Global

Don't eat it all at once: Snack size core banking transformation

At some point for every product, you’ll have gone through an initial period of exciting discovery. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

How Australia is banking on new competition

By Michael Douglas, Vice President, Strategy, Galileo

Will blockchain replace core banking in 2019?

TL;DR None of the challenger banks use blockchain, the guy who’s leading the most popular smart contract platform (Ethereum) say’s it’s a bad idea. So, I mean read on…but. No, don’t use a blockchain or smart contracts for the love of god.

Leda Writes: The Venn diagram of doom

I’d like to start this by stating that Africa is not a monolith and for the purpose of this post, I’ll be zeroing in on the East and West African markets. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Our 2019 crypto predictions

It’s been an incredible year for fintech, but one thing’s for sure. 2019 is going to be an even wilder ride.

Our 2019 fintech predictions

So about 350 days ago I made some predictions about how 2019 would shape up. Here I’ll break down how accurate, or not, I was. TL:DR - pretty damn accurate.

New Year resolutions: in 2019 digitalise on purpose

Niall Cameron joined David Brear on Fintech Insider to discuss HSBC, innovation and partnering with fintechs. We found out his views of how incumbents can best work alongside and partner with fintechs in the changing digital space:

Looking back on Crypto in 2018

As a uni student, it drove Ollie Purdue crazy that his bank couldn’t provide him with basic info to help manage his financial life. How much money was he likely to have at the end of the month? Could he cut back on work and have more fun – or did he need to increase his hours to pay the bills? At age 20, he founded Loot to create a better banking experience that used data in a smarter way. In episode 232 of FinTech Insider, Ollie, CEO of Loot, shares the story behind his company, including how he got bank execs to talk to him when he was still in school.

What happened in fintech 2018

The 11:FS research team is in the midst of building out an internal platform that has some elements of gamification (and because we see a lot of products coming through our benchmarking tool 11:FS Pulse which make use of it), I’ve been spending a bit of time considering the topic.

Leda Writes: The hard currency of bankers’ feelings

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to careers, indecision and the Venn diagram of doom.

Top 3 Blogs of 2018

I was recently asked whether digital transformations meant partnerships will become obsolete. In fact, I think quite the opposite - banks who don’t use partnerships will become obsolete.

The Bankmare before Christmas

If you’ve been listening to the news at all in the last few months, you’ve likely run across the term Open Banking – a lot. The internet is awash with articles, thought pieces, blogs, books and podcasts on Open Banking. It’s a full-time job keeping up with the latest trends and following the right people. That’s why at 11: FS we’ve put together the authoritative resource on Open Banking. Whether you’re new to Open Banking or a bonafide guru, we’ve cut through the noise to bring you the go-to guide.

Leda Writes for Fintech Futures: You’ve been doing meetings wrong

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to Wonder Woman, technology without heart and why love is key to innovation.

U.S. Millennials: A balancing act of YOLO and debt-induced anxiety

If you’re a banker, particularly a retail banker, last year was like the longest pre-fight build up we’ve ever seen. Unless you’ve been living under a rock, you will know that this year four new challenger banks will finally come to the UK market in the form of Monzo, Atom, Starling, and Tandem. They were the constant drum beat in the background while you were making your roadmaps and planning your transformations; the constant understanding that winter was coming.

Are card payments under threat? The rise of the A2A payment

Much has been written about how Open Banking has announced itself with more of a whimper than a bang, since going live at the beginning of 2018.

782

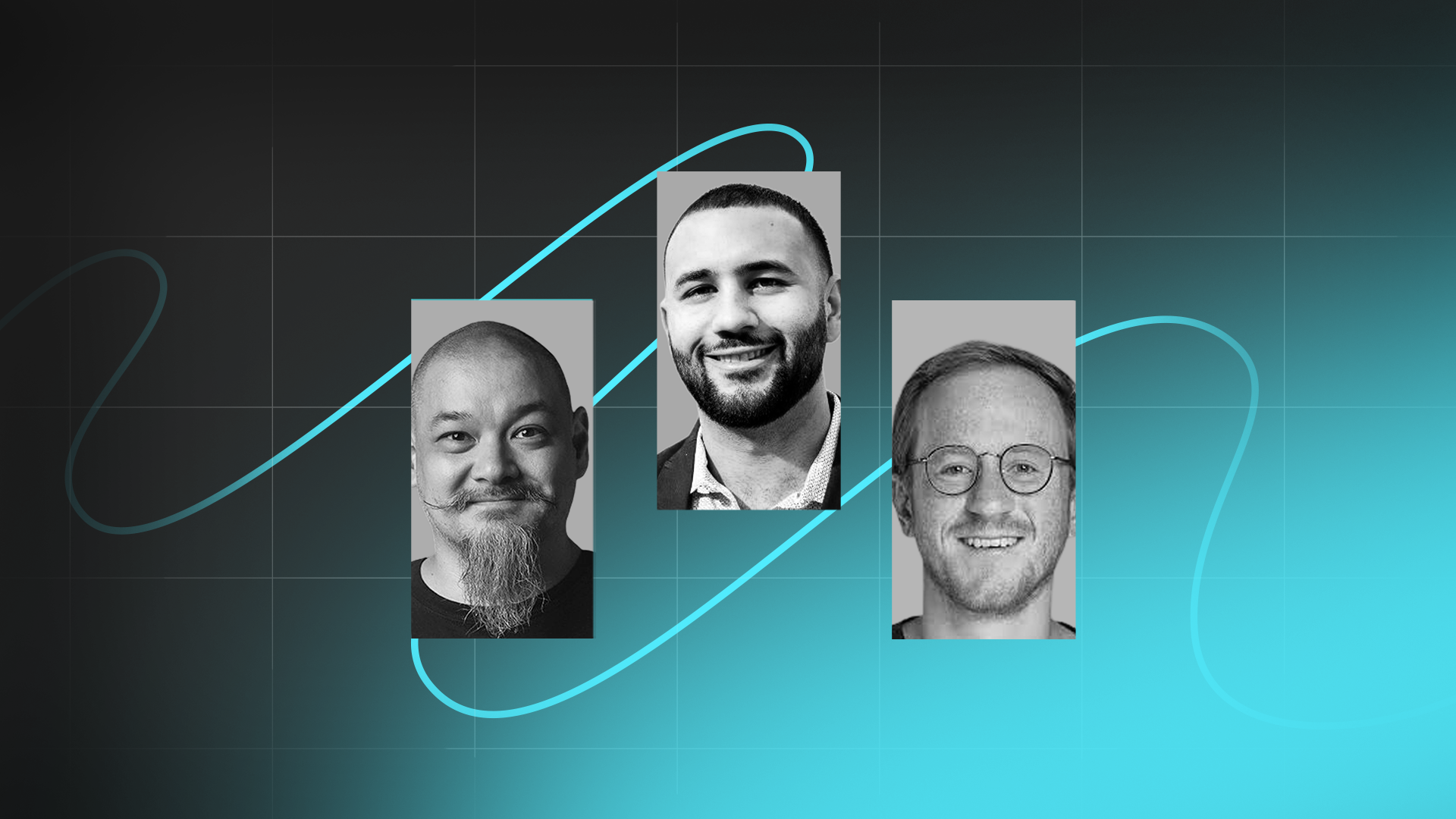

782. Insights: How should we measure success in fintech? (Rewind)

What is the best metric for measuring the success for fintech? In this rewind show from the archives, Benjamin Ensor is discussing the answer to that question, joined by some great guests, from Allica Bank, Anthemis, and This Week In Fintech.

779

779. Insights: What AI can and can’t do in financial services

David Brear is joined by a panel of experts from Cleo, Feedzai and Starling Bank to look at how financial services need to adapt to the changes brought by AI, where it can have the most influence and where the human touch is still needed.

195

195. Insights: The current state of stablecoins

L.F.G. Today we bring you: a super interesting discussion on the current status of stablecoins in the US and beyond and with the launch of PYUSD from PayPal what might the wider impact be? Are stablecoins going mainstream? All this and much more on today's Blockchain Insider!

778

778. News: JP Morgan invests in Brazil, African funding passes £2bn, and M-Pesa enter Ethiopia

JP Morgan increases its investment in Brazilian neobank C6, as Goldman Sachs sells its PFM unit, African fintech investment surpasses $2 billion, as M-Pesa enter Ethiopia for the first time. Benjamin Ensor and David Barton-Grimley are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including Sarah Kocianski and Samee Zahid from Chipper Cash.

775

775. News: Ramp raises $300m, Goldman returns to the rich and Monzo tops the charts

Ramp raises $300M (and that's a down round!), Goldman Sachs plans sale to concentrate on the ultra-wealthy and Monzo is named best bank - Kate Moody and Benjamin Ensor are joined by some great guests from CCG and Lightyear to talk about the most interesting stories in financial services over the last 7 days.

774

774. Insights: How are financial services players using blockchain?

David Brear is joined by some great guests from Fireblocks, DigitalX and Moniflo to talk about how financial services are actually using blockchain technology and how they choose an option that works best for them.

194

194. Insights: What is the impact of AI on social media and web3?

L.F.G. Today we bring you: a super interesting discussion on the impact AI software and AI generated content can have on the world of social media, and where the overlaps with the crypto space live, and how to make this safe for consumers. All this and much more on today's Blockchain Insider!

773

773. News: Mastercard pushes in to Africa with MTN deal and niche banks are on the rise

Mastercard takes minority stake in MTN, rental platform Fronted closes down, and Bank Of Ireland customers go crazy for ATM glitch – Benjamin Ensor is joined by some great guests, from Anthemis, Cornerstone Advisors, and Ebanx, to talk about the most interesting stories in financial services over the last 7 days.

772

772. Insights: Has the fintech revolution ignored older customers?

Kate Moody is joined by some great guests, from 11:FS, ClearEstate, and PensionBee, to look at the financial services aimed at customers over 60.

770

770. News: PayPal launches stablecoin and Apple $10 billion rocks the banking world

PayPal launches stablecoin, Apple announces $10 billion in deposits, and Drake launches Shopify mansion – Kate Moody and Ross Gallagher are joined by some great guests, from Fiat Republic and Knot API, to talk about the most interesting stories in financial services over the last 7 days.

193

193. Insights: Checking in on our 2023 predictions

EL. EF. GEE. Today we bring you: a recap of our 2023 predictions for the crypto space. what did we predict correctly? What did we get completely wrong? What still has potential to materialise in the next few months leading up to 2024? All this and much more on today's Blockchain Insider!

768

768. News: Shopify and HSBC blur the lines between e-commerce and financial services

Shopify launches credit card, HSBC and Tradeshift launch joint embedded finance venture, and Snoop gets acquired – Ross Gallagher and David Barton-Grimley are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days.

767

767. How do you innovate in a highly regulated industry?

David M. Brear is joined by Standard Chartered CEO, Bill Winters, in this interview deep-diving into innovation in the banking space!

765

765. News: FedNow powers up and Dame Alison Rose steps down

Fed launches long-awaited instant payments service, NatWest boss Alison Rose resigns, and McDonalds launches McNuggets Land in the metaverse – Kate Moody and Benjamin Ensor are joined by some great guests, from Founders Factory and Chamber of Progress, to talk about the most interesting stories in financial services over the last 7 days.

192

192. Insights: A new world of functionality - a Smart Tokens case study

EL. EF. GEE. Today we bring you: a case study on all things smart tokens. What are they? How do they work? What do they mean for web3? All this and much more on today's Blockchain Insider!

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)