TL;DR The Bank of England wrote a report about digital currency. Could it replace your bank notes? Could it change financial services dramatically? Yes. But the much more interesting questions were why should a CBDC be created and how?

A couple of days ago the Bank of England released a report that asked “Is the future digital for Bank of England bank notes?” If you’ve been following the subject for a while, some people call this CBDC (or Central Bank Digital Currency).

Now, whenever you hear “digital currency” I’m fairly sure a part of you groans or doesn’t want to listen, but stick with it, because this isn’t your Bitcorns [ed. note: Simon always calls Bitcoin “Bitcorn” and insists we keep it that way 🤷♂️] or Shitcoins we’re talking about here. This is one of the world’s most well-respected institutions looking at what digital money for the 21st century should all be about.

Why have they written this? Isn’t Crypto over?

Well. No. Remember Libra?

Libra happened. Facebook (and 20 other companies) banded together to create what central bankers call a “private digital currency”, seen as both a threat to central banks but also a risk to global stability. “Move fast and break things” doesn’t work well with global economic policy. This resulted in Mark Zuckerberg being asked to testify to congress and much more activity in central banks.

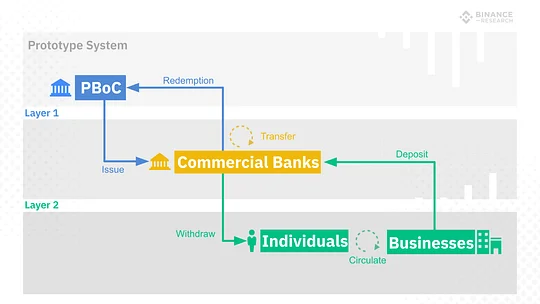

Then there’s China and its DECP project (Digital Currency Electronic Payment), which has announced something it’s billed as “superior” to the Libra project. Officials noted it would have two tiers: a centralised core and ultra-fast central bank payments system connected to commercial banks, and a second layer where commercial banks connect to consumers.

Source: CoinDesk

What’s CBDC?

Well that’s sort of the thing. Nobody really knows. Is it what China’s building? Implied in the name is that it’s from a central bank – like the notes and coins in your pocket – but once you get past that, there’s a lot of disagreement. The Bank of England report does a really good job of breaking this down.

It splits the central bank’s role with this new currency type into two areas:

- A new form of money held by commercial banks, non-bank financial institutions, businesses and potentially even households

- A new payments system, run by the central bank, that can be accessed directly by commercial banks and perhaps even a much wider audience of fintech companies and businesses

This “currency” would be a new form of money that sits alongside both the deposits held at banks (the money you see in your bank account) and physical notes and coins as a new, other thing.

For this currency to have value, though, it would need to be stable, and for it to work as a central bank currency it would need to actually be real sterling (unlike “stablecoins,” which are linked to real currency held at a bank somewhere else). The BoE points out that cryptoassets and currencies like Bitcoin are therefore unsuitable as an underlying technology platform or economic base.

What would a CBDC enable the BoE to do?

It’s important to remember that the Bank of England’s job is to ensure financial stability in the UK by keeping inflation low. A pretty tough job, all things considered...

It also runs a number of payment systems that allow banks to settle very large sums of money. In times of stress, it can print new money and change interest rates to achieve this. Here come some bullet points…

- Resilient Payments: Private payment systems go down, Visa goes down sometimes, banks go down. Whilst there’s no guarantee a central bank system would not go down, it provides an alternative. The key is doing so in a way that doesn’t outcompete the market while still offering something new and complimentary

- Avoid private money risks: Basically, something that competes with Libra by making it unnecessary in the UK at least. Offer all the same benefits and none of the risks.

- Create payment competition: This one is super interesting. There are a limited number of providers of payment services and most of them sit on top of banks, which connect to the central bank. The system was never designed for that type of innovation, but what if one was?

- Future Payments: Here the report talks about “programmable money,” a concept that has been innovated by crypto, but could be especially powerful. The basic idea is that the money comes with logic. For example, the currency and payments system itself would be able to pay tax on an item you bought in a shop or you could give out pocket money but restrict what it could be used to purchase. There may be many other concepts like this that emerge.

- Widening access to “Central Bank Money”: This is a double edged sword. “Central Bank Money” is often considered much safer than bank deposits, so there would be demand from businesses and some consumers. But deposits allow banks to “create” money by lending out against those deposits. Commercial banks play a crucial role in keeping the economy moving by printing their own money. The Central Bank wouldn’t want to damage that (more on this later)

- Helping the vulnerable as cash declines: Over the past three decades, the use of cash has continued to decline, with many consumers and businesses now going “cash free”. This can have a significant negative impact on the most vulnerable in society. Offering a “cash-like” service that happens to be digital in nature could help ease some of those issues.

- Make cross border payments better: As with domestic payments, making international payments can “feel” near instant, but only when you’re using a service that is built several layers above the banking infrastructure. There is a missed opportunity to fix the problem at source, between the central bank payment systems themselves. This is an area for further exploration.

Pretty cool right?

How would a CBDC work?

This report suggests you can have all of the benefits of a blockchain or decentralisation without actually chaining blocks. Programmability, sharing of data, decentralisation and novel cryptography are all things you can use and learn from the world of cryptoassets without copying them. In fact, you could use those ideas with much more run of the mill “centralised” tech and get the best of both worlds: the speed of a more centralised service with the resilience and security of something decentralised.

The payments infrastructure itself might look a lot like it does today. The central bank builds a highly secure centralised payments engine, and a number of organisations plug directly into that to offer services out to market. Today the only organisations that can do that in the UK are clearing banks. What’s new here is that the Bank of England is suggesting any number of payments providers could access the central bank payment infrastructure (assuming they proved they were secure and proper to do so).

Afterward, a number of organisations could connect to the payment providers to build wallets or payments applications across an open standard. Think of this as the software equivalent of anyone being able to make a leather wallet and put a £10 note inside. Digital payments don’t really have an equivalent. When you see money in a digital app, typically what you’re seeing is a representation of money held elsewhere on your behalf.

What the Bank of England is suggesting here is anyone could hold value that is a claim on the central bank balance sheet

What the Bank of England is suggesting here is anyone could hold value that is a claim on the central bank balance sheet. An equivalent to physical notes and coins.

So you’d log into an app – any app, it could be your mobile banking app, it could be a payments app, it could be a chat app – and within that app, you’d be able to “store” pounds sterling and “pay” in pounds sterling in this brave new world.

When you think about it, that feels a lot like how payments already work in China, with Wechat and Alipay being near instant app-to-app payments. The major difference here is that Wechat and Alipay hold that cash, which potentially allows them (or their underlying bank partners) to lend against it. Cash held in a wallet or app that is CBDC Sterling might not work that way.

(** For the nerds; if this sounds an awful lot like the goals for an existing Bank of England RTGS replacement program learning from crypto and picking the most useful ideas. I agree. **)

Wouldn’t that Disintermediate Commercial Banks?

Disintermediating commercial banks isn’t as exciting as it sounds. Banks provide a vital source of lending to the economy. When lending shrinks, so does the economy. The financial crisis of 2007-8 is a classic example. If CBDC were introduced in a careless way, the Central Bank risks creating another crisis. This is the direct opposite of their reason for being, ensuring financial stability. So why would they introduce CBDC if the risk for disintermediation does exist (excluding all the benefits outlined earlier)?

What if you got paid interest just for holding cash in your pocket?

Money for nothing? Not exactly.

To answer this, the Bank of England paper considers whether the CBDC should be remunerated (pay interest). The notes and coins in your purse or wallet are not remunerated. Sadly, you don’t receive interest from the Bank of England for holding that cash.

Things get more interesting when we imagine a remunerated CBDC. In this scenario, the central bank would pay you interest for the money sitting in your digital wallet. As the central bank increased money supply (printed money), you’d see the effect on consumer purchasing power much faster than we do today, where the central bank buys bonds in financial markets and that liquidity in theory trickles down to you and me as spending power.

By introducing a “digital cash” that’s more convenient than physical cash... the central bank could avoid that flight to physical cash

Imagine, however, if a central bank wanted to get into negative interest rates. There would be a cost to just holding cash. They’d have a problem, because all of those notes and coins in circulation just got a lot more attractive. Holding cash digitally or at a bank would result in you losing money in real terms, but holding cash as notes and coins wouldn’t have the same problem. So by introducing a “digital cash” that’s more convenient than physical cash but has many of the benefits (e.g. anonymity, benefitting the poorest in society), the central bank could avoid that flight to physical cash. Cheeky.

What happens now?

The report asks some pretty searching questions, and invites you, dear reader, to respond to the bank directly with your thoughts.

For example, do you want central bank money? Would that break banking as we know it? Is the threat of Libra worth doing the CBDC thing regardless? Do you want programmable money?

The report is available here, and well worth your time to read

If you’re wondering how this will impact your organisation, would love to talk. Do reach out: simon@11fs.com

.svg)

.svg)