Global

The risk of fintech blanding

How many times have you looked at a job posting only to see the mention of free fruit? Sure it’s nice to have free food, but what purpose does it serve and does it have anything to do with employee wellbeing?

8 takeaways from our latest Banking as a Service episode

The fourth episode of our brand-new video series, Decoding: Banking as a Service, is here! If you missed it (or any of the others) catch up here. Here’s a rundown of this episode if you prefer reading to watching 📖

How to turn outdated corporate identities into fresh opportunities

Behavioural design is the process of using psychological insights into how people think and act irrationally, to design better products and services. Sounds good, right? But…er… what does that actually look like?

What is the future of payments? We head to FinTech Connect 2020 to find out

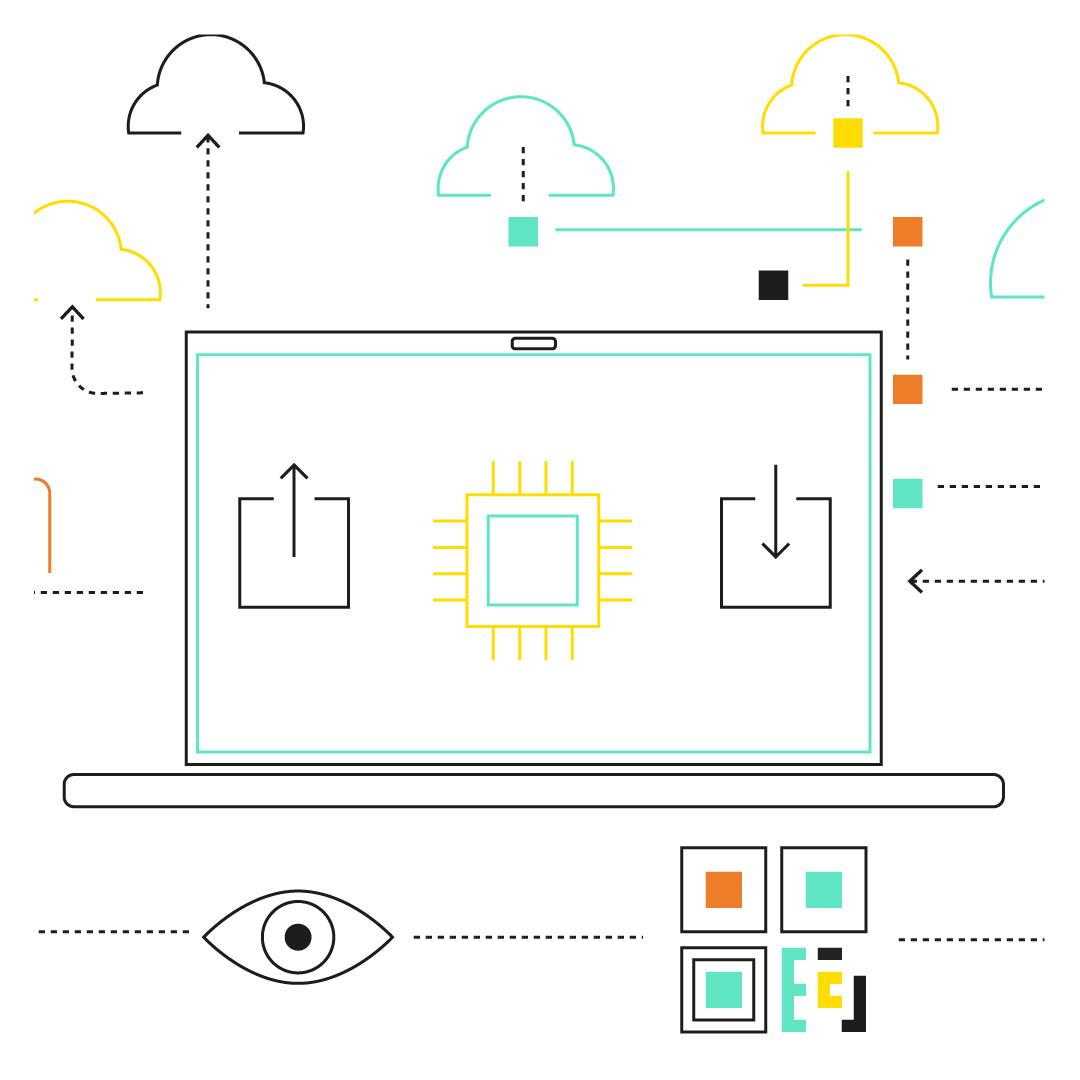

Businesses are slowly awakening to the idea that it's time to consider new sources of growth when it comes to securing their futures. They’ve realised that, sometimes, designing the most engaging customer value propositions requires leaning on the brand strength of other players outside of your domain.

Buy Now Pay Later: Love it or hate it, you can’t ignore it

Buy Now Pay Later (BNPL) is one of the hottest trends in fintech. The concept of 0% finance has been around for decades, but it’s caught fire in the last 3 years with new market entrants like Affirm, Afterpay and Klarna transforming how this works for consumers in an e-commerce setting. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

What is embedded finance?

While FinTech folk salivate – and the big banks bloviate – about PSD2 and the open banking reforms coming our way in 2018, we wondered whether those outside of this bubble will actually notice? What does PSD2 actually mean for customers?

The future of banking: all paths lead to lending

A Black-owned bank is defined as one in which at least 50% of voting shares are owned by African-Americans. They’re a dwindling force in the States today.

Crafting impactful design principles

Throughout history, humans have found direction from statements of intent that suggest 'better' ways of living.

Why is BaaS so hot right now?

The first episode of our brand-new video series, Decoding: Banking as a Service, is live! If you missed it, catch up here. Here’s a rundown of the episode if you prefer reading to watching 📖

In defence of virtue signalling

Nothing’s worse than not having any options, but having too many can be just as bad.

7 reasons Banking as a Service is a game changer

We now live in a world where almost anyone can build and launch innovative, regulated financial products as easily as they can create a Shopify page - that’s the magic of Banking as a Service (BaaS).

Goldman Sachs is leaning into embedded finance: other banks should take note

As 11:FS wraps up its 5th year in business, we can’t help but think about what the next 5 will look like. And our ambitions are big. It’s only just on the right side of scary.

Is the future really cashless?

Richard Brown, CTO at R3, says that blockchain allows us to, for the first time, build systems and technologies that run between different organisations that don’t trust each other and bring them to consensus. This means potentially significant savings for financial services, especially in file reconciliation and manual activity. For blockchain to succeed in finance, multiple firms must work together, and Corda is helping to do just that.

Using the cloud to fly sky high above the competition

As we roll into 2018 thoughts inevitably turn to the big themes that we might expect (and hope) to see for user experience in the financial services industry this year.

Jobs to be Done: How to help US SMBs keep their personal assets separate from their business finances

Jobs To Be Done (JTBD) is a theory. Its main aim is to explain why customers start - and stop - using different products and services in the market. Stripped down to the essentials, it’s a fairly straightforward concept first introduced by Harvard professor Clayton Christensen that can be adapted into a useful tool for product development.

90

90. The 'real' bitcoin market

We. Are. Here. Today we bring you: Square ramp up crypto unit, the ‘real’ Bitcoin market and a failed ICO turns to eBay.

307

307. News: Tinder for banking

David Brear and Jason Bates are joined by some great guests to talk about some of the most interesting stories of the last 7 days. Including: WorldPay sells to FIS for $35bn, Alipay does a thing with Barclaycard and a German bank lets its customers decide the dress code.

306

306. Interviews: Benoit Legrand, CIO of ING

CEO of ING, Benoit Legrand came on to the Fintech Insider podcast to talk with Simon Taylor about unsuccessful startup experiences, innovation from the outside in and much more.

89

89. Checkmate

We. Are. Here. Today we bring you: CBOE halt Bitcoin futures, Binance to the moon? And Deloitte puts ASX at checkmate.

36

36. Insights: Anthemis Takeover - investing in insurtech

Sarah and Nigel are being taken over by Anthemis this week! We're talking about what makes insurtechs attractive to the VC firm and why boring is beautiful.

305

305. News: Graceful degradation

Sarah and Simon are joined by some great guests to talk about some of the most interesting stories of the last 7 days. Including: RBS trials fingerprint credit cards, Visa told to hire PwC to help with outages and fintechs won big against incumbents at the British Bank Awards…and so did we!

304

304. Interviews: David Duffy, CEO of CYBG

CEO of CYBG, David Duffy came on to the Fintech Insider podcast to talk with Simon Taylor about banking in the age of fintech and challenging the challenger narrative.

88

88. Fire emoji

We. Are. Here. Today we bring you: BitGo exaggerate insurance coverage, tokenising equity and the owner of the Burj Khalifa plans an ICO.

303

303. News: Magic beans

Sarah and Simon are joined by some great guests to talk about some of the most interesting stories of the last 7 days. Including: The Revolut revelations rumble on, AI is a non-starter for 40% of startups and Grab gobbles $1.4 billion investment to build a super app.

302

302. Insights: Women in financial services

It's International Women's Day and we have a show packed full of content and views from some great women working in financial services today.

87

87. Forked off

We. Are. Here. Today we bring you: Thailand approves some cryptocurrencies, FaceCoin and Nivaura raise $20m

301

301. News: Not cashless but less cash

David and Sarah are joined by some great guests to talk about some of the most interesting stories of the last 7 days. Including: We take a look at the fallout of the RBS Remedies fund pool A results, Goldman Sachs takes a bite out of the credit card market by teaming up with Apple and Lithuania reveals its' Top Gear-inspired strategy to become a fintech hub

300

300. Insights: This. Is. Fintech.

It's our 300th episode! That calls for something a little bit special so we have a roundtable of our hosts plus the person who's the reason Fintech Insider exists.

86

86. Too legit to quit

We. Are. Here. Today we bring you: Brazilian Bank embrace crypto, a European exchange giant is jumping on the crypto bandwagon and XRP the STD...finally!

299

299. News: Buzzwords for everyone

David and Simon are joined by Tom Blomfield and Romi Savova to talk about some of the most interesting stories of the last 7 days. Including: Britain's banks predicted to reveal the biggest profits since the financial crisis, the latest announcements from the RBS Remedies fund and Santander pays IBM $700M to help them transform.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)