Global

The difference between good and great

When did you last pay for something in cash? If you can’t remember, you’re not alone.

Leda Writes for Fintech Futures: The subtle art of holding yourself accountable

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to the view from your desk. But this isn’t a blog about facilities management.

David the fintech vs Goliath the bank

Incumbent banks are losing. It’s no secret that challenger banks are taking advantage of the opportunities that incumbents have left on the table. But what if that could change?

One year on: Open Banking

Four years ago, policymakers in the UK and EU took the first steps to enshrine open banking into law, but now we’re at a turning point for digital adoption and the old ways of working aren’t working anymore.

Leda Writes for Fintech Futures: Self care tips for corporate change makers

Each week, Leda Glyptis, CEO of 11:FS Foundry, creates #LedaWrites. This week it's all about a word we've heard and spoken more than any other over the last few months - 'normal'

How we started Fintech Insider

Awards?! ‘Yay’, I hear you say. But it’s not like this wasn’t a crowded market already, so surely this is nothing new, right? Check out more details on our awards show here.

Leda Writes for Fintech Futures: The era of indulgent clients is over

Every Thursday, Leda Glyptis, CEO of 11:FS Foundry creates #LedaWrites. This week she returns to the topic of gender.

Don't eat it all at once: Snack size core banking transformation

At some point for every product, you’ll have gone through an initial period of exciting discovery. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

How Australia is banking on new competition

By Michael Douglas, Vice President, Strategy, Galileo

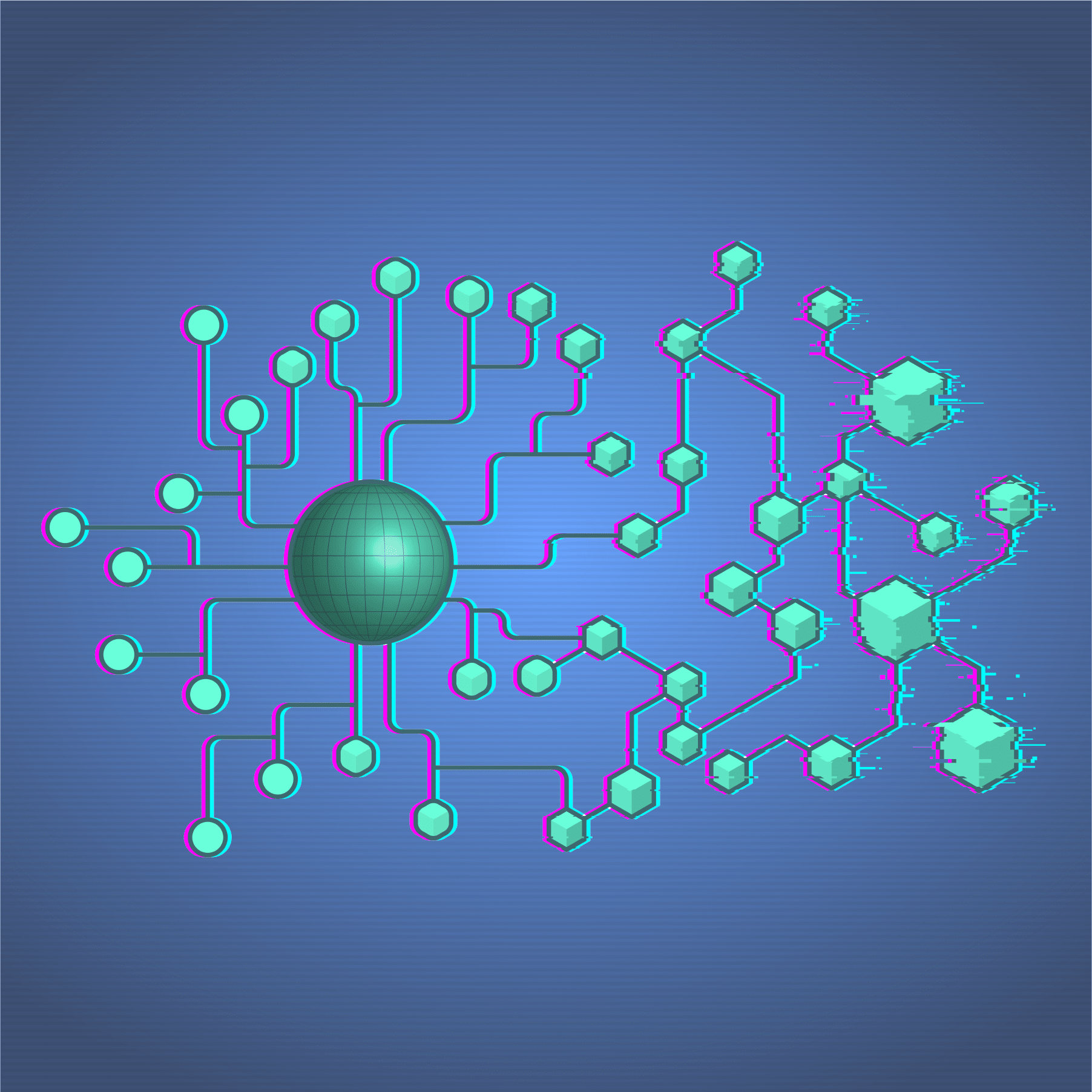

Will blockchain replace core banking in 2019?

TL;DR None of the challenger banks use blockchain, the guy who’s leading the most popular smart contract platform (Ethereum) say’s it’s a bad idea. So, I mean read on…but. No, don’t use a blockchain or smart contracts for the love of god.

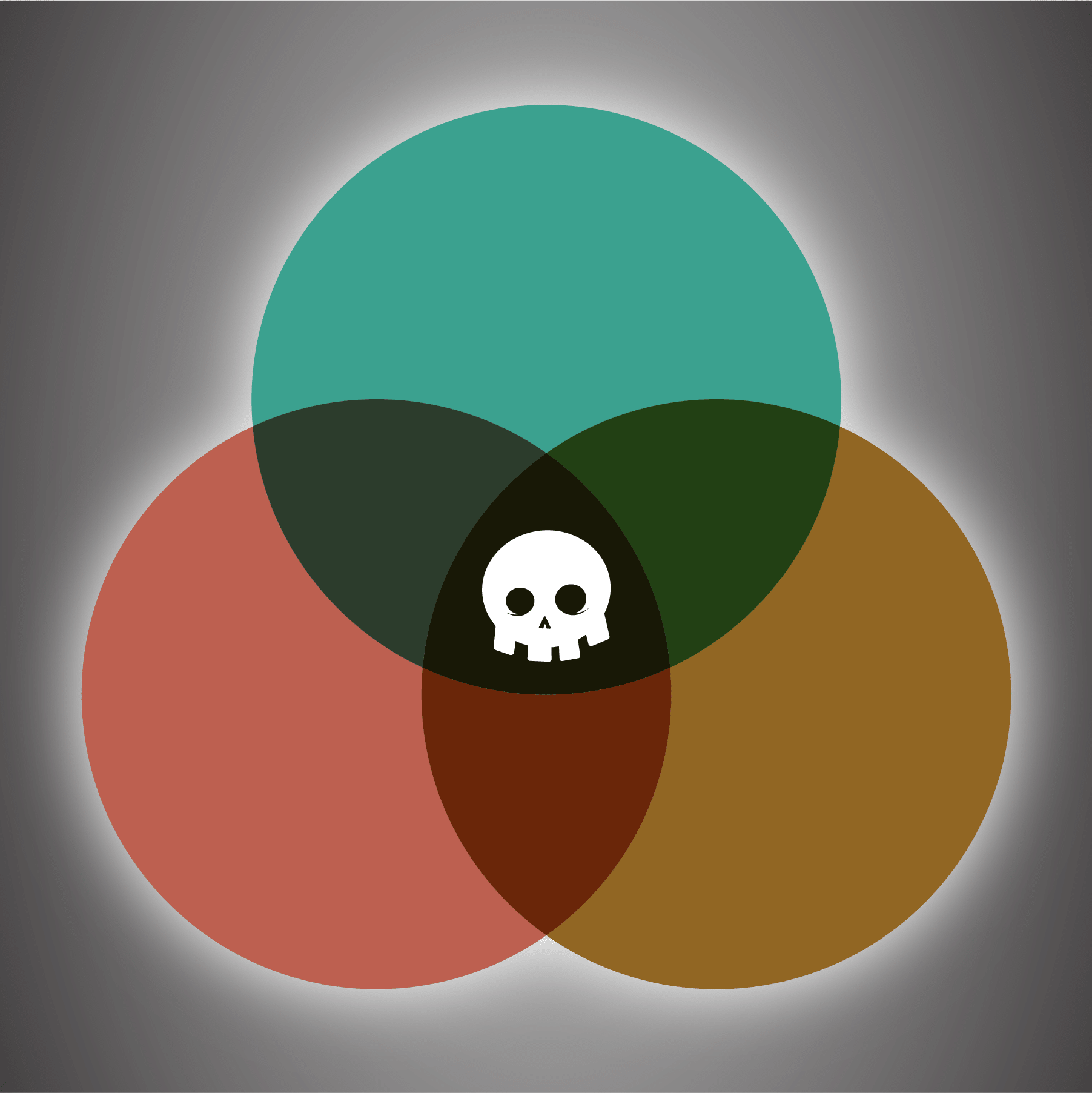

Leda Writes: The Venn diagram of doom

I’d like to start this by stating that Africa is not a monolith and for the purpose of this post, I’ll be zeroing in on the East and West African markets. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Our 2019 crypto predictions

It’s been an incredible year for fintech, but one thing’s for sure. 2019 is going to be an even wilder ride.

Our 2019 fintech predictions

So about 350 days ago I made some predictions about how 2019 would shape up. Here I’ll break down how accurate, or not, I was. TL:DR - pretty damn accurate.

New Year resolutions: in 2019 digitalise on purpose

Niall Cameron joined David Brear on Fintech Insider to discuss HSBC, innovation and partnering with fintechs. We found out his views of how incumbents can best work alongside and partner with fintechs in the changing digital space:

Looking back on Crypto in 2018

As a uni student, it drove Ollie Purdue crazy that his bank couldn’t provide him with basic info to help manage his financial life. How much money was he likely to have at the end of the month? Could he cut back on work and have more fun – or did he need to increase his hours to pay the bills? At age 20, he founded Loot to create a better banking experience that used data in a smarter way. In episode 232 of FinTech Insider, Ollie, CEO of Loot, shares the story behind his company, including how he got bank execs to talk to him when he was still in school.

380

380. After Dark: A Fintech Christmas Carol

In this very special edition of Fintech Insider, David Brear, Simon Taylor, Sarah Kocianski and Jason Bates are joined by some great guests at the Revolut HQ for the latest instalment of After Dark. In the spirit of Christmas, join us as we journey through the past, present and future landscape of financial services!

125

125. Jamie Bartlett: Still searching for the Missing Cryptoqueen

We. Are. Here. Today we bring you an interview with Jamie Bartlett, co-writer and co-host of The Missing Cryptoqueen podcast.

379

379. News: Is Goldman Sachs going mass market?

Simon Taylor and David Brear are joined by a trio of terrific guests to talk about some of the most interesting stories of the last 7 days, including: Plaid's European expansion, Westpac chief quits amid money laundering scandal and RBS' Bo moo-ves into the market. All this and much more on today's Fintech Insider News!

378

378. Interviews: Robinhood Snacks - Investment content simplified

Sam Maule is hosting in New York and this week he's joined by Jack Kramer and Nick Martell from Robinhood Snacks!

124

124. Venture Bingo & Cryptomaximalists

We. Are. Here. Today we bring you: JP Morgan to finance blockchain-based inventory system, the UK confirms the legal status of cryptoassets, and 25,000 Chinese blockchain firms are accused of issuing their own tokens. All this and much more on today's Blockchain Insider!

54

54. Automation in insurance: Computer says no!

On this week's episode, Sarah Kocianski is joined by some great guests to talk all things AI and automation! What are the benefits of automation? Can you truly automate an entire claims process? All this and much much more on today's Insurtech Insider!

377

377. News: Fintechs for sale!

Sam Maule and Will White host this week's news show from NYC and are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Chime rings in the new year in style, Silicon Valley’s reality check with California’s new consumer privacy laws, and Barclays harnesses puppy power to ease students’ money stress.

377

377. Fintechs for sale!

Sam Maule and Will White host this week's news show from NYC and are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Chime rings in the new year in style, Silicon Valley’s reality check with California’s new consumer privacy laws, and Barclays harnesses puppy power to ease students’ money stress.

123

123. Bitcoin or britcoin?

We. Are. Here. Today we bring you: Andreessen Horowitz leads $25M funding round, the argument for why the UK should have its own cryptocurrency, and Brave browser introduces crypto-coin rewards for your fave websites. All this and much more on today's Blockchain Insider!

375

375. News: Everything is fintech!

Sarah Kocianski and Simon Taylor are joined by some great guests to talk about the most interesting fintech stories of the last 7 days. This week our stories include: Google's offering of checking accounts, Facebook launches Facebook pay, and HSBC and RBS' new digital banking platforms! All this and much more on today's Fintech Insider News!

374

374. Insights: The importance of cashflows for SMEs - Live at Xerocon

This week we bring you an episode of the podcast recorded live at Xerocon London 2019! David Brear is joined by a fantastic panel of guests to discuss and debate the importance of cash flow for SMEs in this combined news and insights show!

122

122. ETH 2.0, Bitcoin the asset & blockchain for banking

We. Are. Here. Today we bring you: Bakkt's biggest trading day to date, North Korean crypto money laundering, and Ray Dalio's take on broken financial systems. All this and much more on today's Blockchain Insider!

373

373. News: Robinhood's 'free money' glitch

Leda Glyptis and Adam Davis are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Robinhood traders find “infinite leverage” glitch, Digital banks grow as fintech funding slows and Westpac announces banking-as-a-service platform! All this and much more on today's Fintech Insider News!

372

372. Interviews: Lee Wetherington & Ben Metz, Jack Henry and Associates

Sam Maule is in San Diego, and is joined by Lee Wetherington, Director of Strategic Insight at Jack Henry and Associates and Ben Metz, Senior Managing Director at Jack Henry & Associates!

121

121. Central banks have fomo

We. Are. Here. In New York actually! Today we bring you: China announces new regulatory authority for blockchain and digital payments, Harbor adds SEC license to help security token issuers pay out dividends and association of German banks call for a digital Euro. All this and much more on today's Blockchain Insider.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)