Global

Why startups often get CRM wrong

A guest post by Jessica Holzbach, Head of Customer Relations at Penta CRM is often misconstrued or just written off as email marketing. As such, startups often forget to factor in true customer retention management into their marketing strategies, until they have too many customers that their current methods are not scalable.

Should I buy cryptocurrency? What’s going on here? Is it a bubble?

Taste your product, be big and fast, invest in your own teams and partner with Snoop Dogg. Chief Commercial Officer of Klarna, Michael Rouse has more than a few nuggets of wisdom to share.

The Race is On: How 3 Challenger Banks Plan to Win Customers (and Make Money)

This post appeared first in The Times and Raconteur in the UK in June 2016. Until the financial crisis banks had enjoyed decades of growth unencumbered by the disruption seen in the newspaper, telecommunications and music industries. During the good years banks’ profits soared and, while they embraced customer-facing internet and mobile apps, the foundations, processes and technology on which banks are built, despite billions spent on technology, would look familiar to those who worked there in the 1970s. UK banks now face the perfect storm of significant technological advancements plus a regulator and government that want to foster innovation, and an ever-growing disillusionment of banking customers to banks’ offerings.

Strengthen Your Core or Suffer the Consequences

When it comes to managing bills and expenses, there’s a variety of products available on the market. Some are not amazing, others are good, but there is still a gap for an offering tailored to student needs.

Antony Jenkins: We Can Build a Better Banking System with Technology

Antony Jenkins, former CEO of Barclays, has spent 35 years working in large financial services institutions. He says that it struck him that, although there’s a lot of technology in banks, it doesn’t help much when it comes to improving the customer experience or lowering costs, and it hasn’t improved the reputation of banks within society. He founded 10x to create a new banking experience — one that is more diverse, open, and fair. In episode 229 of FinTech Insider, he talks to us about his new company, the future of banking, and the transition from running one of the biggest banks in the world to founding a startup.

6 Ways to Transform Your Bank – without Spending Billions

Spending billions on digital transformation – and bragging about it – seems to be the only game in town for large incumbent banks. But this spending hasn’t paid off, and financial institutions continue to battle a heavy fixed-cost base. You know digital transformation is critical, so how do you convince an incumbent bank’s CFO and CxOs that digital transformation doesn’t have to cost billions or take decades?

The First 5 Steps to Transform Your Bank

In the past decade, the banking industry has seen an incredible amount of innovation and disruption. New entrants like Monzo in the UK and Nubank in Latin America are finally taking on the incumbents that, for decades, were impossible to challenge.

UK Banking: How Are You Sleeping?

The UK’s digital-only challenger banks are currently engaged in something of an arms race to offer customers the broadest range of features and services. Hot on the heels of joint accounts, coming soon from both Monzo and Starling, came Monzo’s announcement that its customers can now use TransferWise within the bank’s app to send money abroad.

Banking APIs Aren't about Tech or Banking

I’m sure that you’ve seen the same presentations that I have. An expert from a large consultancy stands up and his first slide says “API stands for Application Programming Interface”. He continues with a description of new regulations (PSDII / CMA) and describes the technology that will let customers give third parties to access their banking data and trigger new transactions. That’s all true, but it’s a mistake to start there, it leads in the wrong direction.

Monzo: A Peek inside the Playbook of the World's First Truly Digital Bank

Fintechs can’t hire product marketers quick enough at the moment. If you’re new to the marketing game and looking to become a specialist rather than a generalist, then it’s probably one of the most interesting areas to specialise in right now.

11 Things Your CIO Needs to Know About Blockchain Today

Blockchain and DLT are in the labs of most large banks and have been useful from a PR perspective. But what next? What the hell should we actually be doing with this technology? Here are 11 things your CIO needs to know about blockchain / DLT so your organisation doesn’t get left behind.

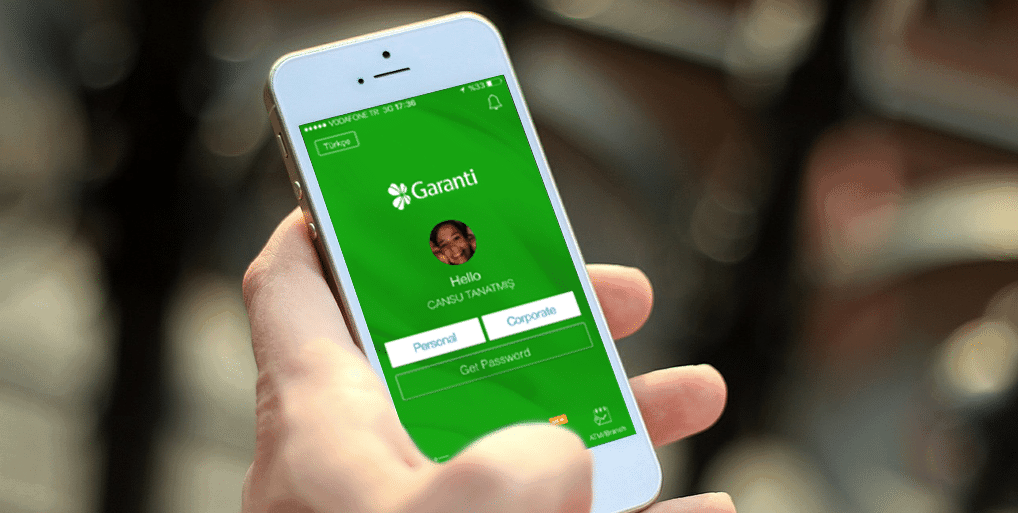

Garanti: The banking app that isn't on your radar

For Season 2 of Connection Interrupted we’re kicking off in style with a super star of media, social media, podcasting and much much more: Gary Vaynerchuk! I had the pleasure of meeting Gary at the Vaynermedia offices in NYC with one mission: to try and get to know him, to find out who the real Gary is behind brand Gary V: the man who loves his family (and the Jets). Listen to the episode here or below and read on for my personal highlights.

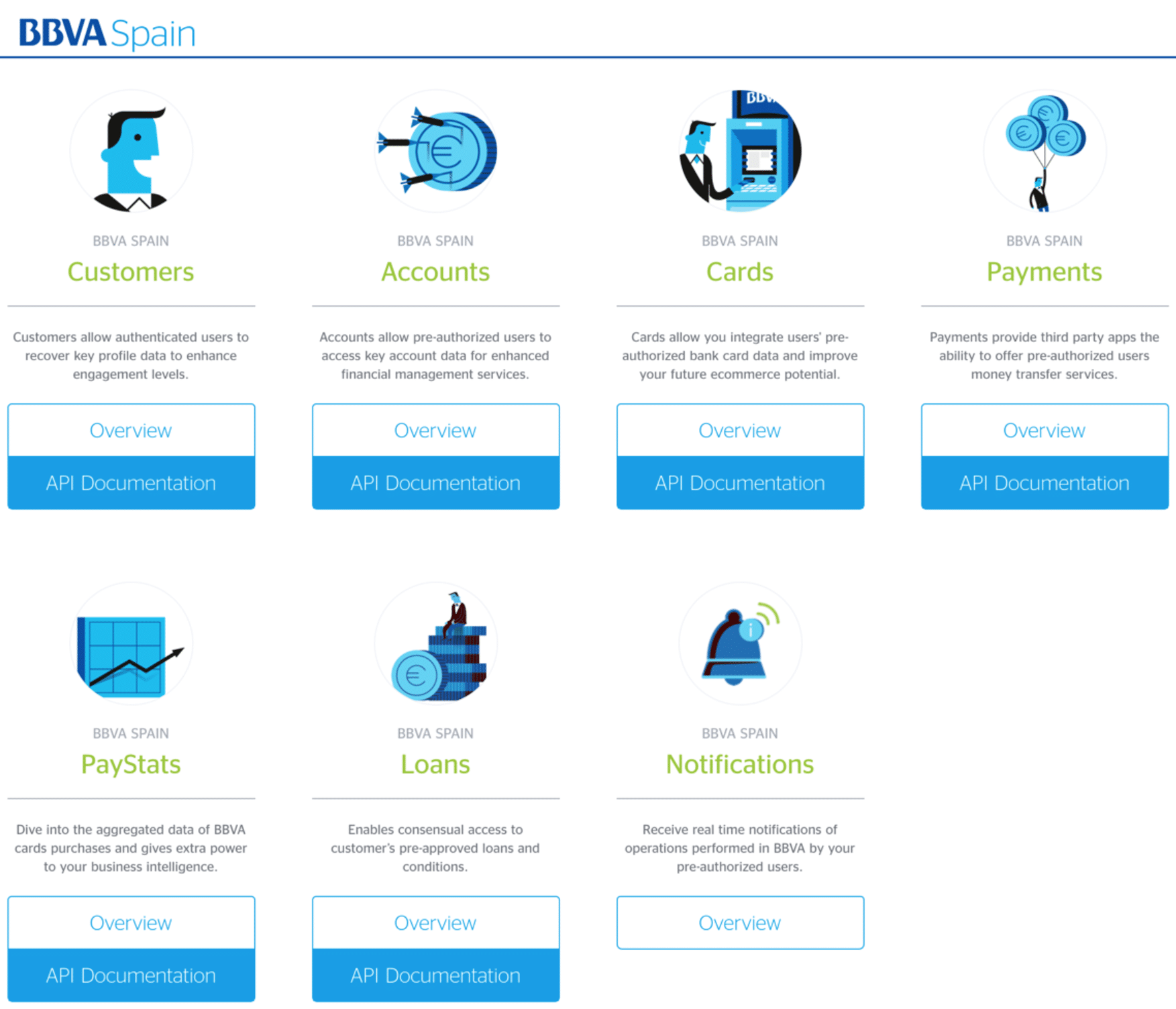

11 Banks and FinTechs Doing APIs Better Than You

In its final report, the Competition and Markets Authority has formally implemented reforms aimed at giving people more control of their money. By Q1 of 2018, European banks have to completely open up their data through full APIs. But some banks aren’t prepared to wait that long. Read on to see which ones have taken the lead.

4 Blockchain Macro-Trends: Where to Place Your Bets

The challenges (and opportunities) ahead for enterprise applications of distributed ledger tech.

The 11 FinTech and Banking Trends You Need to Follow

The arrival of a new year is often a time for reflection and an opportunity to look ahead. In design it’s no different.

380

380. After Dark: A Fintech Christmas Carol

In this very special edition of Fintech Insider, David Brear, Simon Taylor, Sarah Kocianski and Jason Bates are joined by some great guests at the Revolut HQ for the latest instalment of After Dark. In the spirit of Christmas, join us as we journey through the past, present and future landscape of financial services!

125

125. Jamie Bartlett: Still searching for the Missing Cryptoqueen

We. Are. Here. Today we bring you an interview with Jamie Bartlett, co-writer and co-host of The Missing Cryptoqueen podcast.

379

379. News: Is Goldman Sachs going mass market?

Simon Taylor and David Brear are joined by a trio of terrific guests to talk about some of the most interesting stories of the last 7 days, including: Plaid's European expansion, Westpac chief quits amid money laundering scandal and RBS' Bo moo-ves into the market. All this and much more on today's Fintech Insider News!

378

378. Interviews: Robinhood Snacks - Investment content simplified

Sam Maule is hosting in New York and this week he's joined by Jack Kramer and Nick Martell from Robinhood Snacks!

124

124. Venture Bingo & Cryptomaximalists

We. Are. Here. Today we bring you: JP Morgan to finance blockchain-based inventory system, the UK confirms the legal status of cryptoassets, and 25,000 Chinese blockchain firms are accused of issuing their own tokens. All this and much more on today's Blockchain Insider!

54

54. Automation in insurance: Computer says no!

On this week's episode, Sarah Kocianski is joined by some great guests to talk all things AI and automation! What are the benefits of automation? Can you truly automate an entire claims process? All this and much much more on today's Insurtech Insider!

377

377. News: Fintechs for sale!

Sam Maule and Will White host this week's news show from NYC and are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Chime rings in the new year in style, Silicon Valley’s reality check with California’s new consumer privacy laws, and Barclays harnesses puppy power to ease students’ money stress.

377

377. Fintechs for sale!

Sam Maule and Will White host this week's news show from NYC and are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Chime rings in the new year in style, Silicon Valley’s reality check with California’s new consumer privacy laws, and Barclays harnesses puppy power to ease students’ money stress.

123

123. Bitcoin or britcoin?

We. Are. Here. Today we bring you: Andreessen Horowitz leads $25M funding round, the argument for why the UK should have its own cryptocurrency, and Brave browser introduces crypto-coin rewards for your fave websites. All this and much more on today's Blockchain Insider!

375

375. News: Everything is fintech!

Sarah Kocianski and Simon Taylor are joined by some great guests to talk about the most interesting fintech stories of the last 7 days. This week our stories include: Google's offering of checking accounts, Facebook launches Facebook pay, and HSBC and RBS' new digital banking platforms! All this and much more on today's Fintech Insider News!

374

374. Insights: The importance of cashflows for SMEs - Live at Xerocon

This week we bring you an episode of the podcast recorded live at Xerocon London 2019! David Brear is joined by a fantastic panel of guests to discuss and debate the importance of cash flow for SMEs in this combined news and insights show!

122

122. ETH 2.0, Bitcoin the asset & blockchain for banking

We. Are. Here. Today we bring you: Bakkt's biggest trading day to date, North Korean crypto money laundering, and Ray Dalio's take on broken financial systems. All this and much more on today's Blockchain Insider!

373

373. News: Robinhood's 'free money' glitch

Leda Glyptis and Adam Davis are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Robinhood traders find “infinite leverage” glitch, Digital banks grow as fintech funding slows and Westpac announces banking-as-a-service platform! All this and much more on today's Fintech Insider News!

372

372. Interviews: Lee Wetherington & Ben Metz, Jack Henry and Associates

Sam Maule is in San Diego, and is joined by Lee Wetherington, Director of Strategic Insight at Jack Henry and Associates and Ben Metz, Senior Managing Director at Jack Henry & Associates!

121

121. Central banks have fomo

We. Are. Here. In New York actually! Today we bring you: China announces new regulatory authority for blockchain and digital payments, Harbor adds SEC license to help security token issuers pay out dividends and association of German banks call for a digital Euro. All this and much more on today's Blockchain Insider.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)