Get the latest news and insights from the retail banking space.

Banks should use Open Banking to drive environmental behaviour change

COP26 is over. But the climate emergency is still with us. The headlines might say otherwise but I got the feeling that very little progress was made on climate change. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Our fintech predictions for 2022

There’s so much to look forward to in 2022. It’s the Year of the Tiger. There’s a World Cup in November. And, of course, the sands of insurtech will keep shifting.

The future of Black banking in the US

Despite being hailed as transparent and secure, the cryptocurrency industry has been beset by fraud, scams and general crisis in recent months.

Banks need to stop thinking Gen Z financial literacy will be built on TikTok

Financial literacy, it’s a silent pandemic. Gen Zs need all the help they can get. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

What have 11:FS Pulse subscribers been viewing in 2021?

The second episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

Can digital companies make banking affordable for Canadians?

Banking in Canada is expensive. Incumbent banks apply charges on just about everything, from transaction fees for sending money to monthly charges for just having an account open.

Making financial services better, faster, stronger

As July continues apace, brands all over the world are rolling up their rainbow logos and packing them away for another year.

5 considerations for the future of Islamic banking

Guest author Nahim Bassa shares his thoughts on the future of Islamic banking.

How is fintech tackling football?

Behind every great feature is a problem that needs to be solved. Lloyds Banking Group’s Benefit Calculator tackled one head-on — and is already making waves in how support reaches those who need it most.

Banking as a Service accelerates Open Banking adoption

This article was originally published in The Paypers’ ‘Open Banking Report 2021: Open Finance and the Race for Relevance and New Business Models in Banking'.

Would you rather be a fintech Super App or a bank?

Every time I see a fintech announce they are applying for a charter, I wonder ‘do you really want to be a bank?’ This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Inspiring business model innovation in banking

You can catch the full Fintech Insider take on the news today at 4pm on the podcast here. Following on from a great response last week we’re going to be doing another close look at the most interesting story of the week’s show. Again you can let us know in the comments below or at our community site, Fintech Insider News. Fintech Insider hosts Sarah and Ross sit down with Daniel Hegarty, CEO and Co-Founder of Habito, and Nina Mohanty, Business Development at Bud to discuss the news, including what might just be the next stage of online shopping.

In Australia, data is the new salt

I sat down with our new Chairman, and my long time mentor, Shaun Meadows to chat innovation, being different and why culture is vital for future success.

New neobanks need to take bolder bets

One of our core values here at 11:FS is ‘everything on purpose and with purpose’. We even have a porpoise sticker (the puns keep coming) to celebrate it. It is what enables us to deliver fast, without waste and with relentless focus on outcomes. That and a kick-ass team. They often go together.

You’re building the first banking ecosystem on Mars. Where do you begin?

For this edition of After Dark, the live recording of our Fintech Insider podcast, we went for something a little bit different. Presenting After Dark: Starting from scratch, the short story... Check out the video here.

749

749. What is Anne Boden’s legacy in fintech? (rewind)

David M. Brear is joined by Anne Boden, CEO of Starling, in this interview from the archives!

741

741. Focus: How UX is fundamental to seamless money movement

David Barton-Grimley is joined by a fantastic guest, from Wise, to continue exploring the importance of UX to the fintech revolution in Europe.

737

737. Insights: Is the future of KYC truly digital?

Benjamin Ensor is joined by some great guests, from 11:FS, CAF, and Hummingbird, to talk about the latest developments in Know Your Customer and Know Your Business.

735

735. News: JP Morgan swoops in for First Republic, while Revolut takes on Nubank

JP Morgan snaps up First Republic Bank, Revolut launches in Brazil, and ChatGPT investment fund "smashes" competition – Kate Moody and Benjamin Ensor are joined by a great guest from Reuters to talk about the most interesting stories in financial services over the last 7 days.

729

729. Insights: How do community banks stay relevant in 2023?

Benjamin Ensor and Kate Moody are joined by some great guests, Bridge built by Citi and Seattle Bank, to look at the challenges and opportunities for community banks in America.

721

721. Focus: Building financial inclusion for seven generations, with Amber Buker, CEO of Totem

Our expert host, David Barton-Grimley, is joined by a fantastic guest from Totem to continue exploring financial inclusion in the USA.

716

716. Focus: What does effective financial inclusion look like in the USA?

David M. Brear is joined by some great guests, from Visa and Capway, to really dig into the keys to successful financial inclusion in America.

710

710. News: Revolut tops app downloads – but is Chase coming for the crown?

Vexi raises to offer young Mexicans lower interest rate credit cards, gig workers denied equal opportunity to financial services, and BMO bank no longer has a den for Hubert the Harris Lion – Kate Moody and Benjamin Ensor are joined by some great guests, from Vexi and Rollee, to talk about the most interesting stories in financial services over the last 7 days.

709

709. Insights: How does financial services make it all about the customer?

Kate Moody is joined by some great guests, from 11:FS, Ramp, and Citi's DX10, to talk about how crucial customer centric design is to building better financial services.

Bonus: Disrupting the corporate and consumer divide, with Pagaya's Ashok Vaswani

L.F.G. Mauricio and Catherine bring you a fantastic conversation looking at what it means to be a digital creator today and the global community it creates, with two amazing digital creators taking part in the global Visa Creator Program. All this and much more on today's Blockchain Insider!

666

666. News: After Dark: Credit card companies look to tackle gun control

David M. Brear and Jason Bates are joined live in London, by a panel Fintech Insider All-Stars, to talk about the most interesting stories in financial services over the last 7 days, including: lease-to-own fintech Kafene raises Series B, a new credit card code to prevent gun violence in the US, and the big red button of news!

650

650. News: Peter Thiel backs European investment app Shares

David M. Brear and Nicole Perry are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: European investing app Shares snaps up $40m financing round, Plaid launches Variable Recurring Payments, and we dip into the Fintech Insider mailbag!

648

648. News: Starling pulls back from Ireland while Stori becomes Mexico's latest fintech unicorn

Kate Moody and Amy Gavin are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Starling pulls Irish bank application, Stori becomes Mexico’s latest fintech unicorn, and ‘Eat The Rich’ popsicles are selling fast!

644

644. News: Should Open Banking become a legal requirement for credit assessment?

Benjamin Ensor and Deepa Anikhindi are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Agricultural bank Oxbury raises £20m in a funding round, Payl8r calls for open banking to be legally required for credit assessing, and the world's first fintech sitcom!

642

642. News: Kroo lands coveted banking license, while Credit Suisse found guilty of money laundering

David M. Brear and Kate Moody are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Kroo lands full banking licence, Credit Suisse bank found guilty over money laundering charges, and we answer questions from the Fintech Insider mailbag!

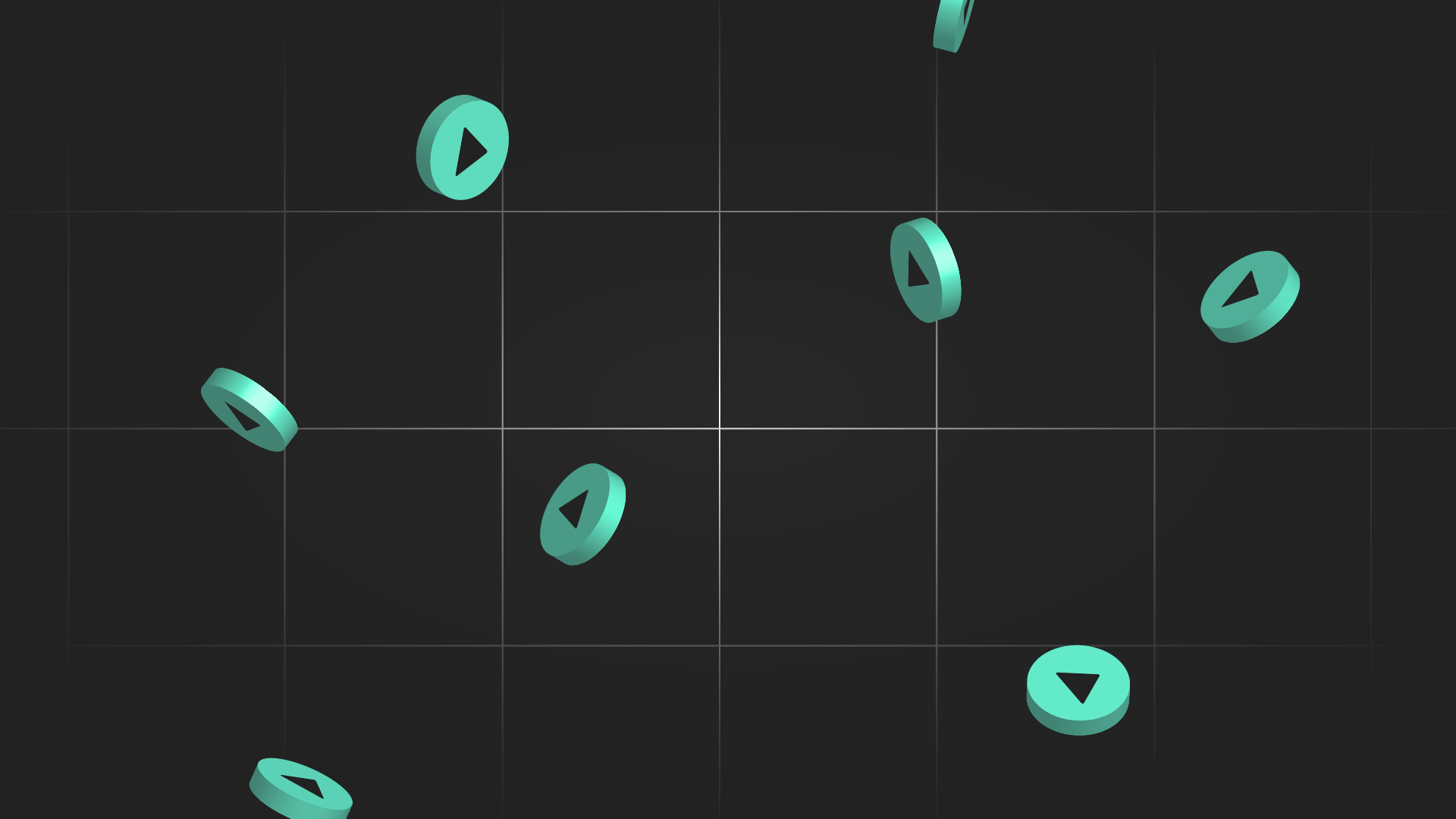

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

Decoding: Banking as a Service - Episode 5

Welcome to episode 5 of our new video series, Decoding: Banking as a Service!

11:FS Explores: Digital R.I.C.H.E.S ft. David M. Brear

11:FS CEO David M. Brear takes to the lightboard to give us the full run-down, with examples of companies that are leading the way.

Decoding: Banking as a Service - Episode 4

Welcome to episode 4 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 3

Welcome to episode 3 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 2

Welcome to episode 2 of our new video series, Decoding: Banking as a Service!

Decoding: Banking as a Service - Episode 1

Welcome to episode 1 of our new video series, Decoding: Banking as a Service!

It's not the technology - Why banking is broken ft. Ewan Silver

When people discuss 'banking being broken', they often refer to the technology itself. However, that isn't necessarily the case.

Microservices architecture - Asynchronous systems ft. Vaughan Sharman

Minimum Lovable Brand | 11:FS Explores

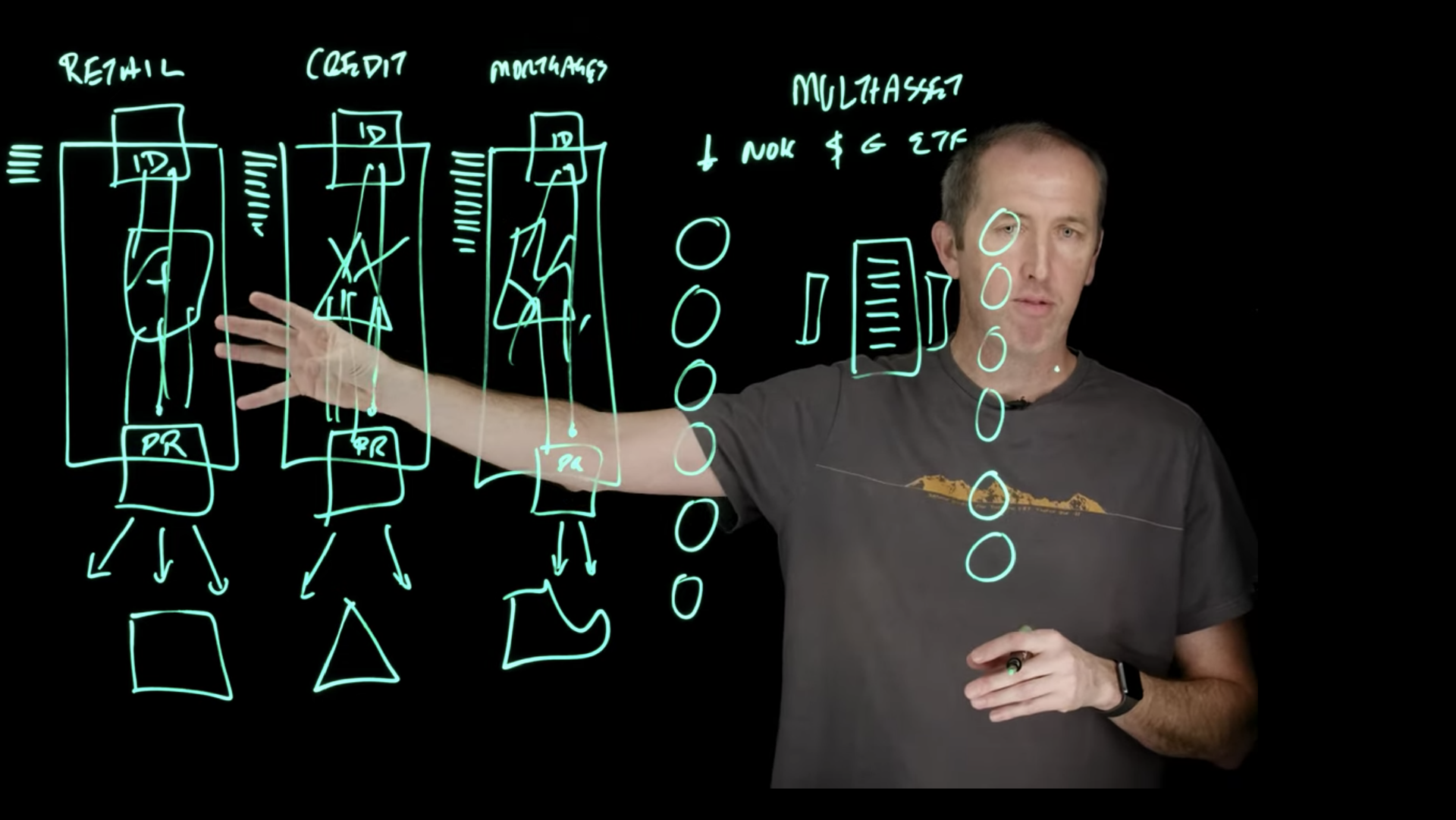

How banks make money - UK retail banking ft. Sarah Kocianski

In this video, our Head of Research, Sarah Kocianski, unpacks exactly how banks make money - with the handy edition of a super cool lightboard!

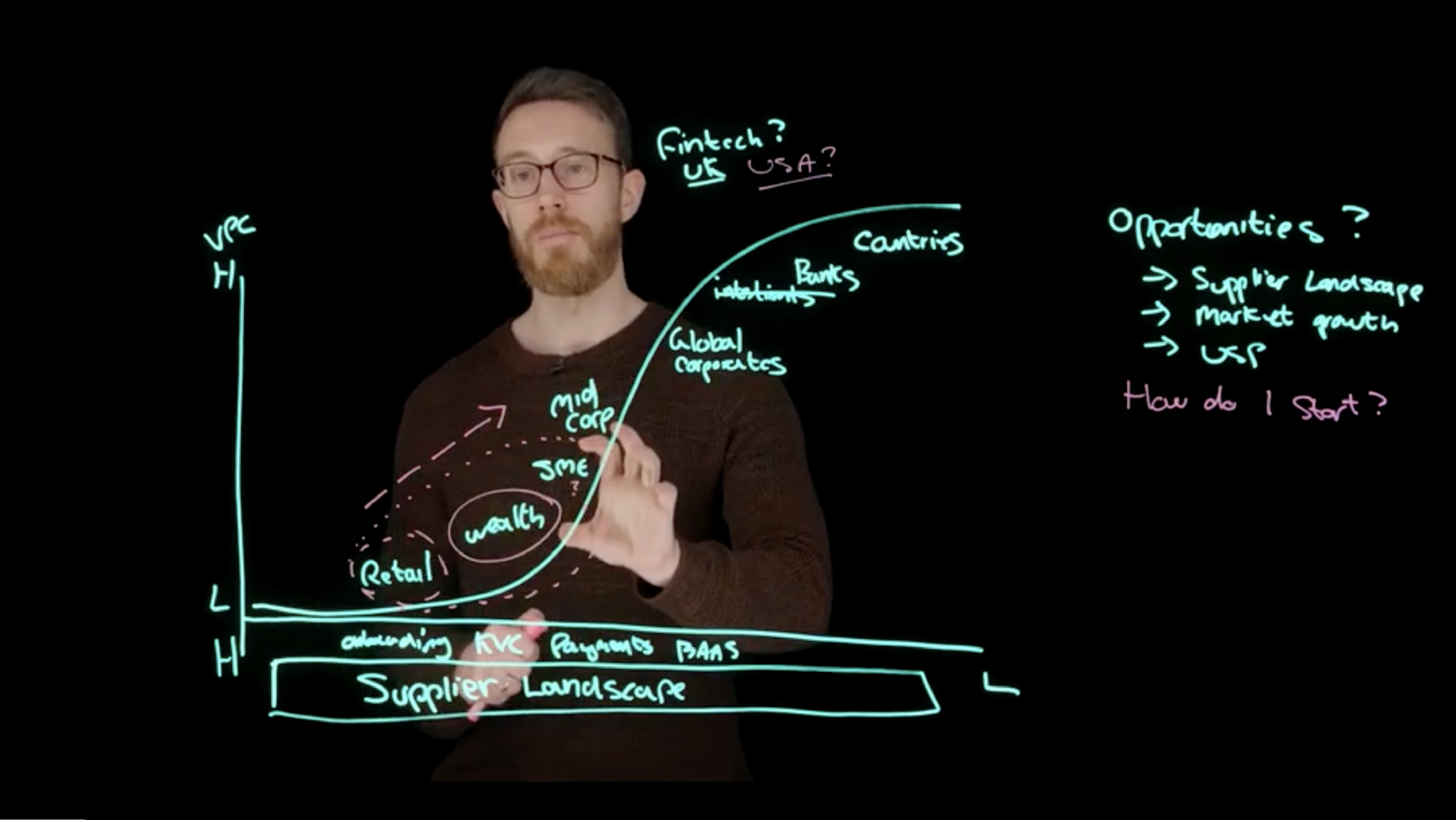

Fintech is only 1% finished - The fintech market ft. Simon Taylor

Fintech is only 1% finished. But what do we mean by that? Simon Taylor, Head of Ventures at 11:FS takes us through the landscape of financial technology in this Lightboard edition of 11:FS Explores.

What is Open Banking? | 11:FS Explores

In this episode of 11:FS Explores, Adam Davis picks apart Open Finance, and what we have to look forward to if this technology became a reality.

What Griffin are going to do now they have their banking licence with CCO Adam Moulson | Spotlight

Inclusive design is a mindset and a process that suggests that you should bring as many people as possible - and the most diverse of voices that you can - into your product design product process, so that you're being truly inclusive. It's designing with people rather that just at them. Charlotte Fereday, Product Director, Ventures, explains what inclusive design is, why it's important, how you can design more inclusively, and answers - how possible is truly inclusive design?

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)