Global

Leda Writes for Fintech Futures: High school jocks living their best lives

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to hiring the people who make the best teams.

Leda Writes for Fintech Futures: situation not normal

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week finds her contemplating cheese.

11:FS COVID-19 Response

Never did I imagine 3 months ago that we’d be dealing with such an unprecedented global crisis as we have done with COVID-19.

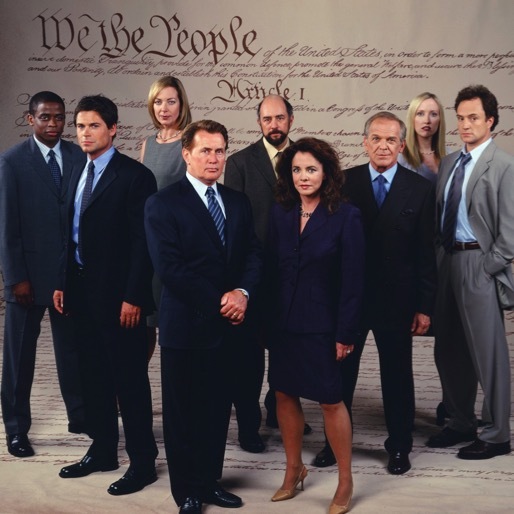

Leda Writes for Fintech Futures: everything I ever needed to know, I learned from The West Wing

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to the problems behind procurement and how to decide whether to build, buy or partner.

Lessons from COVID-19: you need a truly digital strategy, now!

In the first part of this series I introduced the story of Frederic Tudor, the American Ice-Block King; and discussed lessons learned from his then new product offering as it relates to blockchain technology. Tudor was able to successfully corner the ice-block shipping market and eventually was shipping blocks of ice to as far away as Calcutta from his home in Boston.

Is the COVID-19 crisis creating fintech M&A opportunities?

How can community banks remain competitive as large financial institutions gobble up more and more of the market?

Leda Writes for Fintech Futures: the in-between places

Every Thursday, Leda Glyptis, CEO of 11:FS Foundry creates #LedaWrites. This week she turns her thoughts, and thanks, to those in the Messy Middle.

Can digital lenders help more SMEs gain access to COVID-19 relief loans?

How successful have government loan schemes in the UK and US been so far and what’s next?

Leda Writes for Fintech Futures: on making your bed and having a future

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to Open Banking, doing almost nothing and doing everything.

Introducing The Fintech Marketing Podcast

11:FS Pulse is constantly loading more content and we’re always seeking new ways to create transparency in our product so you can understand the reasoning behind why some user journeys are so powerful.

Leda Writes for Fintech Futures: transformation in a post-apocalyptic world

Every Thursday, Leda Glyptis, 11:FS Chief of Staff creates #LedaWrites. This week she turns her attention to trust, consistency and the currency of credibility.

Jamie, me, and the value of connectivity

The number one reason why new propositions fail is that they do not find product market fit. No-one sets out to build a dud product; everyone is shooting for the moon. So what separates the breakthrough successes from the desperate failures? A key part of success is developing a purpose for your product and being able to strongly communicate why your product exists. Importantly, the 'why' is defined by focusing on customer outcomes, which is the reason many of the commoditised banking products lack any meaningful purpose.

Leda Writes for Fintech Futures: the patience of lambs

Each week, Leda Glyptis, CEO of 11:FS Foundry, creates #LedaWrites. This week she ponders what isn’t happening while bank decision-makers are busy pretending everything is in hand.

11:FS turns 4

It’s the 5th of April and that means one thing to us at 11:FS and that is that it’s our birthday! Four years old. Damn. And what a strange time to be in celebrating everything we’ve achieved with everything that’s going on.

Leading a bank through a pandemic

Guest author Richard Davies gives his thoughts on the importance of scaling agile to all functions of an organisation, and some key factors on how to get there.

637

637. Insights: What can crypto learn from TradFi?

David M. Bear is joined by some great guests, from Fintech Business Weekly and Railsr to ask what can the crypto industry learn from traditional finance?

635

635. Insights: How can payments companies compete?

David M. Brear is joined by some great guests, from Truelayer, Binance and Banking Circle, live from Money 20/20 to discuss how payments companies are adding more to their offerings to stay ahead of the competition!

163

163. Insights: Getting familiar with real world use cases

We. Are. Here. Today we bring you: a deep dive into real world use cases. We'll take a look at what real life use cases really means, cover some fantastic case studies and discuss what the role of wallets is within all of this. All this and much more on today's Blockchain Insider!

634

634. News: Alloy and Nova Credit partner to help migrants and green fintech initiative launched

Gwera Kiwana and Sim Rai are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Nova Credit Teams with Alloy on inclusive business lending, world's first green fintech taxonomy launched, and Sex Pistols launch God Save the Queen coin and NFT collection.

633

633. Insights: Will embedded finance make or break the fintech industry?

Gwera Kiwana is joined by some great guests, from NovoPayment, Treasury Prime and Anthemis, to find out who are the winners and losers of the embedded finance revolution.

Bonus. Diving deeper into Terra

Mauricio Magaldi and Simon Taylor take a deep dive into the Terra/LUNA story for this very special bonus episode of Blockchain Insider.

632

632. News: Klarna announces big layoffs while Chase bags UK customers

Benjamin Ensor and Sim Rai are joined by some great guests, from Tranch and Anthemis, to talk about the most interesting stories in financial services over the last 7 days, including: Klarna lays off 10% of its workforce via video message, Chase marks 500,000 UK customers, and our panel answers your questions!

Bonus: The metaverse is 1% finished

David M. Brear and Jason Bates are podcasting from the metaverse!

148

148. Insights: Understanding the Metaverse and Play to Earn

We. Are. Here. Today we bring you: an in depth conversation about all things Play To Earn and Metaverse. We’re going to be looking at the why, the what, and the how – with the help of some great expert guests in the Play to Earn space. All this and much more on today's Blockchain Insider!

559

559. Insights: Ask us anything!

David Brear, Simon Taylor and Jason Bates are here to answer all of your questions on our new Ask Me Anything episode. Tune in to hear more!

8

8. Roundtable: How do fintechs use performance marketing for growth? ft FNBO, Minna

In the fourth roundtable episode of Fintech Marketing Podcast, your host Mariette Ferreira takes a look at how fintechs use performance marketing for growth. Mariette is joined by a great panel of guests to help unpack this and dive a bit deeper into- wide array of tools and tactics, and every company will have its own flavour, from SEO, to PPC, to paid social, to affiliates. Some call it growth marketing, paid marketing, even (sadly) digital marketing.

5

5. First Direct: Understanding your brand ft Chris Pitt

In this week's episode of the Fintech Marketing Podcast, your host Eric Fulwiler is joined by Chris Pitt, CEO at First Direct - to discuss all things marketing - what makes it good, what makes it bad, and what every marketer needs to know to keep levelling up.

4

4. Roundtable: What does it really take to build a finance brand? ft Wise, Habito, Pensionbee

In the second roundtable episode of Fintech Marketing Podcast, your host Mariette Ferreira takes a look at what it really takes to build a finance brand. Mariette is joined by a great panel of guests to help unpick this and dive a bit deeper into trust - the core to brands in financial services, how to maintain your customer connection and your brand identity through a rebrand, building an impactful but lean brand, and much much more.

3

3. Citi: Working for the customer is critical ft Carla Zakhem-Hassan

In this week's episode of the Fintech Marketing Podcast, your host Eric Fulwiler is joined by Carla Zakhem-Hassan, CMO at Citi - to discuss all things marketing, and find out what inspires and motivates her.

2

2. Roundtable: What does good content marketing look like? ft Pleo, Freetrade

In the first roundtable episode of Fintech Marketing Podcast, your host Mariette Ferreira takes a look at what good content marketing looks like. Mariette is joined by a great panel of guests to help unpick this and dive a bit deeper in the quality, quantity, and growing trends.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)