Get the latest news and insights from the retail banking space.

The most interesting digital-only banks don't get enough attention

The third episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

11 US fintechs on our watchlist right now

There’s a reason counties often refer to their tech hubs as “the Silicon Valley of [insert country name here].” The Bay Area is the proud birthplace of some of the world’s biggest technological triumphs, home to global powerhouses like Apple and Visa. Every year the Valley also attracts a host of fintech start-ups - such as Credit Karma, Chime and Varo Bank, to name a few. But it’s not just California driving the future of financial services. We’ve done our research to see which companies across the 50 states are leading the fintech charge. (Did you miss our first blog? See who’s doing awesome things on the other side of the pond with our list of the hottest European fintechs.)

Why the Middle East could be the next fintech hotspot

Back at the end of 2019, we dived into the perfect fintech storm that was brewing in the Middle East. Diversification had already started in the region, but financial inclusion was reluctant to follow. So where are we now? It’s 2020, and things have been hotting up in the region with opportunities continuing to surface. But what does the region hold for fintech and why is the Middle East where the real gold lies?

Seedrs and Crowdcube merger: hot takes

It's a truism that the hardest job in engineering is that of 'Tech Lead'. You're the person who's not only writing code, but simultaneously leading a small group of other engineers and spending large amounts of time talking to stakeholders and the Product Manager (or, ten years ago, *Project* Manager). This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

11 European fintechs we’re excited about right now

London’s been at the centre of the fintech bubble for over a decade now, and the rest of Europe isn’t far behind. One of the few silver linings of the coronavirus pandemic could be that it might act as a catalyst for a tonne of investment into fintech, as more and more people recognise the need to go digital. Despite the trend for falling investments in 2020, the UK fintech sector is still looking flush thanks to investments of over $1.84 billion. To give you a heads up on the next big companies on the scene, we’ve rounded up the hottest startups on our watch list 🔥

Using the cloud to fly sky high above the competition

As we roll into 2018 thoughts inevitably turn to the big themes that we might expect (and hope) to see for user experience in the financial services industry this year.

What the FinCEN files leak means for banks

There’s been a huge leak of files from FinCEN, the US-based Financial Crime Enforcement Network. Over 2000 Suspicious Activity Reports (SARs) and hundreds of other documents appear to show how banks have been unable to prevent trillions in money laundering, tax avoidance and criminality over the past decade. But there's a more in-depth story to uncover here.

How digital customer support can help banks during COVID-19 and beyond

At the beginning of 2022, many early-stage investors looked ahead with optimism as we emerged from the depths of the COVID-19 pandemic, and global economies started to show signs of growth again.

Lessons from COVID-19: you need a truly digital strategy, now!

In the first part of this series I introduced the story of Frederic Tudor, the American Ice-Block King; and discussed lessons learned from his then new product offering as it relates to blockchain technology. Tudor was able to successfully corner the ice-block shipping market and eventually was shipping blocks of ice to as far away as Calcutta from his home in Boston.

Leading a bank through a pandemic

Guest author Richard Davies gives his thoughts on the importance of scaling agile to all functions of an organisation, and some key factors on how to get there.

How messaging is helping banks reconnect with their customers

There’s been no shortage of attention paid to the emergence of fintech in the Middle East recently. In fact, we wrote about the ‘perfect storm’ that was brewing in the region and recently gave an overview of the digital challengers emerging to meet these needs.

11:FS Pulse: wrapped

We’ve sifted through the data to find out what 11:FS Pulse users have been loving and where their focus has been for the last 12 months.

11:FS on tour - Money 20/20 Vegas, Day 1 Roundup

Money 20/20 USA has kicked off and the 11:FS team are here on the ground!

11:FS on tour – Money 20/20 Vegas, Day 2 Roundup

Day 2 has come to an end here at Money 20/20 and, despite last night’s industry party, it was jam packed with action.

11 Stupidest Things Consultancies Say and Do

I’ve poked fun at banks and fintechs, but now it’s time to take on the consultancies. Sometimes it can feel like you’re spending your money on bad advice and worse decisions. Sometimes you are.

796

796. Focus: How to bridge the gap between banks and creators with Eric Wei and Will Kim, Co-CEOs of Karat Financial

In this second episode on our deep dive into the creator economy in the US, David Barton-Grimley and is joined by not one, but two fantastic guests, the Co-CEOs of Karat Financial to discuss how financial services can better understand creators and how financial education is the key.

794

794. Insights: Managing the wealth of the future

Ross Gallagher is joined by some great guests to talk about how fintech and financial services are meeting the needs of Gens Alpha and Beta, and how they are adapting to the needs of tomorrow's wealth makers.

789

789. Insights: The Six Characteristics of Digital Commercial Banking

David Barton-Grimley is joined by some great guests to unpack the six characteristics of digital commercial banking; real-time, standardised, automated, embedded, contextual, and extendable. We’ll explore what they are and how they can (or can’t) support a more efficient, reliable, and secure industry.

781

781. Focus: Creating end to end access to finance in APAC with Vrutika Mody, Head of GoPay Global Partnerships

In this second episode on our deep dive into embedded finance in APAC, David Barton-Grimley and is joined by a fantastic guest, from GoPay, to talk about how embedded finance is opening up access for the unbanked in Indonesia and beyond.

776

776. Focus: How is embedded finance disrupting access to finance in APAC?

David M. Brear is joined by some great guests from Visa, BigPay and Wise to discuss the evolution and growth opportunities of embedded finance in Asia-Pacific!

773

773. News: Mastercard pushes in to Africa with MTN deal and niche banks are on the rise

Mastercard takes minority stake in MTN, rental platform Fronted closes down, and Bank Of Ireland customers go crazy for ATM glitch – Benjamin Ensor is joined by some great guests, from Anthemis, Cornerstone Advisors, and Ebanx, to talk about the most interesting stories in financial services over the last 7 days.

772

772. Insights: Has the fintech revolution ignored older customers?

Kate Moody is joined by some great guests, from 11:FS, ClearEstate, and PensionBee, to look at the financial services aimed at customers over 60.

769

769. Insights: How to build a US mobile bank

David M. Brear and Jason Bates are joined by some great guests, from Milli, to bring you this deep-dive into setting up a new banking proposition in the USA!

767

767. How do you innovate in a highly regulated industry?

David M. Brear is joined by Standard Chartered CEO, Bill Winters, in this interview deep-diving into innovation in the banking space!

766

766. Focus: What problem is mobile money solving in Sub-Saharan Africa?

David M. Brear is joined by some great guests from Visa, Chipper Cash, and DJAMO, to discuss the evolution and further potential of mobile money in Sub-Saharan Africa.

763

763. News: Buy Now Pay Later regulation shelved while Coutts faces Farage account fallout

Buy Now Pay Later regulation shelved in UK, Thunes pockets $72M, and Farage accuses Coutts of closing account over ‘values’ – Ross Gallagher and Nas Ahmad are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days.

762

762. Insights: Three lessons learned from financial services in 2023 so far

Benjamin Ensor is joined by some great guests, from 11:FS, Innovate Finance, and TwentyOne to talk about the biggest lessons for financial services in the first half of 2023.

755

755. News: PSD3 unveils plans to shake up Open Banking

The European Union unveils new open banking rules, Wise announces bumper profits, and Robinhood buys X1 – Ross Gallagher and Benjamin Ensor are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days.

753

753. News: Banks are in an AI talent war and Revolut launches the 'Ultra' account

European banks are putting "AI" in 30% of their job ads, Majority bank opens community meeting space for new migrants, and Gen Z need lessons on how to behave in the corporate world – Benjamin Ensor and Ross Gallagher are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days.

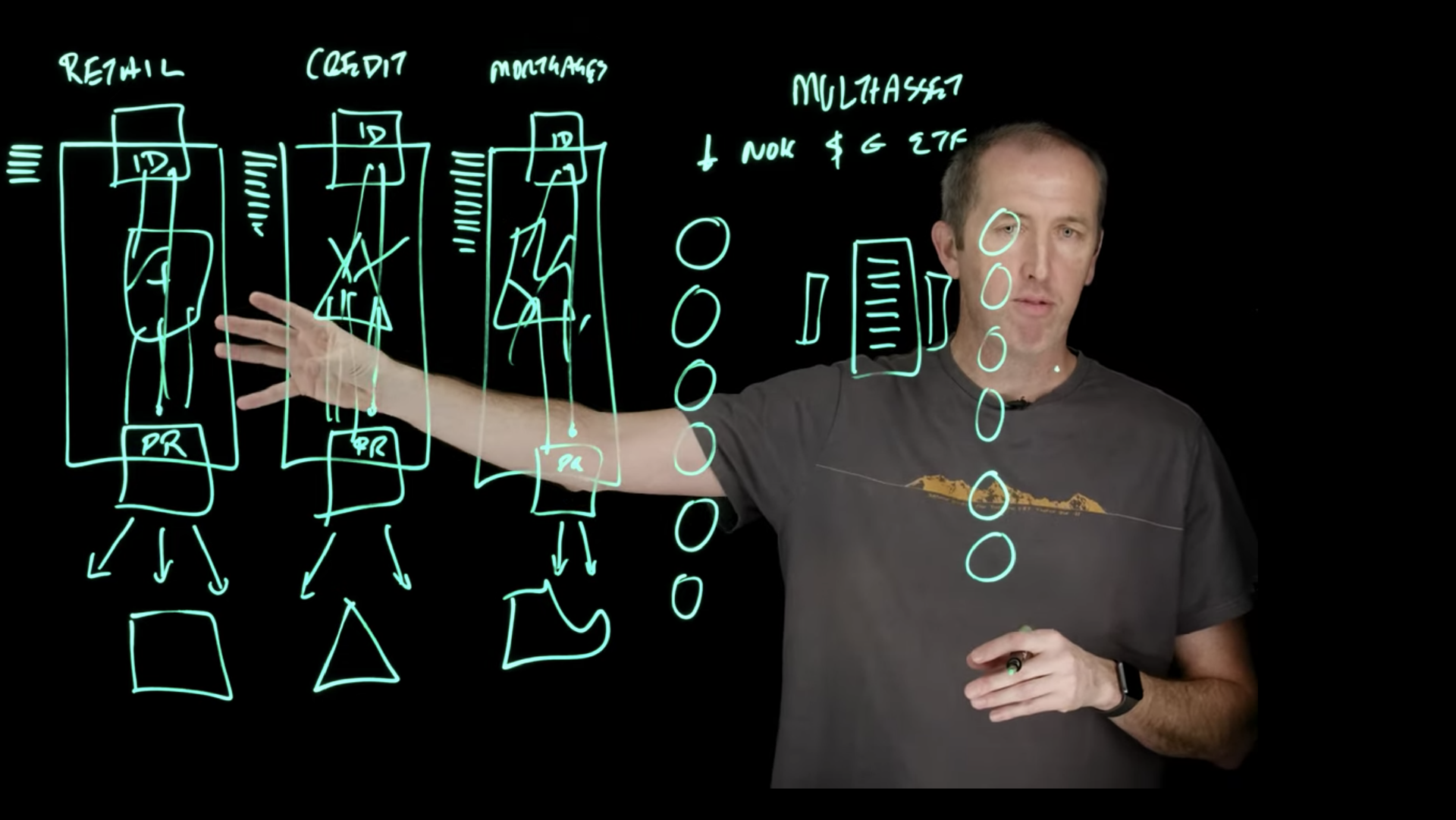

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

Decoding: Banking as a Service - Episode 5

Welcome to episode 5 of our new video series, Decoding: Banking as a Service!

11:FS Explores: Digital R.I.C.H.E.S ft. David M. Brear

11:FS CEO David M. Brear takes to the lightboard to give us the full run-down, with examples of companies that are leading the way.

Decoding: Banking as a Service - Episode 4

Welcome to episode 4 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 3

Welcome to episode 3 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 2

Welcome to episode 2 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 1

Welcome to episode 1 of our new video series, Decoding: Banking as a Service!

It's not the technology - Why banking is broken ft. Ewan Silver

When people discuss 'banking being broken', they often refer to the technology itself. However, that isn't necessarily the case.

Microservices architecture - Asynchronous systems ft. Vaughan Sharman

Minimum Lovable Brand | 11:FS Explores

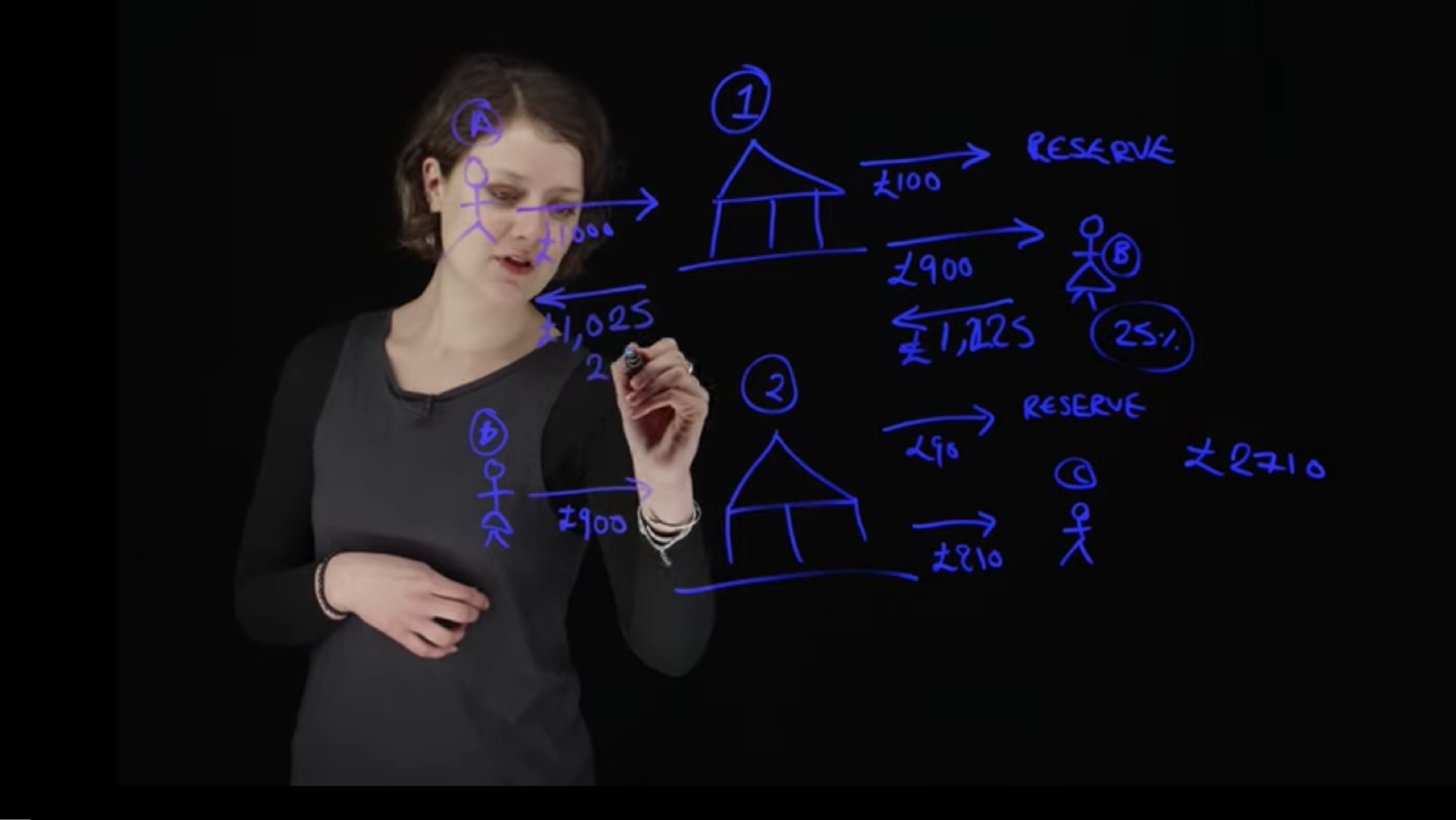

How banks make money - UK retail banking ft. Sarah Kocianski

In this video, our Head of Research, Sarah Kocianski, unpacks exactly how banks make money - with the handy edition of a super cool lightboard!

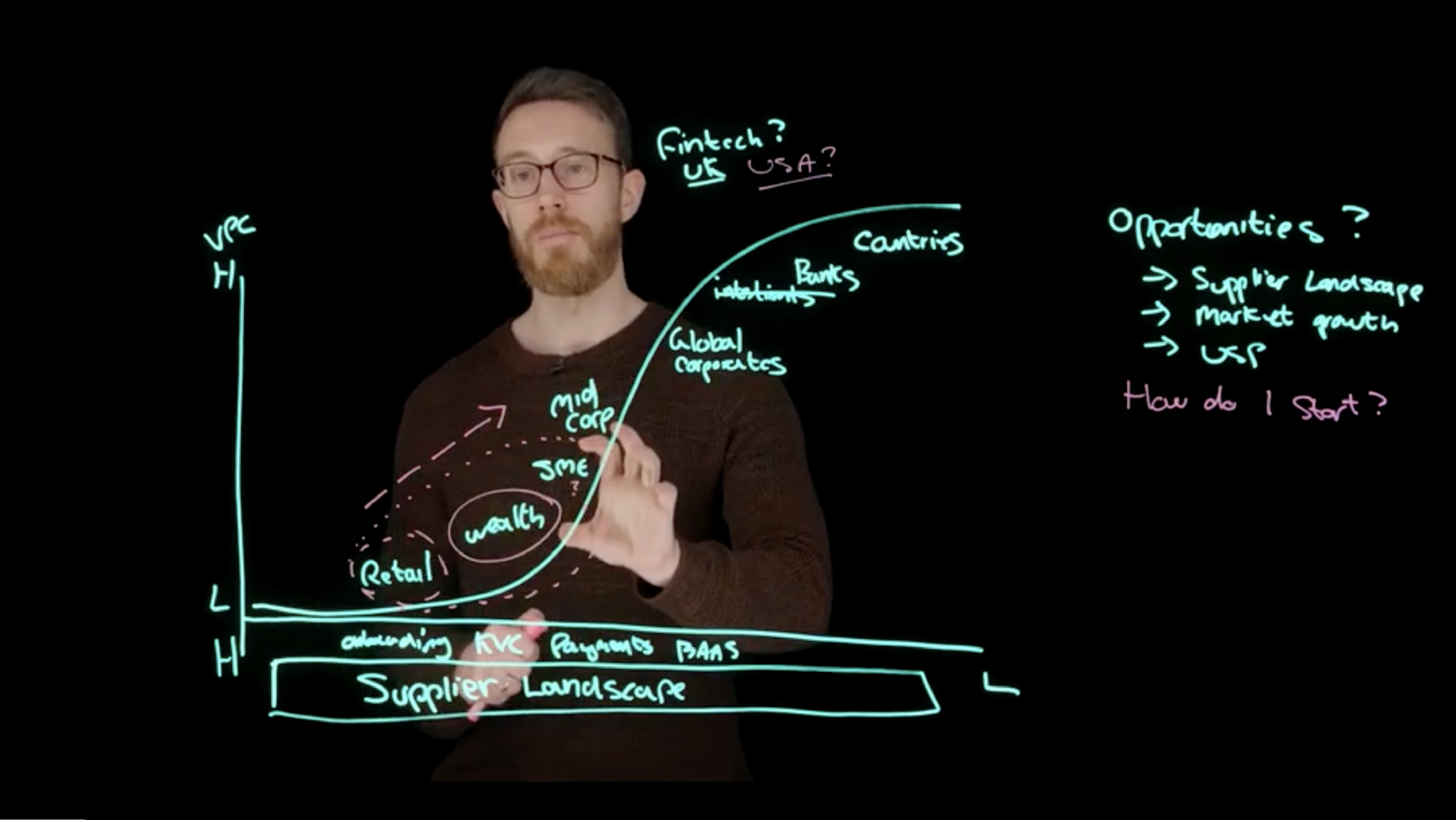

Fintech is only 1% finished - The fintech market ft. Simon Taylor

Fintech is only 1% finished. But what do we mean by that? Simon Taylor, Head of Ventures at 11:FS takes us through the landscape of financial technology in this Lightboard edition of 11:FS Explores.

What is Open Banking? | 11:FS Explores

In this episode of 11:FS Explores, Adam Davis picks apart Open Finance, and what we have to look forward to if this technology became a reality.

What Griffin are going to do now they have their banking licence with CCO Adam Moulson | Spotlight

Inclusive design is a mindset and a process that suggests that you should bring as many people as possible - and the most diverse of voices that you can - into your product design product process, so that you're being truly inclusive. It's designing with people rather that just at them. Charlotte Fereday, Product Director, Ventures, explains what inclusive design is, why it's important, how you can design more inclusively, and answers - how possible is truly inclusive design?

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)