Global

The risk of fintech blanding

How many times have you looked at a job posting only to see the mention of free fruit? Sure it’s nice to have free food, but what purpose does it serve and does it have anything to do with employee wellbeing?

8 takeaways from our latest Banking as a Service episode

The fourth episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

How to turn outdated corporate identities into fresh opportunities

Behavioural design is the process of using psychological insights into how people think and act irrationally, to design better products and services. Sounds good, right? But…er… what does that actually look like?

What is the future of payments? We head to FinTech Connect 2020 to find out

Businesses are slowly awakening to the idea that it's time to consider new sources of growth when it comes to securing their futures. They’ve realised that, sometimes, designing the most engaging customer value propositions requires leaning on the brand strength of other players outside of your domain.

Buy Now Pay Later: Love it or hate it, you can’t ignore it

Buy Now Pay Later (BNPL) is one of the hottest trends in fintech. The concept of 0% finance has been around for decades, but it’s caught fire in the last 3 years with new market entrants like Affirm, Afterpay and Klarna transforming how this works for consumers in an e-commerce setting. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

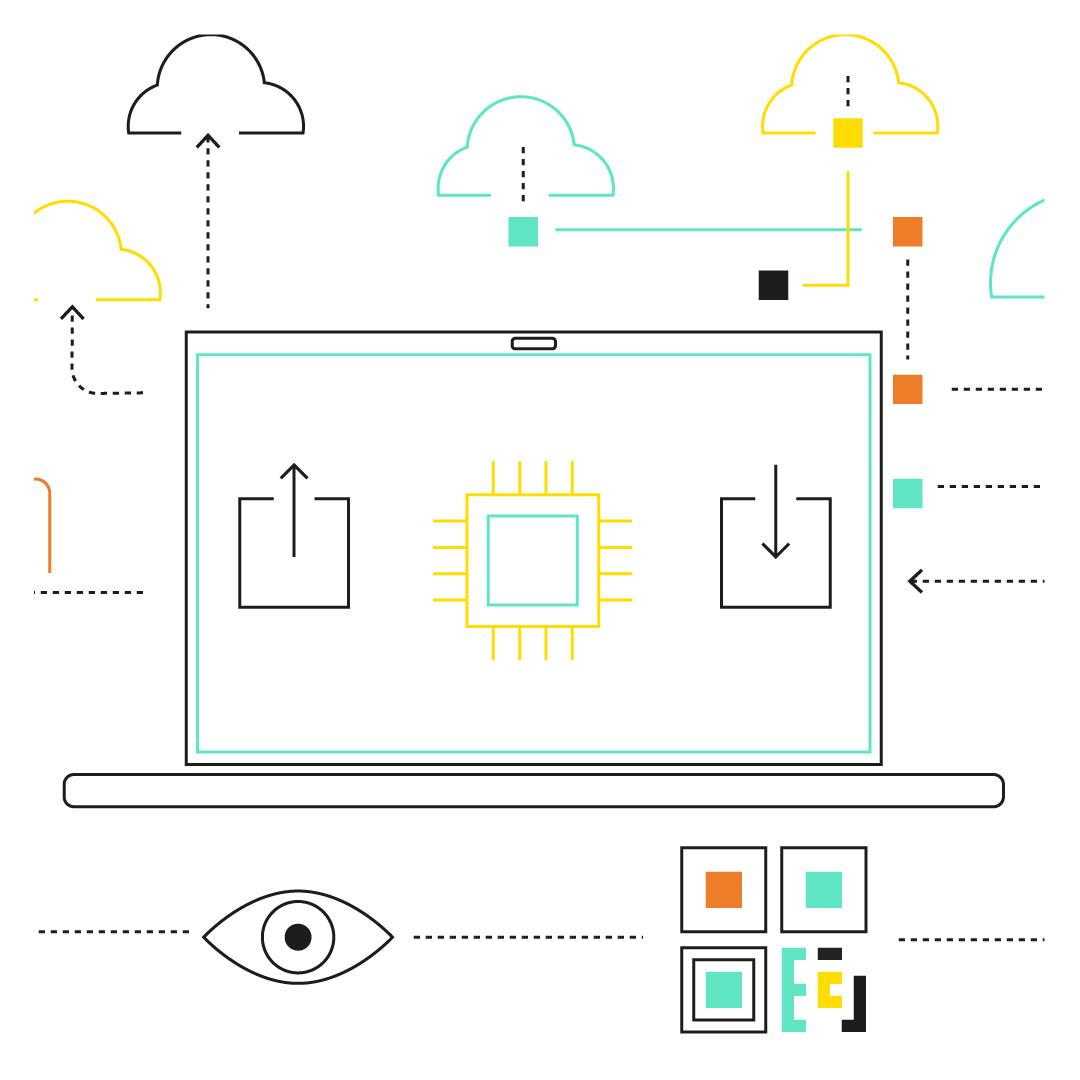

What is embedded finance?

While FinTech folk salivate – and the big banks bloviate – about PSD2 and the open banking reforms coming our way in 2018, we wondered whether those outside of this bubble will actually notice? What does PSD2 actually mean for customers?

The future of banking: all paths lead to lending

A Black-owned bank is defined as one in which at least 50% of voting shares are owned by African-Americans. They’re a dwindling force in the States today.

Crafting impactful design principles

Throughout history, humans have found direction from statements of intent that suggest 'better' ways of living.

Why is BaaS so hot right now?

The first episode of our brand-new video series, Decoding: Banking as a Service, is live! If you missed it, catch up here. Here’s a rundown of the episode if you prefer reading to watching 📖

In defence of virtue signalling

Nothing’s worse than not having any options, but having too many can be just as bad.

7 reasons Banking as a Service is a game changer

We now live in a world where almost anyone can build and launch innovative, regulated financial products as easily as they can create a Shopify page - that’s the magic of Banking as a Service (BaaS).

Goldman Sachs is leaning into embedded finance: other banks should take note

As 11:FS wraps up its 5th year in business, we can’t help but think about what the next 5 will look like. And our ambitions are big. It’s only just on the right side of scary.

Is the future really cashless?

Richard Brown, CTO at R3, says that blockchain allows us to, for the first time, build systems and technologies that run between different organisations that don’t trust each other and bring them to consensus. This means potentially significant savings for financial services, especially in file reconciliation and manual activity. For blockchain to succeed in finance, multiple firms must work together, and Corda is helping to do just that.

Using the cloud to fly sky high above the competition

As we roll into 2018 thoughts inevitably turn to the big themes that we might expect (and hope) to see for user experience in the financial services industry this year.

Jobs to be Done: How to help US SMBs keep their personal assets separate from their business finances

Jobs To Be Done (JTBD) is a theory. Its main aim is to explain why customers start - and stop - using different products and services in the market. Stripped down to the essentials, it’s a fairly straightforward concept first introduced by Harvard professor Clayton Christensen that can be adapted into a useful tool for product development.

461

461. News: Banks tackle deepfraud and RTGS collaborates with Microsoft

Sam Maule and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: RTGS Global rolls out stage 1 of liquidity visibility network in collab with Microsoft, banks work with fintechs to counter ‘deepfake’ fraud, and Paypal terminates accounts linked to a Russian influence operation.

460

460. Insights: Is crypto becoming mainstream?

Simon Tayor is joined by some special guests to talk about the growth cryptocurrencies in mainstream finance.

74

74. Digital transformation - Managing the hybrid

Sarah Kocianski and Nigel Walsh are joined by some amazing guests to talk through digital transformation in the insurance industry.

459

459. News: Paypal take on Klarna and Afterpay; Vipps and Visa team up & Chip’s new raise

David Brear and Mel Stringer are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: More raises as Chip launches Series A, Paypal is coming for Klarna and AfterPay, and Goldman Sachs launches its own font: Goldman Sans.

456

456. Insights: Truly Digital After Dark

This week we bring you our first-ever, Truly Digital After Dark! In the sound of the times, we have not only turned our fantastic After Dark show Truly Digital, but we also bring you insights as to how digital is currently shaping the financial industries!

73

73. News: Lemonade post a positive Q2 as Zurich struggles with the pandemic

Sarah Kocianski and Nigel Walsh are joined by a panel of guests to talk through the latest news in the insurance and insurtech space!

454

454. Insights: Digital Investing - the importance of education and community

Simon Taylor is joined by some great guests to talk about digital wealth managers and how these have disrupted the market with their new and educational investment tools.

453

453. News: Can F2 solve Facebook’s problems & will Amex buy Kabbage?

Sam Maule and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days in US financial services and beyond including: Facebook rolls out its Facebook Financial Initiative; AmEx in talks to buy Kabbage and Robinhood blows past rivals in day trades, and much much more!

452

452. Insights: Banking as a Service - the tech behind fintech

Simon Taylor is joined by some great guests from two of the biggest banking as a service providers from both sides of the Atlantic, GPS and Galileo, to lift the lid on this industry niche that's blowing up right now

72

72. E-scooters: should you need a licence to ride?

Sarah and Nigel are joined by a panel of guests to talk through hotly contested e-scooters and e-scooter insurance! All this and much much more on today's Insurtech Insider!

449

449. News: Can fintech fast track our economic recovery?

Simon Taylor and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: The UK's Fintech industry is "firing on all cylinders" as big banks’ profits fall; we look at why investing is booming despite the pandemic; and JPMorgan Chase partner with Marqeta to offer virtual cards.

448

448. Insights: Do we still need bank branches?

Simon Taylor is joined by some great guests to talk about the future of bank branches. Will they open up after the pandemic? Do we still need them or have we seen the last of the bank branch?

71

71. News: Insurance acquisitions and casualties

Sarah Kocianski and Nigel Walsh are joined by a panel of guests to talk through the latest news in the insurtech and insurance world!

447

447. News: Can finance ever be fully democratised?

Simon Taylor and Ross Gallagher are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Robinhood abandons its UK launch amid criticism of their platform; Klarna reins in their lockdown lending and Monzo re-launch their Plus product.

446

446. Insights: Digital Payments Innovation: Is this the end of cash?

Sarah Kocianski is joined by some great guests to talk about the development of digital payments and the global shift towards cashless payment solutions.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)