Global

The risk of fintech blanding

How many times have you looked at a job posting only to see the mention of free fruit? Sure it’s nice to have free food, but what purpose does it serve and does it have anything to do with employee wellbeing?

8 takeaways from our latest Banking as a Service episode

The fourth episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

How to turn outdated corporate identities into fresh opportunities

Behavioural design is the process of using psychological insights into how people think and act irrationally, to design better products and services. Sounds good, right? But…er… what does that actually look like?

What is the future of payments? We head to FinTech Connect 2020 to find out

Businesses are slowly awakening to the idea that it's time to consider new sources of growth when it comes to securing their futures. They’ve realised that, sometimes, designing the most engaging customer value propositions requires leaning on the brand strength of other players outside of your domain.

Buy Now Pay Later: Love it or hate it, you can’t ignore it

Buy Now Pay Later (BNPL) is one of the hottest trends in fintech. The concept of 0% finance has been around for decades, but it’s caught fire in the last 3 years with new market entrants like Affirm, Afterpay and Klarna transforming how this works for consumers in an e-commerce setting. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

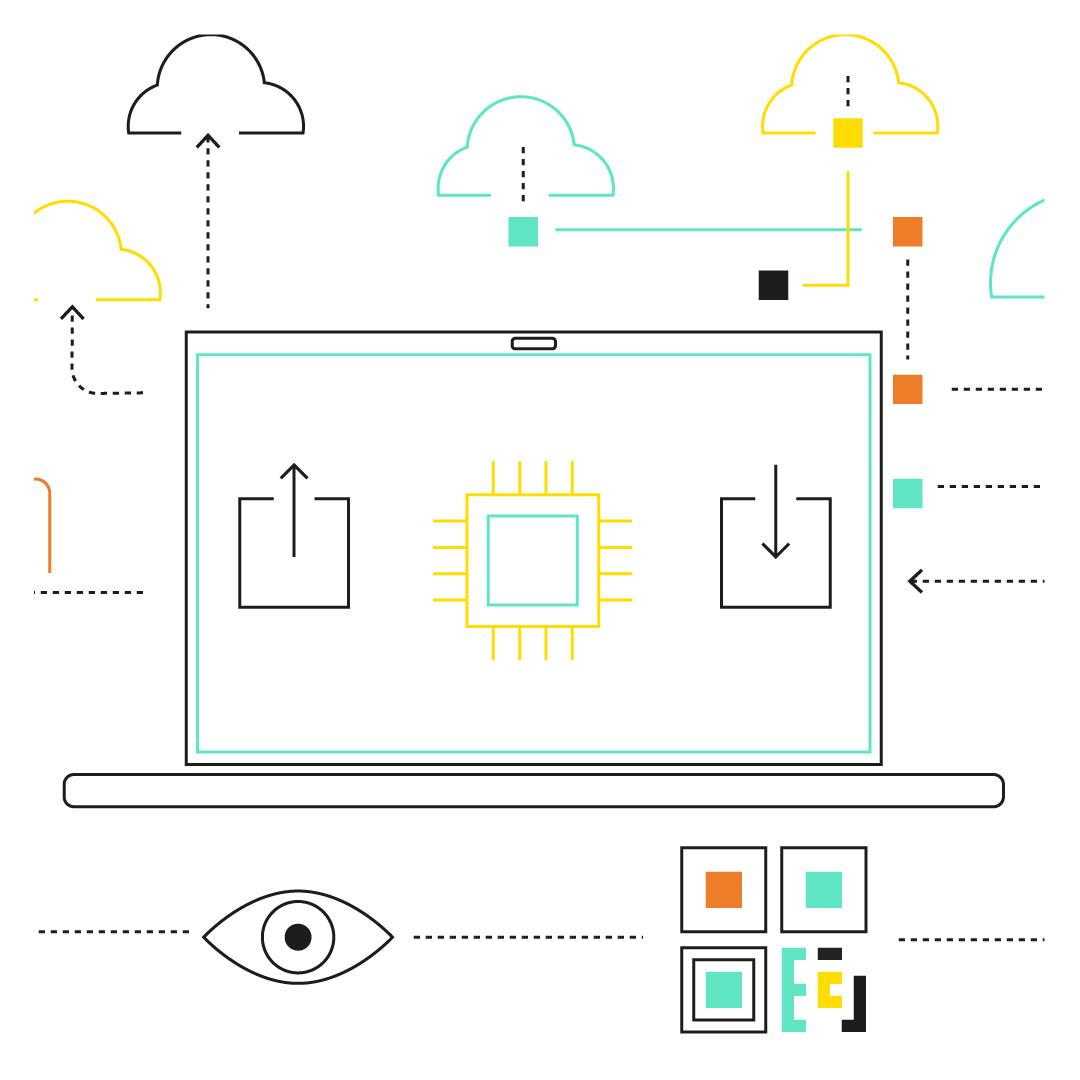

What is embedded finance?

While FinTech folk salivate – and the big banks bloviate – about PSD2 and the open banking reforms coming our way in 2018, we wondered whether those outside of this bubble will actually notice? What does PSD2 actually mean for customers?

The future of banking: all paths lead to lending

A Black-owned bank is defined as one in which at least 50% of voting shares are owned by African-Americans. They’re a dwindling force in the States today.

Crafting impactful design principles

Throughout history, humans have found direction from statements of intent that suggest 'better' ways of living.

Why is BaaS so hot right now?

The first episode of our brand-new video series, Decoding: Banking as a Service, is live! If you missed it, catch up here. Here’s a rundown of the episode if you prefer reading to watching 📖

In defence of virtue signalling

Nothing’s worse than not having any options, but having too many can be just as bad.

7 reasons Banking as a Service is a game changer

We now live in a world where almost anyone can build and launch innovative, regulated financial products as easily as they can create a Shopify page - that’s the magic of Banking as a Service (BaaS).

Goldman Sachs is leaning into embedded finance: other banks should take note

As 11:FS wraps up its 5th year in business, we can’t help but think about what the next 5 will look like. And our ambitions are big. It’s only just on the right side of scary.

Is the future really cashless?

Richard Brown, CTO at R3, says that blockchain allows us to, for the first time, build systems and technologies that run between different organisations that don’t trust each other and bring them to consensus. This means potentially significant savings for financial services, especially in file reconciliation and manual activity. For blockchain to succeed in finance, multiple firms must work together, and Corda is helping to do just that.

Using the cloud to fly sky high above the competition

As we roll into 2018 thoughts inevitably turn to the big themes that we might expect (and hope) to see for user experience in the financial services industry this year.

Jobs to be Done: How to help US SMBs keep their personal assets separate from their business finances

Jobs To Be Done (JTBD) is a theory. Its main aim is to explain why customers start - and stop - using different products and services in the market. Stripped down to the essentials, it’s a fairly straightforward concept first introduced by Harvard professor Clayton Christensen that can be adapted into a useful tool for product development.

370

370. Interviews: Bill Winters, Group Chief Executive at Standard Chartered

Jason Bates is at SIBOS 2019 at the Excel in London where he is joined by Bill Winters, Group Chief Executive at Standard Chartered!

52

52. Making insurance attractive

On this weeks episode, Sarah Kocianski is joined by some awesome guests to talk all things how to attract and retain talent in the insurance industry! Where is the talent going? Who has the hang of company culture? All this and much much more on today's Insurtech Insider!

369

369. News: Startups growing up

David Brear and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Revolut teams up with Mastercard to help them launch in the US - weeks after their Visa deal was announced, Santander takes on Goldman in the US deposits market, and EY’s alternative workplace training for women! All this and much more on today's Fintech Insider News!

368

368. News: 2008 throwback special

David Brear, Jason Bates and Simon Taylor are joined by some great guests for this very special throwback episode! Today we are doing the news as if it were 2008, specifically focussing on the news from the week of the financial crash, including: Lehman Brothers files for Bankruptcy, Madoff Jailed over $50bn Fraud and - Note to self: Don’t slag your bank off…...in your online banking password! All this and much much more on today's Fintech Insider News - as if it were 2008!

119

119. Has Bitcoin failed? Is Libra losing?

We. Are. Here. Today we bring you: Marcus makes Stablecoin Claim, Poloniex spun out by Circle and - Has bitcoin failed? All this and much more on today's Blockchain Insider!

367

367. News: The holy grail of the unbanked

Sarah Kocianski and Adam Davies are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Pensions bank rolling start ups, Robinhood tries again at a savings account and the UK just rolled out a payment card made from solid gold, and worth $23,000!

118

118. Libra has to exist!

We. Are. Here. Today we bring you: Attack of the Ten TON Regulator, Libra’s last legs and Zuck’s a sitting duck, later this month! All this and much more on today's Blockchain Insider!

51

51. SME insurance - Prevention and education

On this weeks episode, Sarah Kocianski and Nigel Walsh are joined by some awesome guests to talk all things SME insurance! What are the risks? Where are the opportunities? Why is this such an underserved market? All this and much much more on today's Insurtech Insider!

365

365. News: Free money!

David Brear and Will White bring you this news show recorded in our new offices in New York! As always, they are not alone but joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Samsung Pay launches International payments in the US, Credit Karma moves into savings as Brex moves into cash management and Financial jargon brings people out in a sweat and they think investing is as scary as skydiving!

364

364. Interviews: SIBOS 2019 Industry leader special

This week we bring you our final interview mashup from SIBOS 2019 at the Excel in London! This week we have the pleasure of bringing you two fantastic interviews with two industry leaders!

117

117. Blocking Libra left and right

We. Are. Here. Today we bring you: Zuck could be stuck, unless he testifies, Blockchain & Banking and The Nature of Money is Changing

363

363. News: Banking isn’t a side hustle

David Brear and Leda Glyptis are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Transferwise is the latest UK fintech to take on the US, Revolut teams up with Visa to help them go global and a US Marijuana Banking Bill Passes House in Historic Vote! All this, and much more on today's Fintech Insider.

362

362. Interviews: International deep tech special

This week we bring you another interview mashup from SIBOS 2019 at the Excel in London! This week we are focussing on more international companies with a flavour of deep tech and infrastructure.

116

116. Blockchain as an excuse

We. Are. Here. Today we bring you: EOS maker Block. One fined $24m by the SEC over unregistered securities saleSwiss Stock Exchange SIX lines up buyers for its Initial Digital Offering and Fidelity Digital Assets to Provide Custody for Bitcoin Derivatives Yield Fund. All this and much more on today's Blockchain Insider.

50

50. A celebration of insurtech

On this weeks episode, we are celebrating our 50th birthday! To celebrate this milestone we’re joined by some of our most frequent returning guests from across the series to date! In today’s show we will be looking at the top news, topics and trends in insurtech over the last 50 episodes and going forward.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)