Web3, blockchain, and crypto innovation in financial services.

How crypto can change SMB banking, now

Months after the UK entered a coronavirus-induced lockdown and financial services firms are struggling to service their customers. Building a digital first approach now can alleviate immediate issues and set firms up for sustained customer success.

The metaverse will power a new era of industrial efficiency

Digital-only banks have been all the rage for some time now. Who hasn't heard of Monzo and Starling or, if your gaze is stateside, Chime? This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

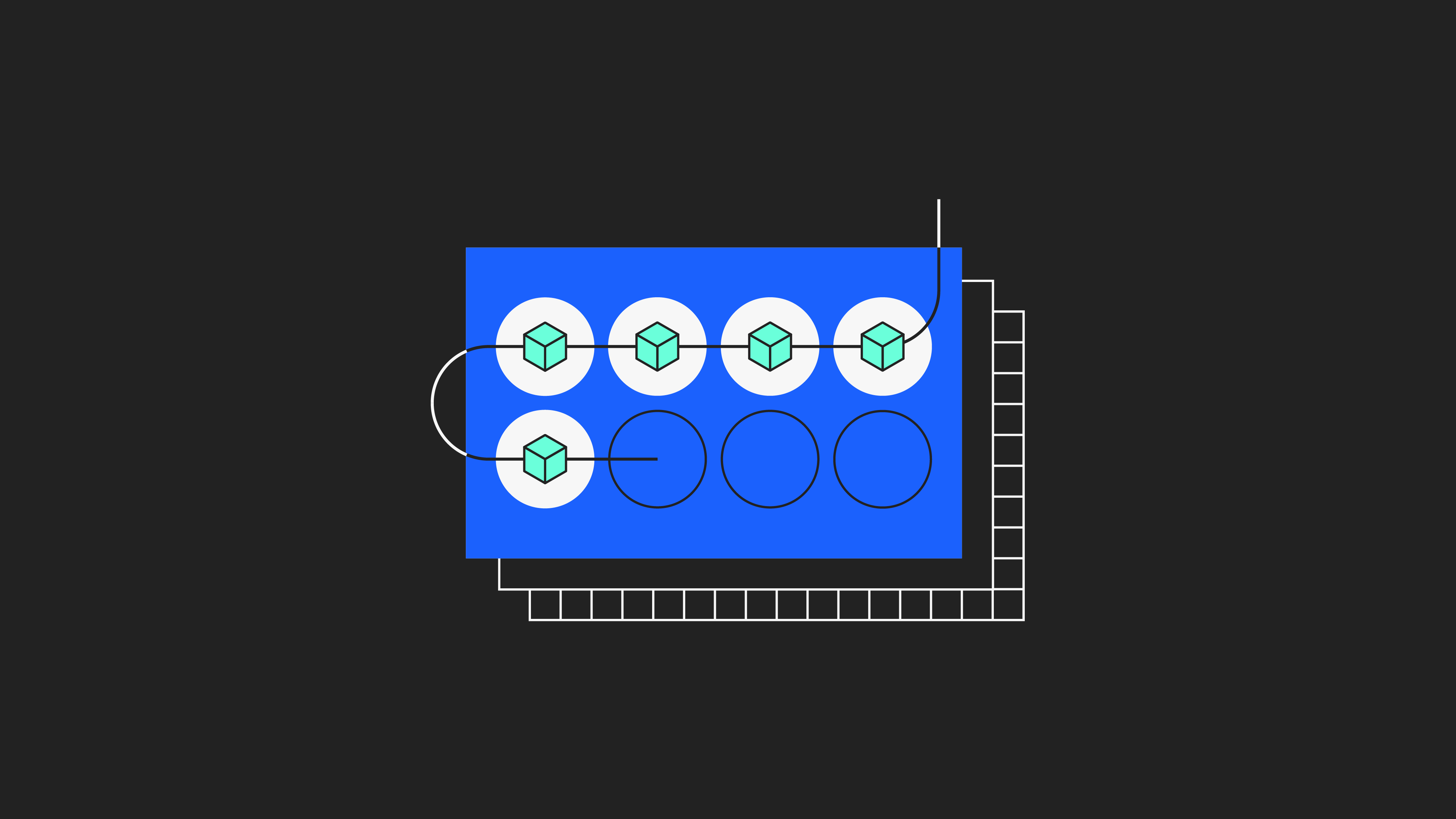

The future of crypto? On-chain and independently verified

If you change how money moves, you change the world. Money touches everything. Want to build a school? You need money. Want to prevent unsustainable business models? Want to prevent human trafficking? Manage the money flow.

Can neobanks reach the underbanked in Eastern Europe?

I wrote about the underbanked phenomenon in Eastern Europe a few weeks ago. Mainly I talked about which basic services are used, not used, and why.

What are our crypto predictions for 2023?

Happy 2023, fintech fans!

4 fintechs fighting the cost-of-living crisis

Around the globe, millions are feeling the pinch as the cost-of-living crisis continues. The biggest fall in living standards since records began is forecast in the UK, while inflation rates are starting to cool after a tumultuous year across the pond.

It’s time for incumbents to invest in web3

One of the phrases you often encounter when reading things about mental health is "It's OK to not be OK." Whilst I get the sentiment, as someone who has been there, it really isn't OK. It sucks.

It's time for community investing to go mainstream

Despite the global economic climate, a lot of banks and fintechs have dipped their toes into the crypto waters in recent months.

Can circular economies do what ESG couldn’t?

This is the second article in a three-part series on how fintech for good (FFG) is helping people and the planet. The first touched on consumer behaviour. If you missed it, check it out here.

Universal crypto adoption will come down to education and design

It’s happening. After months of ‘will they, won’t they’, Monzo is heading Stateside.

What's brewing in web3 during the crypto winter?

At this point we can all agree that the financial market as a whole has gone through a period of lows. Paired with increased inflation (even in developed countries), and the US confirming a recession, things seem to have really taken a turn for the worse - the so-called bear market.

ESG investing is broken. This is how fintechs can help fix it.

When I see headlines about “hipster” banks and “trendy” cards, it strikes me that the narrative is missing a huge shift about the consumer. Ethical is the new luxury. Private is the new showy. Transparent is the new trusted.

Has fintech made us more resilient or vulnerable to economic shocks?

As part of the editorial process for Fintech Insider we review a lot of stories and see how media outlets report on challenger banks. Some recent pieces had the distinct feel of unhappy incumbent bankers lobbying hard to change the narrative.

How loyalty broke and why web3 can fix it

Fintechs regularly provide updates on how many customers they have. Motivations for doing so are varied — garnering headlines, proving naysayers wrong, or right, keeping investors happy and so on. More interestingly, they also have a variety of definitions of “customer” that are not always clear.

What does the future hold for crypto regulation?

Everyone’s got a bike these days, right? How many bikes would you admit to owning? Is your ‘multi-bike’ strategy paying off? Now ask yourself the same questions about your use of cloud.

6

6. How to get a job in blockchain & Bitcoin Cash: week one roundup

In another packed episode Colin and Simon are joined by guests Chris Burniske and Zeth Couceiro.

Blockchain Special Part 3: EEA and ZCash

We. Are. Here. On...Fintech Insider. Simon's cutting across the podcasts to give a sneak preview on one of the biggest interviews of the year.

Blockchain Special Part 2: Consensus Recap

In the third of our three part Blockchain Special, Simon and Colin are joined by some very special guests to discuss EEA, ZCash and the potential similarities between blockchain and the rise of cryptocurrencies and the dot-com bubble in the 90s, and asks the question: “Why should we be paying attention?”. They also debate the anonymity of blockchain and user privacy; and centralisation vs decentralisation in blockchain APIs - do we still need the middle man?

Blockchain Special Part 1: Tokens

Part 2 of our Blockchain Special, Simon and Colin with a roster of fascinating guests focus on the recent Consensus conference. We cover what the conference is, who should be attending and where it means to the industry. We give you a crash course on the difference between cryptocurrencies and DLT, what the main impacts ledger technology will have on banks and what is causing the major spikes in crypto currency prices right now.

260

260. Blockchain Special Part 3: EEA and ZCash – Open Blockchains for Enterprise?

In this episode In the third of our three part Blockchain Special, Simon and Colin are joined by some very […]

257

257. Blockchain Special Part 2: Consensus Recap

In this episode Part 2 of our Blockchain Special, Simon and Colin with a roster of fascinating guests focus […]

254

254. Blockchain Special Part 1: Tokens

In this episode As crypto currency interest and prices reach an all time high Simon and Colin bring you the first […]

250

250. If You Liked It, Then You Should’ve Put A Blockchain On It

In this episode We discuss what a challenger bank really is – drawing a line in the sand for who […]

246

246. Finding Blockchain’s Feet

In this episode Simon and David sit down with Richard and Maya to discuss the state of the Blockchain. We […]

227

227. Tantric Blockchain and Other FinTech Fun

In this episode On this episode of FinTech Insider we cover all sorts of intrigue, from money laundering, to tantric blockchain, […]

220

220. Blythe Masters on Blockchain’s Once in a Generation Opportunity

In this episode Blythe Masters spent 27 years at JP Morgan in a variety of roles, including running the global commodities business, working […]

125

125. Blockchain’s Godfather & Wealth’s Superhero

In this episode Hello, FinTech Insiders! This week we chat with two awesome guests leading innovation in different areas: blockchain […]

120

120. Will FinTech Survive Trump? Plus Blockchain’s Biggest Brains

In this episode Will Trump roll back regulation? Did chatbots swing the election? The 11:FS team discuss with three brilliant guests: Richard […]

119

119. Back on the Blockchain Gang!

In this episode 11:FS’ resident blockchain geek, Simon Taylor, is in heaven this week. Today we bring you ace interviews with Adam […]

108

108. Everything Blockchain. Ever.

Key stories this week: Finextra – BBVA says EU Bonus Cap hampers tech talent acquisition : LINK Tech Crunch – […]

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)