Global

The Death of Omnichannel Banking

Lately I’ve noticed a few banks and fintechs wanting to “get started designing screens right away”. It seems great, but building the wrong thing is worse than building nothing at all.

FinTech Legend Leda Glyptis: If You Choose Who You Are, What You Do Will Follow

Over the past eight years, as a fintech founder who happens to be gay, I’ve met with 100+ corporate and institutional investors around the world.

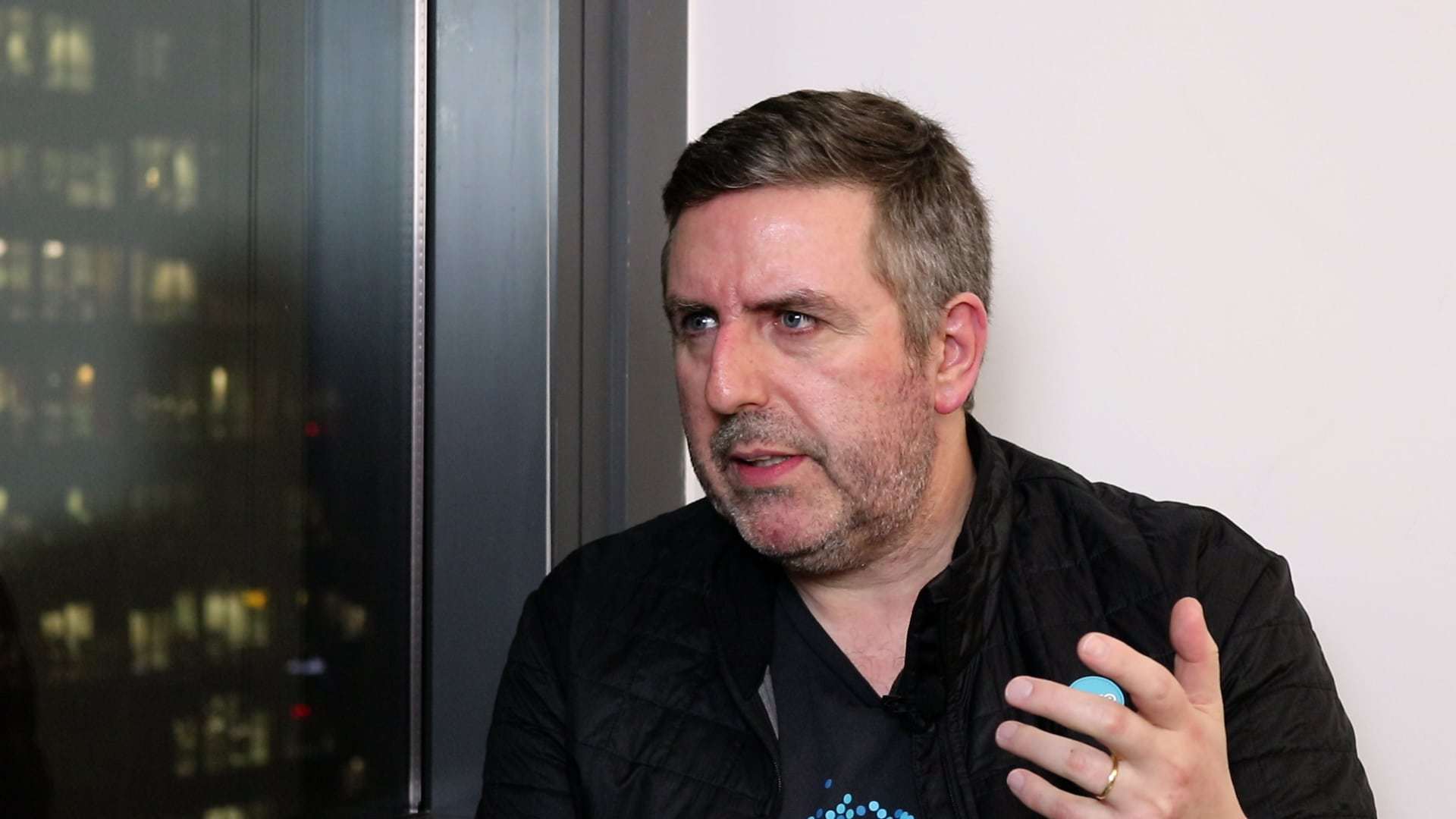

Xero: Giving 800,000 Business Owners Their Lives Back

Gary Turner is Co-Founder and Managing Director of Xero, which Forbes described as the “World’s Most Innovative Growth Company.” Xero provides small- to medium-sized businesses (SMBs or SMEs) with ‘beautiful’ online accounting software. Gary helped take Xero from a 3-person startup to a company that will have £150 million in revenue this year.

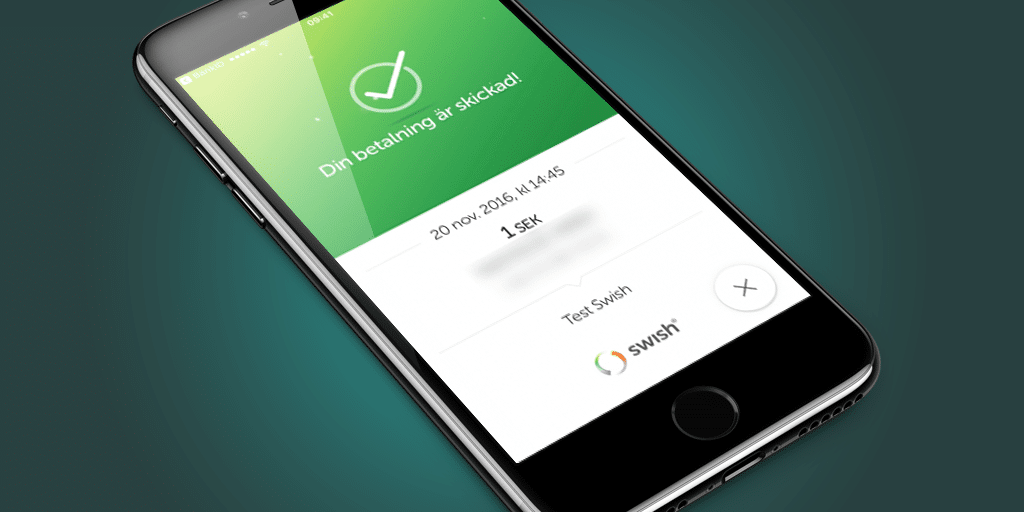

Swish: 3 Takeaways for Every Bank

How do we stay ahead of fraud and financial crime without compromising the speed, ease, and trust that make instant payments so compelling? In this article, Mastercard's Bryan Sharkey explores it all.

Digital Wealth Management: It’s All about the Offense

When people start explaining how technology can be used to modernise financial services their language instantly becomes fraught with acronyms, buzzwords, and idioms that can make little sense to those both inside, and especially, outside the industry.We have a hunch sometimes people do this to appear smart but we need to do more research!

‘Nicest Guy in Fintech’ on 'Golden Age of Finance'

Sam Maule, Director of Digital & Fintech at NTT DATA Americas, talks to us about how a kid from Detroit became a fintech leader, his new podcast, femtech, and Silicon Valley’s rude awakening.

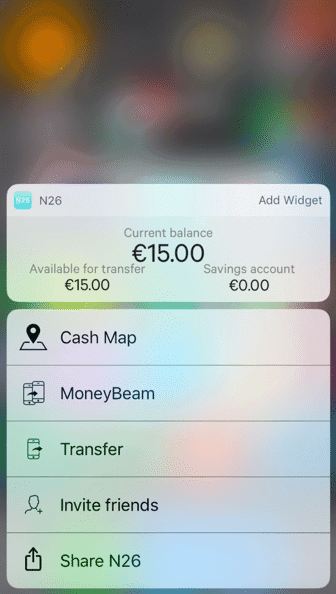

Going Native: Force Touch, Siri, and Messages Payments

Goldman Sachs broke the fintechnet this week when it launched its developer portal, intentionally allowing companies to ‘embed finance’ within their organisation using their Banking as a Service (BaaS) offering. Hari Moorthy, Goldman’s Global Head of Transaction Banking, referred to it as “the financial cloud for corporates.” Cue a flurry of emails inside every large bank from CEOs wondering how seriously they should take this. Take it seriously. Take it very seriously.

It’s Blockchain, Not Bitcoin, That’s Relevant to Finance

Let’s start by calling Buy Now Pay Later (BNPL) what it is - debt. Debt, of course, has many faces. But ‘credit, pay in instalments, pay nothing today, etc.’ are all just debt. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Gates Foundation Interview - What Banks Can Learn from the Frontline of Financial Inclusion

Over the past twelve months, we’ve been seriously busy here at 11:FS. Now we’re announcing arguably the most exciting project we’ve ever taken on.

"My Bank Already Has An App!"

That’s what 11:FS bank building guru Jason hears when he tells people that he’s just spent the last two years building a new digital bank, and they’re right!

Top 10 Things To Know About Blockchain This Week

The Pulse team spends their time trawling through the world of banks and fintech apps, sorting the good from the bad so you don’t have to.

Why Should a Central Bank Issue a Digital Currency?

In this blog post Simon Taylor explores the concept of a Central Bank Digital Currency and why you would want a DLT (or “Blockchain”) like architecture for such a system.

BaaP (Banking as a Platform) Part 2 - How could banks develop their platform levers?

If you missed Part 1 of this 2 part piece then you can catch it here and catch up with the rest of the class: BaaP (Banking as a Platform) Part 1 – Why haven’t we seen a banking platform play?

Jurassic Bank – Why banks will have to go the way of the dinosaurs

The landscape for fintech and banking is evolving more rapidly than ever, and in case you weren’t aware, there’s a war going on for your customers. With challengers attacking from left, right, and centre, it’s never been more important to stay on top of the latest and greatest UX innovation. Pssst – click here to go straight to the goods and request a demo of 11:FS Pulse.

BaaP Part 1 - Exploring Banking as a Platform (BaaP) Model

The opportunity to change the way we deliver financial services is changing as new channels, products and partnerships are being explored. Banking as a Platform (BaaP) is one of the alternatives.By me, David M. Brear, CEO and Co Founder at 11:FS and Pascal Bouvier, Venture Partner at Santander InnoVentures

404

404. Insights: Bank earnings: is the competitive tide turning?

Simon Taylor and Adam Davis are joined by some great guests to talk about big banks' earnings. Guests on today's show are Sharon Kimathi, Editor at Fintech Futures and Lianna Brinded, Head of Yahoo Finance UK.

403

403. News: JPMorgan's open banking rules for US fintechs

David Brear and Sam Maule are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: JPMorgan sets data deadline for fintechs, Marcus proves popular in new poll, and celebs invest in immigrant credit company.

402

402. Interviews: Making cross-border payments seamless with GoCardless and TransferWise

Jason Bates is joined by TransferWise CEO, Taavet Hinrikus and GoCardless CEO, Hiroki Takeuchi to talk about their new partnership and the future of cross-border payments.

133

133. The great bZx DeFi exploit

We. Are. Here. Today we bring you: DeFi protocol hit by hackers, JP Morgan’s Quorum looks to merge with ConsenSys, and multiples M&A moves in the crypto world. Today's guests include: Ed Cooper - Revolut, Michael Coletta - London Stock Exchange Group, Rhain Lewis - London Womon in Bitcoin, and Aman Kohli - DXC. All this and much more on today's Blockchain Insider!

400

400. Insights: Love and partnerships in fintech

In a Valentine's Day and episode 400 special, hosts Leda Glyptis, David Brear and Jason Bates get together to talk about the things they love most about this industry and their favourite fintech partnerships. Later in the show, they're joined by some friends of the podcast who also share some of theirs!

59

59. Modern Insurance - Build a better product!

Nigel Walsh is joined by a panel of guests to talk through how insurance is evolving and changing in our modern world. All this and much much more on today's Insurtech Insider!

399

399. Will Goldman Sachs and Amazon conquer the SMB space?

Leda Glyptis and David Brear are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Could Goldman Sachs and Amazon join forces on small business lending?, two more payments giants are consolidating, and banker busted for allegedly filching food.

399

399. News: Will Goldman Sachs and Amazon conquer the SMB space?

Leda Glyptis and David Brear are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Could Goldman Sachs and Amazon join forces on small business lending?, two more payments giants are consolidating, and banker busted for allegedly filching food.

132

132. Central bank digital currencies are so hot right now

We. Are. Here. Today we bring you: will banks bet big on central bank digital currencies?, more execs leave Swiss stock exchange SDX, and Ripple eyes IPO. Simon Taylor hosts and is joined by Eric Van der Kleij, CEO of Frontier Network and Andrew Smith, CTO at RTGS.All this and much more on today's Blockchain Insider!

396

396. Insights: Do consumers care about Open Banking?

Sarah Kocianski is joined by some great guests to discuss the first 2 years of Open Banking in the UK - what's worked, what hasn't and how many more opportunities and innovations are yet to come.

395

395. News: Has Open Banking failed?

David Brear and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Open Banking passes a million customers on its second anniversary, shakeups at RBS as Bo exec to step down, and BlackRock to shift away from fossil fuel investments.

394

394. Insights: The future of investing

In this week's Insights show, Adam Davis is joined by some great guests to discuss the future of investing.

131

131. The digital dollar

We. Are. Here. Today we bring you: The currency cold war, tokenising your future income, and when will we see a digital dollar? All this and much more on today's Blockchain Insider!

393

393. News: Visa buys Plaid - the first megadeal of 2020

Fintech Insider is stateside this week as hosts Will White and Sam Maule are joined by a panel of great guests to talk about some of the most interesting stories of the last 7 days, including: Visa acquires Plaid in $5bn deal, banks tell us how they did in Q4 2019, and the new bank for the 60+ set.

392

392. Insights: VC Roundtable: What makes a good fintech investment?

Simon Taylor is hosting solo this week and is joined by some great guests to talk about the future of fintech VC investment.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)