Global

The Death of Omnichannel Banking

Lately I’ve noticed a few banks and fintechs wanting to “get started designing screens right away”. It seems great, but building the wrong thing is worse than building nothing at all.

FinTech Legend Leda Glyptis: If You Choose Who You Are, What You Do Will Follow

Over the past eight years, as a fintech founder who happens to be gay, I’ve met with 100+ corporate and institutional investors around the world.

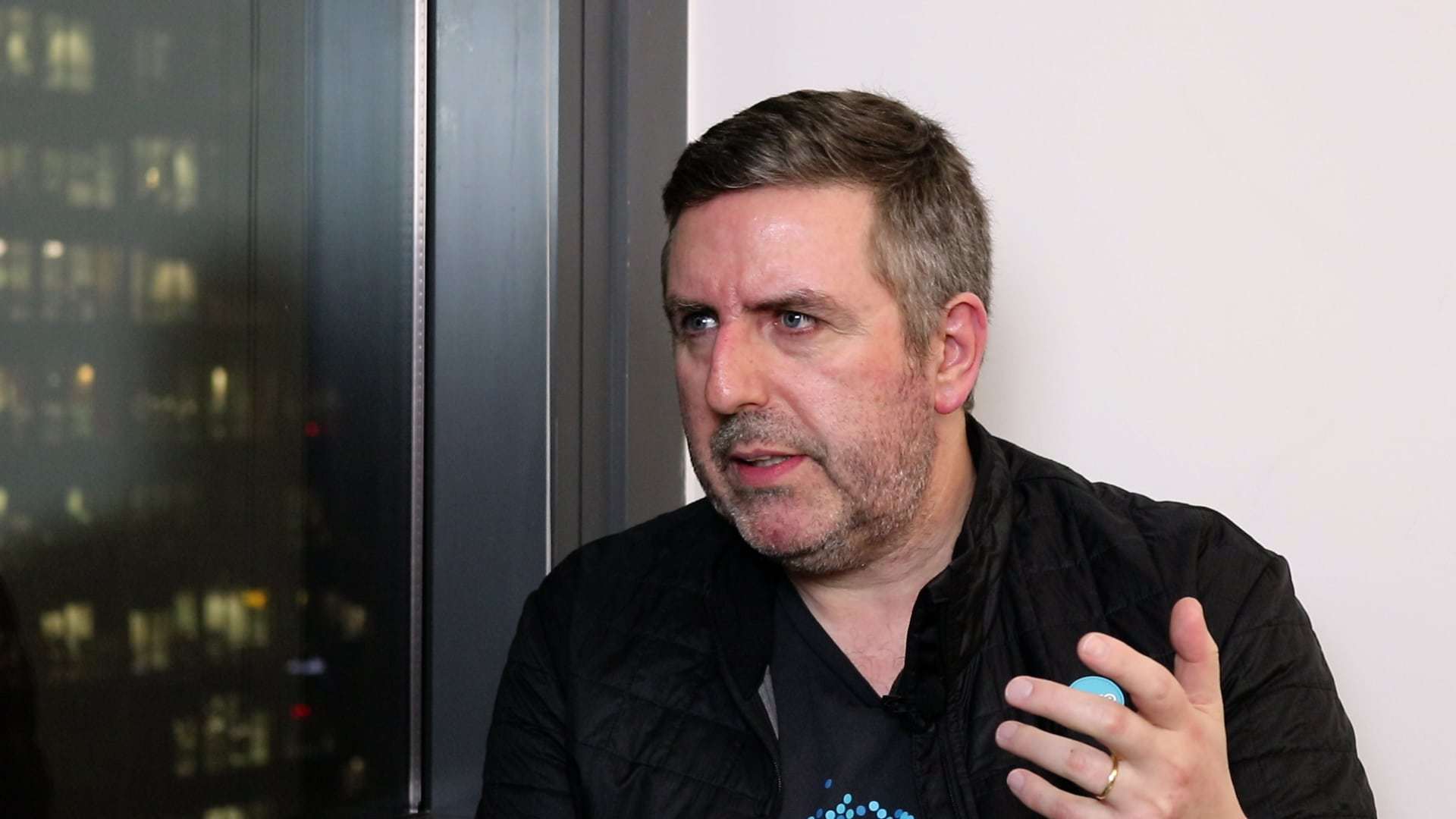

Xero: Giving 800,000 Business Owners Their Lives Back

Gary Turner is Co-Founder and Managing Director of Xero, which Forbes described as the “World’s Most Innovative Growth Company.” Xero provides small- to medium-sized businesses (SMBs or SMEs) with ‘beautiful’ online accounting software. Gary helped take Xero from a 3-person startup to a company that will have £150 million in revenue this year.

Swish: 3 Takeaways for Every Bank

How do we stay ahead of fraud and financial crime without compromising the speed, ease, and trust that make instant payments so compelling? In this article, Mastercard's Bryan Sharkey explores it all.

Digital Wealth Management: It’s All about the Offense

When people start explaining how technology can be used to modernise financial services their language instantly becomes fraught with acronyms, buzzwords, and idioms that can make little sense to those both inside, and especially, outside the industry.We have a hunch sometimes people do this to appear smart but we need to do more research!

‘Nicest Guy in Fintech’ on 'Golden Age of Finance'

Sam Maule, Director of Digital & Fintech at NTT DATA Americas, talks to us about how a kid from Detroit became a fintech leader, his new podcast, femtech, and Silicon Valley’s rude awakening.

Going Native: Force Touch, Siri, and Messages Payments

Goldman Sachs broke the fintechnet this week when it launched its developer portal, intentionally allowing companies to ‘embed finance’ within their organisation using their Banking as a Service (BaaS) offering. Hari Moorthy, Goldman’s Global Head of Transaction Banking, referred to it as “the financial cloud for corporates.” Cue a flurry of emails inside every large bank from CEOs wondering how seriously they should take this. Take it seriously. Take it very seriously.

It’s Blockchain, Not Bitcoin, That’s Relevant to Finance

Let’s start by calling Buy Now Pay Later (BNPL) what it is - debt. Debt, of course, has many faces. But ‘credit, pay in instalments, pay nothing today, etc.’ are all just debt. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

Gates Foundation Interview - What Banks Can Learn from the Frontline of Financial Inclusion

Over the past twelve months, we’ve been seriously busy here at 11:FS. Now we’re announcing arguably the most exciting project we’ve ever taken on.

"My Bank Already Has An App!"

That’s what 11:FS bank building guru Jason hears when he tells people that he’s just spent the last two years building a new digital bank, and they’re right!

Top 10 Things To Know About Blockchain This Week

The Pulse team spends their time trawling through the world of banks and fintech apps, sorting the good from the bad so you don’t have to.

Why Should a Central Bank Issue a Digital Currency?

In this blog post Simon Taylor explores the concept of a Central Bank Digital Currency and why you would want a DLT (or “Blockchain”) like architecture for such a system.

BaaP (Banking as a Platform) Part 2 - How could banks develop their platform levers?

If you missed Part 1 of this 2 part piece then you can catch it here and catch up with the rest of the class: BaaP (Banking as a Platform) Part 1 – Why haven’t we seen a banking platform play?

Jurassic Bank – Why banks will have to go the way of the dinosaurs

The landscape for fintech and banking is evolving more rapidly than ever, and in case you weren’t aware, there’s a war going on for your customers. With challengers attacking from left, right, and centre, it’s never been more important to stay on top of the latest and greatest UX innovation. Pssst – click here to go straight to the goods and request a demo of 11:FS Pulse.

BaaP Part 1 - Exploring Banking as a Platform (BaaP) Model

The opportunity to change the way we deliver financial services is changing as new channels, products and partnerships are being explored. Banking as a Platform (BaaP) is one of the alternatives.By me, David M. Brear, CEO and Co Founder at 11:FS and Pascal Bouvier, Venture Partner at Santander InnoVentures

124

124 Insights - Starling Bank Takeover

Fintech Insider takes over Starling Bank's offices to bring you this week's Insights Show!

7

7. Filecoin's record-breaking raise & Tezos launching a VC fund

Simon and Colin are joined by Capco's Sara Feenan, Tokeneconomy founder Stefano Bernadi and Jennifer O'Rourke of the Illinois Blockchain Initiative.

123

123. News: Data is the new oil

David and Chris are joined by Andrew Ellis, Strategy Lead at RBS; Sarah Kocianski, Business Insider reporter, and Sameer Chishty, founder of Streeton Partners for this week's news.

122

122. Interview - Phillip Keller & Harley Morlet, Tail

Meaghan Johnson interview Phillip Keller and Harley Morlet, CEO and co-founder of Tail

6

6. How to get a job in blockchain & Bitcoin Cash: week one roundup

In another packed episode Colin and Simon are joined by guests Chris Burniske and Zeth Couceiro.

2

2 Serial disruption

David and Nigel are back for episode two! They discuss the latest news and trends in insurtech, and also speak to Phoebe Hugh, CEO of Brolly.

2

2 Serial disruption

David and Nigel are back for episode two! They discuss the latest news and trends in insurtech, and also speak to Phoebe Hugh, CEO of Brolly.

121

121. News: Amazon is Everywhere

David is joined by fellow 11:FS co-founder, Meaghan Johnson, colleague and core banking guru Andra Sonea and Tanya Andreasyan, editor of Banking Technology for this week's news.

120

120. Interview: PwC Financial Wellness Report

David interviews Robert Churcher, Financial Strategy Lead at PwC Consulting and author of the Financial Wellness Report.

5

5. The Bitcoin Fork and Bitcoin Cash

This week we talk Bitcoin cash, BTC-e, Ethereum miners charting jumbo jets, and we hear from 3 fantastic guests.

118

118. News: Tokenaires and the Spiral of Complacency

Simon and David are joined by Sarah Kocianski to discuss the top stories of the last seven days.

4

4: The SEC verdict on ICOs, the Parity hack and bitcoin forks!

In a packed episode we talk about THAT Parity hack that unfolded last week, the upcoming bitcoin fork and we have an exclusive reaction to the SEC's verdict on ICOs and Tokens from Jeff Bandman, plus an interview with a very special guest: R3's CTO, Richard Brown.

116

116. Insights – Live from TNW 2017

In this episode: We bring you the highlights from The Next Web Conference 2017 in Amsterdam, where we spoke to […]

115

115. News: buying jewellery from a bank?

In this episode: David, Jason and Simon are joined for this week’s show by news show regulars Liz Lumley and […]

114

114. Interview – Mariano Belinky & Shachar Bialick

In this episode Jason Bates and David Brear interview Mariano Belinky, Managing Partner of Santander InnoVentures and Shachar Bialick, CEO of […]

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)