Europe

Barclays UK CEO On The Exciting Challenges of Today

From dreams of running a five-star hotel to the reality of running a five-star bank, Ashok Vaswani, the CEO of Barclays UK, speaks with Simon Taylor about culture, digital transformation challenges and opportunities, front line staff empowerment and how Simon might be able to buy a Lamborghini in the future.

Loot CEO Explains How to Create Next-Gen Banking as Your Side Hustle

Lesley-Anne Vaughan, Director of MiLA Consulting and Co-Creator of M-PESA, Vodafone’s famed mobile money transfer service, has been dedicated to mobile money and mobile financial services in emerging markets since 2005. Here, she shares how M-PESA transformed from a microfinance product to a revolutionary service that’s changed Kenya’s infrastructure, increased financial inclusion, and earned the majority of the market for mobile money transfers.

FCA: Positive Disruption in the Industry is a Really Good Thing

The UK banking battlefield has never been more competitive. Customers expect financial apps that are personalised, seamless, and that genuinely make a difference — and they compare them not just to other banks, but to the best digital experiences in any industry. The margin for mediocrity is gone.

First UK high street bank to jump into the world of mobile savings goals. - 11FS

With so much noise about new market entrants in the SMB banking space, it’s easy to think your bank’s missed the boat and has to play catch-up. But that’s not necessarily the case.

An Open Letter to Mark Carney on Robo-Advice

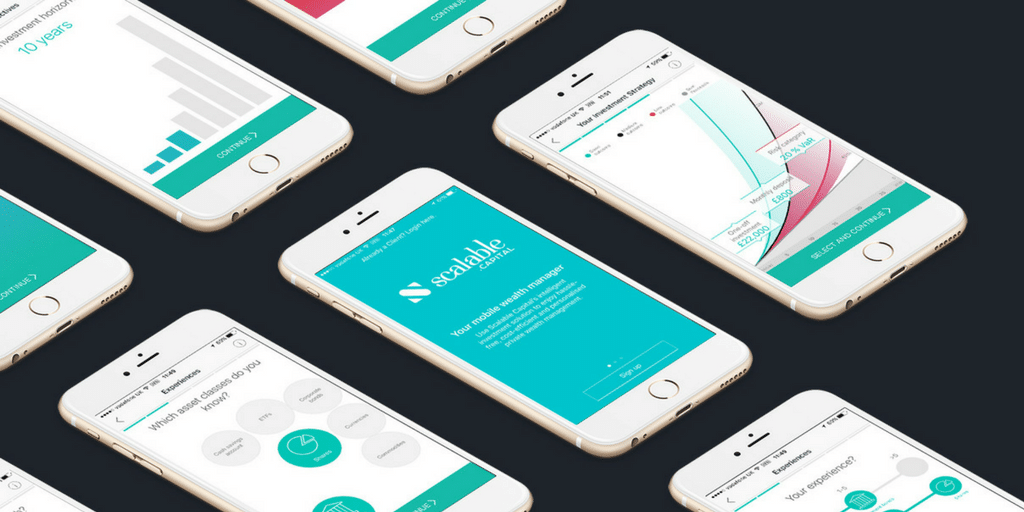

Bank of England Governor Mark Carney has robo-advice on his mind. For him to be speaking about a nascent industry, he must believe that firms using technology to help manage people’s money will grow to become a significant part of the market. However, in his recent speech, he appears concerned about robo-advisors becoming a risk to our financial system, arguing they may lead to excess volatility or increase pro-cyclicality as a result of herding. Guest blogger Adam French, CEO of Scalable Capital, says this attack on robo-advice is misinformed for several reasons.

How to Build a Bank - Our Interview with Monzo

I was recently asked by a client: ‘how do I hire a design team?’

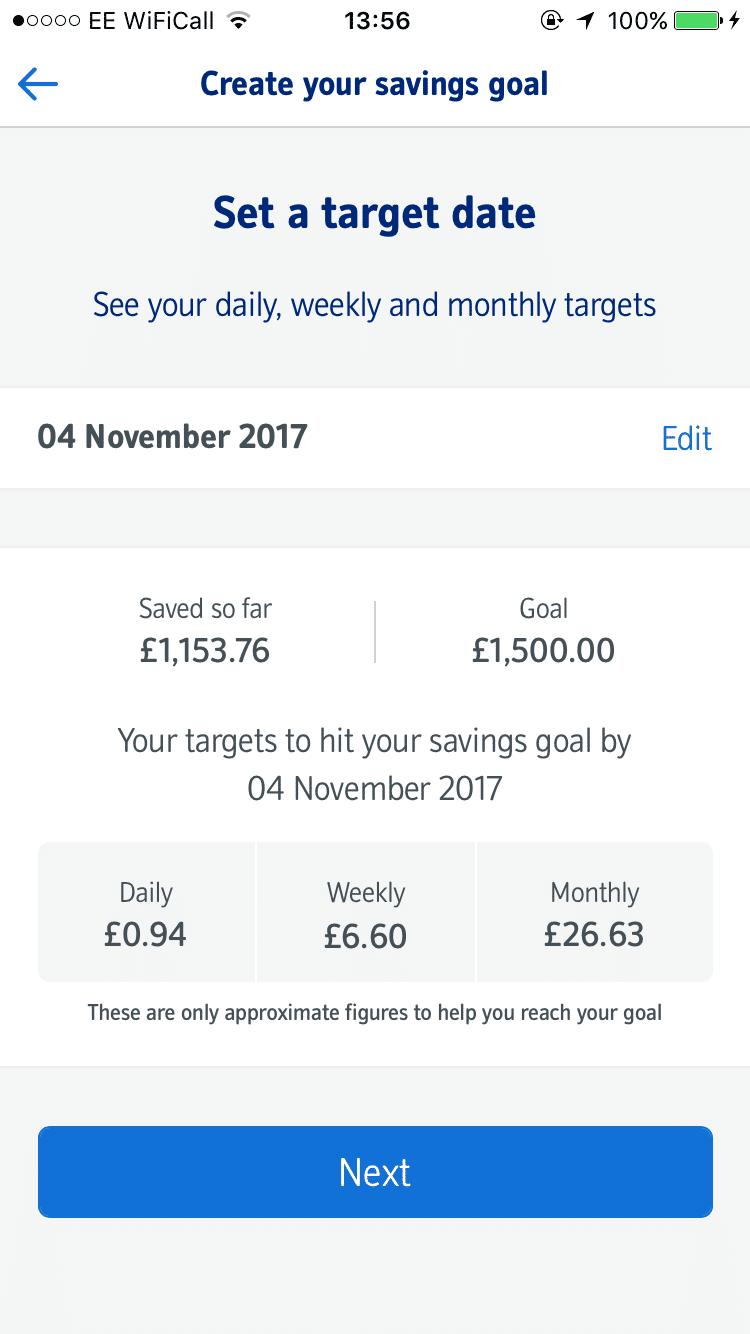

Nationwide vs Monzo: Tracking Savings Goals

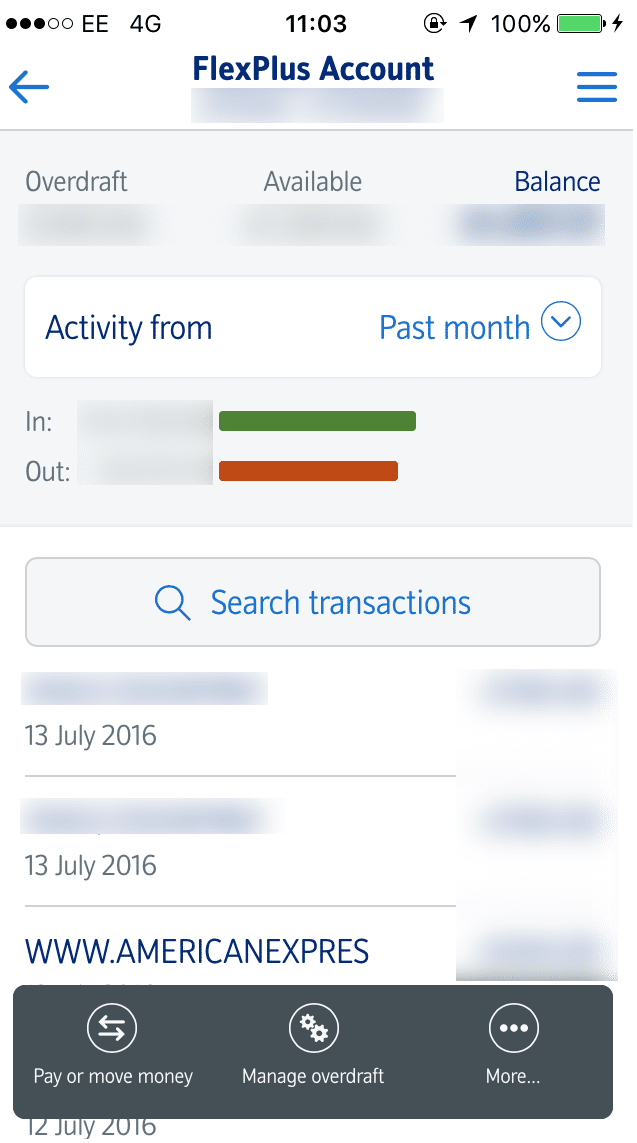

In the race to add as much functionality to mobile banking apps as possible, few banks are stepping back and thinking about the “little things” that will enhance the customer experience, such as re-vamped journeys and navigation. The newly released banking app from Nationwide Building Society, which automatically adapts to suit mobile and tablet screens, demonstrates that paying attention to the little things makes a big difference

First UK high street bank to jump into the world of mobile savings goals. - 11FS

Yesterday we saw Nationwide launch a new Savings Goal feature within its mobile banking app. It takes a different approach to savings, prompting customers to set a goal of the total amount of their savings account at a particular date.

Regulation Sandbox Changes the Rules of Fintech Playground

Sarah Kocianski should be familiar to all of you now, she has hosted our three podcasts: Fintech Insider, Blockchain Insider, and Insurtech Insider, as well as penned many of our blog posts and reactions to major news in the fintech space. I had a chance to sit down with Sarah and talk to her about what makes her most passionate about fintech and what she believes needs to happen most in business.

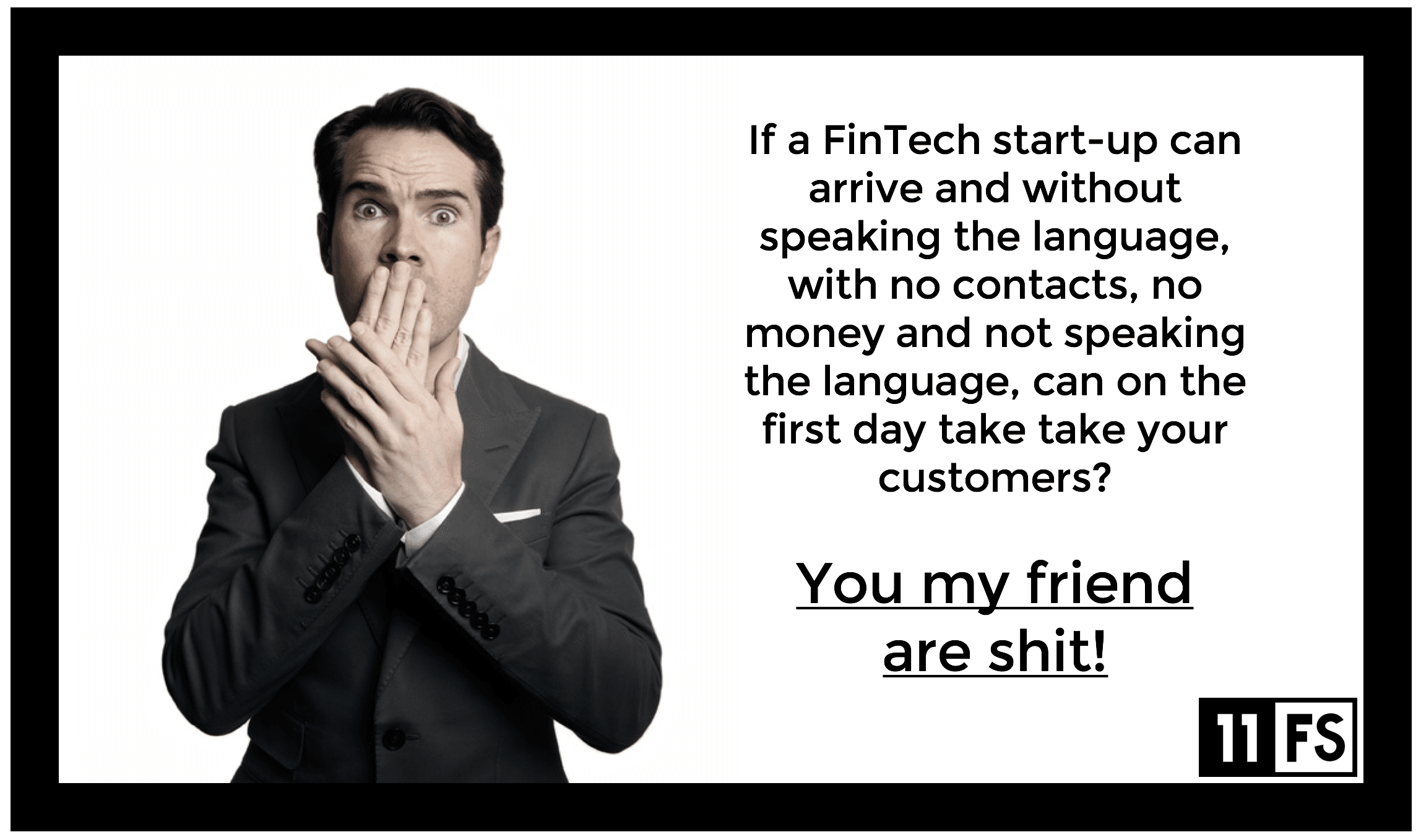

Bank Innovation – Why are the most innovative banks outside the UK? Case Study: @HellenicBank

I hope I am not about to shatter anyone’s egos here but this is something that has puzzled me for a long time; Why are most innovative banks outside the UK? So what’s the deal? The UK is the center of the FinTech world, on most people’s listings. We have the regulator who supports innovation and we have a blossoming design and technology pool to pluck talent from. So why I ask are UK banks the “also rans” of European banking innovation fronts? How can this be the case?

Nationwide's New App - A great example of how the little things add up.

Do you remember where you were when you first spotted that hot coral card in the queue at a coffee shop? For me, it was early 2016. A short while after they’d changed their name from ‘Mondo’ but still early enough to feel like I was an ‘early adopter’. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

How will Brexit impact banks and FinTech in the UK?

11:FS CEO David M. Brear reached out to his followers on LinkedIn to ask for their thoughts on the following conundrum: what do you think the future operating model looks like for financial services and why?

The Rebundling of UK Financial Services

Death. It's inevitable. It's also a financial nightmare most don't see coming. But what if you could save tens, if not hundreds of thousands of dollars during this grim process?

Why PSD II could be the final straw to bad leadership and unblocks internal resistance to real banking innovation finally

Our CEO, David Brear, talks everything PSD 2 for HotTopics. Legislation is usually brought in to reduce stupidity amongst individuals, or groups exhibiting behaviors that may cause harm. PSD 2 is no different in terms of its purpose and overall need to exist. The European Commission has tried to foster innovation and filter banks toward more inclusive ways of working. PSD, miData and a number of other “carrots” meant to foster innovation have been used with limited success. Banks have treated all of these as purely compliance driven; tick box exercises, and tend to deliver the bare minimum to meet legislation. With regulators and governments now losing patience with banks, we now have the “go to your room” moment; PSD 2.

Bank Boards Need to Wake Up. - 11FS

It’s all very quiet. Almost too quiet for my liking. The UK banking system is under more stresses and strains than it has ever faced, but yet it is seemingly business as usual for many. The time is now upon us. Fundamentally, the decisions banks make in the next 24 months and the changes they implement in the next five years will define the industry’s winners and losers—period.

163

163. Interview: Toby Triebel, Wealthsimple

This week, Jason Bates speaks to Toby Triebel, CEO Europe, Wealth Simple.

157

157. Fintech Insider LIVE from OP's Beach Party in Helsinki

This week's special episode was recorded live from OP's Slush after-party in Helsinki, where Jason, Simon and Sam are joined by very special guests to bring you 3 shows in one: topical discussion, round table insights and very special interviews from a fantastic indoor beach party in midwinter...

21

21. Bitcoin futures & ConsenSys London launch party

This week Simon and Colin bring you the best of the week's news, including LedgerX bitcoin futures options, crypto funding for movies plus some exclusive insights from ConsenSys' London launch party.

145

145. Insights - Transferwise Takeover

This week, we’re recording from the Transferwise office in Shoreditch Highstreet, a stone’s throw from our home in WeWork, Aldgate, to hear the Transferwise story.

119

119. Insights - NFI (Nordic Finance Innovation)

Coming up on today’s show we bring you the highlights from one of Nordic Finance Innovation's annual events.

111

111. Insights: Money20/20 Europe, Part 2

In this episode: We bring you the second roundup of highlights from Money20/20 Europe in Copenhagen. We caught up with some […]

272

272. Insights: Money20/20 Europe, Part 1

In this episode: We bring you the highlights from last week’s amazing event at Money20/20 Europe in beautiful Copenhagen. We […]

271

271. News: LIVE from Money20/20 Europe

In this episode We bring you our first ever live podcast, recorded in front of a live audience at Money20/20 […]

268

268. News: It’s raining money in Durham

In this episode We have a whole host of hosts as David, Jason, Simon and Aden are joined by Mariano Belinky […]

267

267. Interview – Nathan Bostock, CEO Santander UK

In this episode Simon interviews Nathan Bostock, CEO of Santander UK. Nathan explains how Santander is embracing the tech changes […]

262

262. State of Fintech: Amsterdam

In this episode Jason and Simon catch up with ABN AMRO’s Freek de Steenwinkel & Roland Booijen, and Ali Niknam, […]

258

258. Interview: Valentin Stalf, Co-Founder & CEO at N26

In this episode We welcome back Valentin Stalf, CEO of N26 back to the show. Simon spends some time to […]

238

238. Ashok Vaswani, CEO of Barclays UK

In this episode From dreams of running a five-star hotel to the reality of running a five-star bank, Ashok Vaswani, […]

232

232. Loot CEO Ollie Purdue on Creating a New Banking Experience at Age 20

In this episode What were you doing when you were 20 years old? Ollie Purdue was studying law…and founding a […]

226

226. FCA Policy Director David Geale on the Thought Behind the Regulatory Sandbox

In this episode The Financial Conduct Authority’s progressive regulatory policies have been credited with helping to make London one of the world’s […]

What Griffin are going to do now they have their banking licence with CCO Adam Moulson | Spotlight

Inclusive design is a mindset and a process that suggests that you should bring as many people as possible - and the most diverse of voices that you can - into your product design product process, so that you're being truly inclusive. It's designing with people rather that just at them. Charlotte Fereday, Product Director, Ventures, explains what inclusive design is, why it's important, how you can design more inclusively, and answers - how possible is truly inclusive design?

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)