Has Been. We discuss Pokémon […]

132

132. 2016 FinTech Review – What a Crazy Ass Year Part 1

You’ve had your holiday meals, now it’s time to digest 2016. What a crazy ass year this has been. Brexit. President Trump. […]

129

129. Xero: Giving 800,000 Business Owners Their Lives Back

In this episode Gary Turner is Co-Founder and Managing Director of Xero, which provides small- to medium sized businesses (SMBs […]

128

128. How FinTech is Revolutionising SMEs

In this episode Business banking sucks, but it doesn’t have to, say this week’s stellar guests. The CEO of Tide and Co-Founders of […]

127

127. Giving Banks FinTech Access Through One API

In this episode Onboarding a FinTech into a bank is expensive, due to acquisition and compliance costs, and the risks that […]

125

125. Blockchain’s Godfather & Wealth’s Superhero

In this episode Hello, FinTech Insiders! This week we chat with two awesome guests leading innovation in different areas: blockchain […]

124

124. Wealth: Robo-Advisors or Master of Puppets?

In this episode Wealth Management isn’t just for the super rich anymore. It’s opened up to everyone. But the reality is, most […]

123

123. FinTech Under the Influence

In this episode Guests Sam Maule and Chris Gledhill are among the 100 most influential fintech leaders in 2016. Fun fact: Chris used to […]

122

122. I Like Chatbots and I Cannot Lie!

In this episode Are chatbots the last bridge to true AI? Or are we getting excited over nothing? We discuss whether […]

121

121. Off the Chain! With R3 and RBS

In this episode Richard Brown, Chief Technology Officer at R3, started building a blockchain platform called Corda from scratch a […]

119

119. Back on the Blockchain Gang!

In this episode 11:FS’ resident blockchain geek, Simon Taylor, is in heaven this week. Today we bring you ace interviews with Adam […]

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)