Global

The risk of fintech blanding

How many times have you looked at a job posting only to see the mention of free fruit? Sure it’s nice to have free food, but what purpose does it serve and does it have anything to do with employee wellbeing?

8 takeaways from our latest Banking as a Service episode

The fourth episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

How to turn outdated corporate identities into fresh opportunities

Behavioural design is the process of using psychological insights into how people think and act irrationally, to design better products and services. Sounds good, right? But…er… what does that actually look like?

What is the future of payments? We head to FinTech Connect 2020 to find out

Businesses are slowly awakening to the idea that it's time to consider new sources of growth when it comes to securing their futures. They’ve realised that, sometimes, designing the most engaging customer value propositions requires leaning on the brand strength of other players outside of your domain.

Buy Now Pay Later: Love it or hate it, you can’t ignore it

Buy Now Pay Later (BNPL) is one of the hottest trends in fintech. The concept of 0% finance has been around for decades, but it’s caught fire in the last 3 years with new market entrants like Affirm, Afterpay and Klarna transforming how this works for consumers in an e-commerce setting. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

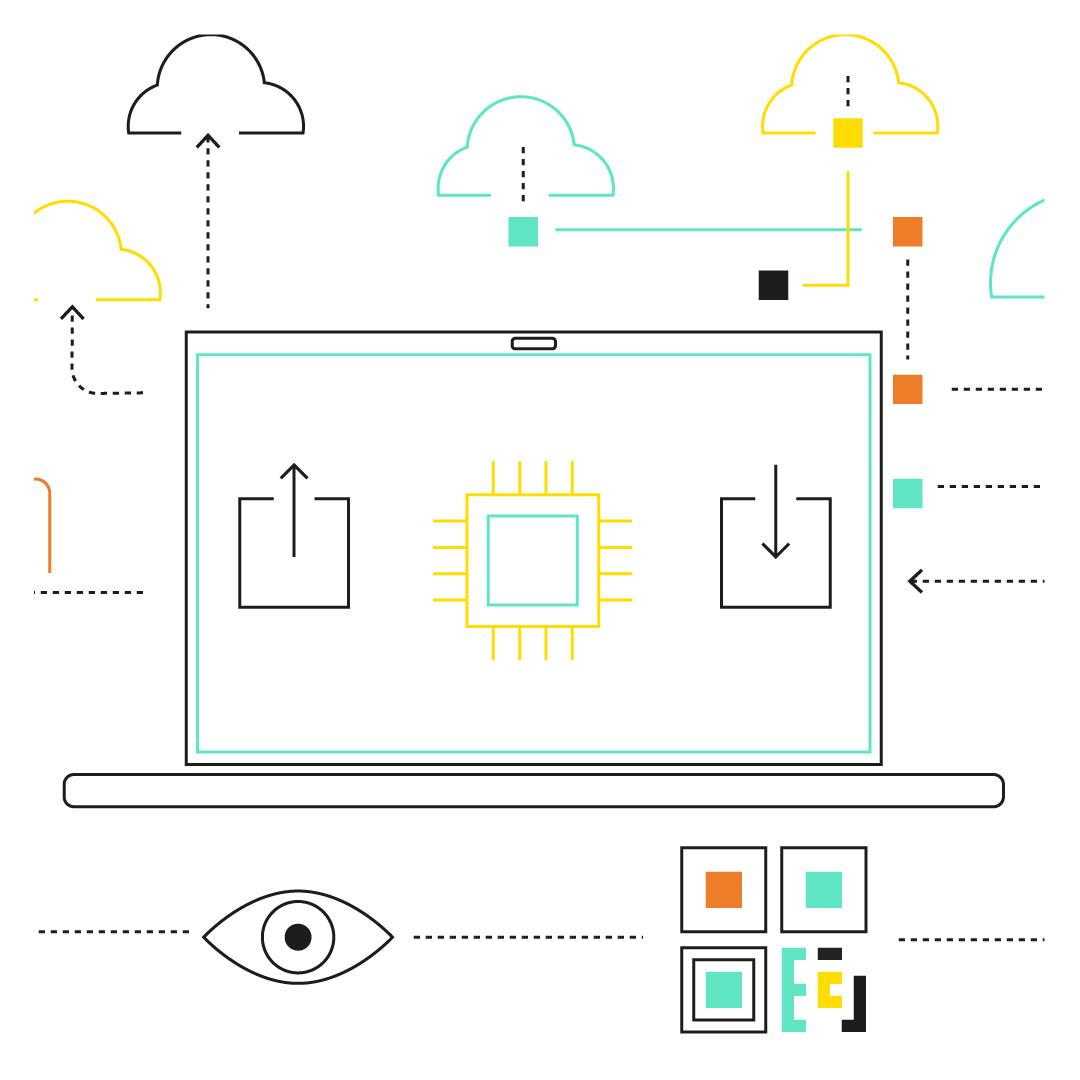

What is embedded finance?

While FinTech folk salivate – and the big banks bloviate – about PSD2 and the open banking reforms coming our way in 2018, we wondered whether those outside of this bubble will actually notice? What does PSD2 actually mean for customers?

The future of banking: all paths lead to lending

A Black-owned bank is defined as one in which at least 50% of voting shares are owned by African-Americans. They’re a dwindling force in the States today.

Crafting impactful design principles

Throughout history, humans have found direction from statements of intent that suggest 'better' ways of living.

Why is BaaS so hot right now?

The first episode of our brand-new video series, Decoding: Banking as a Service, is live! If you missed it, catch up here. Here’s a rundown of the episode if you prefer reading to watching 📖

In defence of virtue signalling

Nothing’s worse than not having any options, but having too many can be just as bad.

7 reasons Banking as a Service is a game changer

We now live in a world where almost anyone can build and launch innovative, regulated financial products as easily as they can create a Shopify page - that’s the magic of Banking as a Service (BaaS).

Goldman Sachs is leaning into embedded finance: other banks should take note

As 11:FS wraps up its 5th year in business, we can’t help but think about what the next 5 will look like. And our ambitions are big. It’s only just on the right side of scary.

Is the future really cashless?

Richard Brown, CTO at R3, says that blockchain allows us to, for the first time, build systems and technologies that run between different organisations that don’t trust each other and bring them to consensus. This means potentially significant savings for financial services, especially in file reconciliation and manual activity. For blockchain to succeed in finance, multiple firms must work together, and Corda is helping to do just that.

Using the cloud to fly sky high above the competition

As we roll into 2018 thoughts inevitably turn to the big themes that we might expect (and hope) to see for user experience in the financial services industry this year.

Jobs to be Done: How to help US SMBs keep their personal assets separate from their business finances

Jobs To Be Done (JTBD) is a theory. Its main aim is to explain why customers start - and stop - using different products and services in the market. Stripped down to the essentials, it’s a fairly straightforward concept first introduced by Harvard professor Clayton Christensen that can be adapted into a useful tool for product development.

361

361. News: Listen to your customers!

Leda Glyptis and Simon Taylor are joined by some great guests, coming to you straights from SIBOS 2019 in London! Together they cover the most notable news stories from the last 7 days, including: SWIFT’s gpi, Alison Rose is appointed RBS new chief exec and Monzo bins off Monzo Plus! All this and much more on today's Fintech Insider.

115

115. Bakkt to reality

We. Are. Here. Today we bring you: Swiss Stock Exchange SIX Launch Digital Asset Prototype, No Yuan for Libra and Bakkt Launches at a Snails pace… All this and much more on today's Blockchain Insider coming to you from SIBOS in London!

359

359. News: Cardmageddon

David Brear and Sarah Kocianski are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: SCA is here! (Kinda), GoCardless launches in the US, and accordingly to The Telegraph students are getting payday loans to help fund their love of avocado on toast. All this and much more on today's Fintech Insider News.

358

358. Insights: Financial Crime - The weakest link

David Brear, Will White and Nas Ahmed are joined by some great guests to talk about some financial crime on this insights show!

114

114. Why do regulators hate libra?

We. Are. Here. Today we bring you: Santander settles big ethereum bond, Vitalik Buterin does some speaking and the Latest From Europe: Libra You’re not Wanted! All this and much more on today's Blockchain insider!

49

49. The future of travel insurance

Sarah Kocianski and Nigel Walsh are joined by Paul Prendegast from Blink and Alex Rainey from Pluto to talk about everything travel insurance, and how some new interesting players are shaking up the way customers are covered when they travel!

357

357. News: The financial sector’s meltdown

Jason Bates and Simon Taylor are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Banks get taken by surprise by last-minute PPI claims, China’s richest man steps down from Alibaba and N26 Launch in Switzerland, but they do not support Swiss Francs! All this and much more on todays Fintech Insider!

356

356. Interviews: Erik Qualman, author of Socialnomics

Sam Maule is joined by motivational speaker and bestselling author Erik Qualman, to chat about his book Socialnomics, transforming technologies and the importance of competition in the financial industries!

113

113. What is the value in bitcoin?

We. Are. Here. Today we bring you: Binance to land in the US, BAKKT Launch edges closer and maximalists can’t meme…...apparently. All this, and much more on todays Blockchain Insider.

355

355. News: Google knows best

Sarah Kocianski and David Brear are joined by some great guests to talk about some of the most interesting stories of the last 7 days, including: Digital banks are set to treble their customer numbers in 2020, Singapore starts accepting their first applications for digital banks and LinkedIn announce their top 25 startups of 2019 - you might recognise some of the names! All this and much more on todays fintech insiders!

112

112. Should crypto stay decentralised?

We. Are. Here. Today we bring you: Telegram ramp up their crypto efforts, a $1 billion crypto venture and should crypto stay decentralised?

112

112. Decentralised point of trust

We. Are. Here. Today we bring you: Telegram ramp up their crypto efforts, a $1 billion crypto venture and should crypto stay decentralised?

48

48. Insurance for the rental market

Sarah Kocianski is joined by Jude Greer, Reposit and Nick Willis, Wrisk to talk about how insurtech is shaking up the rental market and consumer protection when renting their homes.

354

354. Interviews: Boe Hartman, CTO Marcus by Goldman Sachs

Sam Maule is in NYC and joined by Boe Hartman CTO and Partner at Marcus by Goldman Sachs to talk about some great topics, including the origin story of Marcus and what's driven its success to date.

354

354. Interview: Boe Hartman, CTO Marcus by Goldman Sachs

Sam Maule is in NYC and joined by Boe Hartman CTO and Partner at Marcus by Goldman Sachs to talk about some great topics, including the origin story of Marcus and what's driven its success to date.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)