Global

Leda Writes for Fintech Futures: something for nothing

Each week, Leda Glyptis, CEO of 11:FS Foundry, creates #LedaWrites. This week she discusses diversity and ensuring every voice in the room is heard.

The fintech market is saturated. How do you differentiate?

At 11:FS, our mantra is digital banking is only 1% finished – meaning we’ve got a long way to go before banking becomes truly digital. This is an exciting place to be, but how will we get there? 11:FS CEO David M. Brear answered that question at the Technology Disrupting Finance conference in Oulu, Finland. Watch his keynote here and read 5 takeaways below.

No ordinary matter: Atom, will.i.am and the currency of trust

It’s fair to say that Anthony Thomson knows a thing, or three, about setting up challenger banks. He recently talked to Simon Taylor about customer centricity, Techfin and Australian banking.

Leda Writes for Fintech Futures: a banker goes a-banking - Part 4.

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week...Volume 5 (in a likely ongoing series) of her personal banking saga.

Apple vs Spotify: who will own podcasting?

Recent news that Apple is talking to media companies about exclusive shows is another indication of how podcasts are maturing. Who will win? And what could it mean for creators and consumers?

6 takeaways from the Facebook Libra Senate and House hearings

Libra’s David Marcus went before the Senate and the House to talk crypto, Facebook and the end of financial stability. This was epic. Here’s what we learned (and what we didn’t).

Leda Writes for Fintech Futures: wishful thinking and self-fulfilling prophecies

Every Thursday, Leda Glyptis, CEO of 11:FS Foundry creates #LedaWrites. This week she tackles the precariousness of hope, risk taking and work life imbalance.

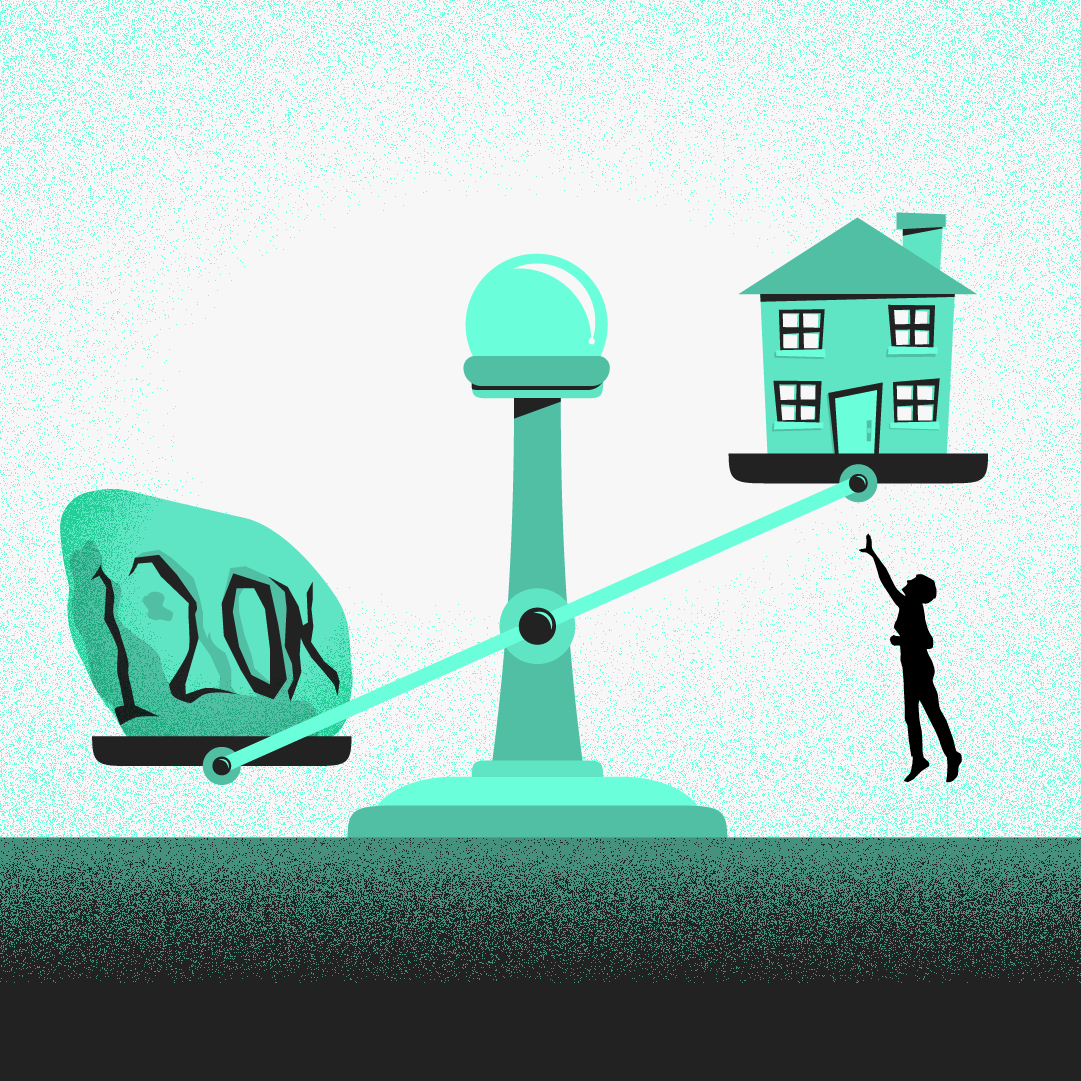

Vadim Toader - Proportunity: mortgage innovation putting homes within reach

Creating a successful new venture is not easy. There are many pitfalls and risks involved from funding to technology. The biggest challenge though is designing something customers love.

Q&A with Urban Jungle: building an insurtech offering

Banking no longer has the luxury of getting up to speed with new technology. If you can’t adapt on the fly you’ll be left behind.

Leda Writes for Fintech Futures: humanity 101

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she's defending bankers.

Ethical is the new luxury; why trust is slipping through the banks' fingers

Open banking payments are already a fact of life in Europe. In the US, not so much. But new infrastructure and the right approach could lead to a sea change stateside. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

What does Libra from Facebook mean for banks?

Rumours emerged a fortnight ago that Revolut was near to closing a $250 million round at a valuation of over $1 billion. The company confirmed the news this morning, saying its valuation had increased 5x since it raised $66 million in the middle of last year and now stands at $1.7 billion. The round was led by Hong Kong based DST Global and the cash injection will be used to fund global expansion, starting with the US, Canada, Hong Kong, Singapore, and Australia this year alone.

Getting people management right: the burden of proof

Fintech sandboxes have been a huge success both home and away with the FCA having just opened applications for the fifth cohort in the UK and exporting the concept globally. Now the FCA is looking to go beyond the sandbox to create the Global Fintech Innovation Network (GFIN).

Leda Writes for Fintech Futures: Caffeine and angry bankers

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to career tips for optimists, curious cats and rebels…and auntie Mabel.

Why have regulators reacted so strongly to Libra by Facebook?

It didn't take long. Within hours of Libra being announced the global regulatory system had plenty of opinions on what it meant and how it needed to be governed.

334

334. Fintech Insider Interviews: Money20/20 Payments Special

In today's episode, we bring you a series of interviews with the people behind some of the most interesting companies in the payments, straight from Money20/20 in Amsterdam! Interviews include Harsh Sinha from Transferwise, Patrick Gauthier from Amazon Pay, Roland Palmer from Alipay and Mark Barnett from Mastercard!

102

102. Libra: The banks are sh***ing themselves

We. Are. Here. Today we bring you: Libra, libra and more libra, Bank of England's Mark Carney positive on DLT and Bitcoin futures. All this and so much more on today's episode.

43

43. News: Buzzword Bingo

Sarah and Nigel are joined by a couple of great guests this week to talk about the most interesting stories happening in insurtech over the past couple of weeks.

333

333. News: Everybody knows a Dave

David and Simon are joined by some great guests to talk about some of the most interesting stories of the last 7 days. Including: The winners from the latest RBS Remedies pool, Monzo heads Stateside and Dave can help your credit score!

101

101. Libra: Facebook's world domination

We. Are. Here. Today we bring you: Zuckerberg's world domination plans, Block.One's social media platform and an amazing interview with Wei Shou from Binance!

Bonus: Sir Geoffrey Vos, Chancellor of the High Court

We. Are. Here. In today's bonus episode of Blockchain Insider, we bring you a fantastic interview with Sir Geoffrey Vos, Chancellor of the High Court and chair of the UK Jurisdiction Taskforce.

331

331. News: With great data comes great responsibility.

Simon Taylor and Brandon Chung are joined by some great guests to talk about some of the most interesting stories of the last 7 days. Including: The FCA’s major overhaul of overdrafts, The finale for Finn and Banking and Big Macs in Russia.

330

330. Interviews: Patrick Collison, CEO of Stripe

In today's episode, we bring you an interview with the extraordinary Patrick Collison, CEO of Stripe! David Brear meets him on stage at Money20/20 Europe in Amsterdam, to talk about all things Stripe, industry dynamics and the importance of being open to partnership.

100

100. Live: Bitcoin - not just for Lamborghinis!

We. Are. Here. We are actually here! We are coming to you live from Level39 in London, to celebrate episode 100 of Blockchain Insider! In this episode, we will be looking back at our 99 previous episodes and we are of course joined by some brilliant guests!

42

42. US startup special

Sarah is joined by Sam Maule in this special episode in which we bring you three interviews with some of the most interesting players on the American insurtech scene! Today we will hear from Quentin Coolen from Waffle, Ryan Rugg from R3 Corda and Rashmi Melgiri from CoverWallet! We hope you enjoy these interviews as much as we enjoyed recording them!

Live from Money20/20: Why tokens might be the future of finance

We. Are. Here. LIVE from Money20/20! Today's episode is coming straight from the stage at Money20/20, from which we bring you a discussion of Centralised VS Decentralised, Utilities vs. Securities and Future of Programmable money!

327

327. News: Boom Time

David and Simon are joined by some great guests to talk about some of the most interesting stories from the last 7 days. Including: Global Payments buy TSYS, NatWest apologises for patronising women, by patronising women, and are Revolut the most complained about fintech?

326

326. Fintech Insider Live at FusionONE - a new era of finance

We are coming to you live from FusionONE! In this live episode, Simon and Sarah are joined by some great guests to talk about the new era of finance being shaped by open platforms, emerging technologies, and the rise of the talent in the developer community.

99

99. Blockchain for mashed potatoes

We. Are. Here. Today we bring you: Facebook and crypto...the love story continues, Central Bank Digital Currencies and Is your Wine Legit? Ft. EY & a blockchain!

41

41. Shutting down Gatwick

Sarah and Nigel are joined by some fantastic guests today to talk about drone insurance, a topic that we have been very excited about for a long time (it has just taken us a while to get this episode together) so here we are!

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)