Global

Amber Baldet on Quorum, JPMorgan and when to use a blockchain

While at Money 20/20 in Las Vegas, Sam Maule, our Managing Partner of 11FS North America caught up with Amber Baldet, an Executive Director at JP Morgan, and the Programme Lead for Blockchain Centre of Excellence.

How to design a modern bank card

When building and growing any new business, our thought process is challenged consistently to ensure the proposed course of action delivers a positive impact. While applicable to all parts of a business, these conversations between teams developing new products are a daily occurrence. And no, they’re not always easy.

When 11:FS got their $100,000 session with Gary Vaynerchuk

David Brear and Jason Bates were put through their paces when they met Gary Vaynerchuk who gave them one of his famous $100,000 sessions.

Behavioural Economics in Financial Apps: Helping People Make Good Decisions

Behavioural Economics has been having a good few years. It’s a topic that’s won multiple Nobel prizes, saved the UK taxpayer hundreds of millions of pounds, and is rapidly becoming one of the tools used by the best product and policy designers around the world.

Celebrating Fintech Insider's 150th Episode - After Dark II: a Halloween special!

This week’s news show marks Fintech Insider’s 150th episode – and what an episode! Recorded live at our offices in London’s WeWork Aldgate, episode 150 was Fintech Insider: After Dark 2 – a news show with a difference.

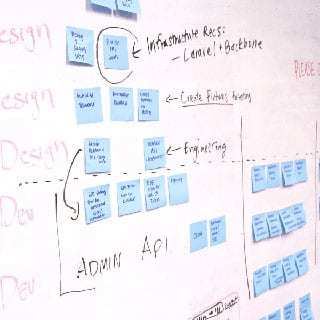

Leading Agile at Scale

At 11:FS we’re always looking to get young people into fintech. We want to recruit the new wave of young people coming in to the market who want to get ahead. Part of that is our internship programme. But we also take on young people looking for work experience, whether it’s to get a taste of the industry they love or to try something new.Lucy was at 11:FS recently for two days, working in our marketing department and getting to grips with what fintech really means. We asked her a few questions to see what she got out of the experience.

Brad Garlinghouse, Ripple CEO, on Swell, r3 and fixing payments in the US

Sam Maule interviewed Brad Garlinghouse, the CEO of Ripple at Ripple’s own event, Swell, in Toronto, for Blockchain Insider.

Niall Cameron on HSBC and fintech partnerships

We recently had the pleasure of welcoming a (fin)tech OG, Nick Ogden, to our offices to talk founding firms, online commerce and building ClearBank.

Open Source: Token Best Practice

Organisation design is essential in building a strong working culture. Getting it wrong can cause a domino effect of problems and inefficiencies across a business.

AI in banking is all about risk management

It is the nature of finance that, at its core, is risk.

Rod Drury on Xero's origin story, new partnerships & Xerocon

Here at 11:FS we’re big on transparency and letting you know what’s going on in our company. We’ve recently made a huge hire to be our COO and we couldn’t be more excited about it.

A global currency is coming, whether you like it or not

I was at a big bank’s conference the other day and was intrigued at how often the subject of cryptocurrencies and bitcoin came up.

Top 11 mobile banking features that your customers will love

Of course, these are our top 3 blogs of 2018. We took a look at the data, talked amongst ourselves about which ones we liked best and came up with the best blogs we’ve put out this year.

Don’t be too blasé about people loving Fintech

Disclaimer: Yes the piece is entirely structured around the lyrics of a Pulp song. Yes, we take requests.

Lessons from the Ice-Block King, Part II

I do not profess to be, as way too many in the tech industry do today, a blockchain guru or subject matter expert. I leave that designation to 11:FS co-founder Simon Taylor. Simon is the MacGyver of the blockchain community. Give him a stapler, a can of Bud Lite, Duct Tape, and a flashlight, and he will somehow concoct a DLT smart contract solution for a client. A solution that can actually be delivered and that addresses a real business case.

207

207. PFM: Don’t Call it a Comeback

In this episode Is PFM dead? Invisible? Or has Personal Financial Management evolved from data-driven piecharts to something more useful? […]

206

206. Trump’s New Deal for Britain, Ant Financial Goes Global

In this episode News, glorious news! We’ve switched up the format of the show in season 2. Every Monday, we’ll bring […]

202

202. APIs: Plug into Banking

In this episode What are APIs? We break it down in today’s episode with some great guests. But a little […]

201

201. Benoit Legrand, Global Head of FinTech at ING

In this episode Today we’re speaking to Benoit Legrand, Global Head of FinTech at ING. Benoit has more than 20 […]

200

200. Transaction Banking: From Zero to Hero

In this episode Transaction banking has been defined as “the plumbing of international business. It ensures that salaries get paid, money […]

136

136. Leda Glyptis, Banking & FinTech Legend

Leda Glyptis (@LedaGlyptis) should be first on your list for any dinner party. Full of wit and wisdom, this banking and […]

135

135. Digital Banking is Only 1 Percent Finished

Happy New Year from FinTech Insider! Wow, 2016 was an incredibly busy year for us. In addition to doing this […]

134

134. FinTech Predictions for 2017

Time to make fintech predictions for 2017! Will PSD II be the biggest disappoint of the year? How big will the challenger […]

133

133. 2016 FinTech Review – What a Crazy Ass Year Part 2

And now for part 2 of our 2016 FinTech Review — What a Crazy Ass Hear This Has Been. We discuss Pokémon […]

132

132. 2016 FinTech Review – What a Crazy Ass Year Part 1

You’ve had your holiday meals, now it’s time to digest 2016. What a crazy ass year this has been. Brexit. President Trump. […]

129

129. Xero: Giving 800,000 Business Owners Their Lives Back

In this episode Gary Turner is Co-Founder and Managing Director of Xero, which provides small- to medium sized businesses (SMBs […]

128

128. How FinTech is Revolutionising SMEs

In this episode Business banking sucks, but it doesn’t have to, say this week’s stellar guests. The CEO of Tide and Co-Founders of […]

127

127. Giving Banks FinTech Access Through One API

In this episode Onboarding a FinTech into a bank is expensive, due to acquisition and compliance costs, and the risks that […]

125

125. Blockchain’s Godfather & Wealth’s Superhero

In this episode Hello, FinTech Insiders! This week we chat with two awesome guests leading innovation in different areas: blockchain […]

124

124. Wealth: Robo-Advisors or Master of Puppets?

In this episode Wealth Management isn’t just for the super rich anymore. It’s opened up to everyone. But the reality is, most […]

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)