Global

Introducing the new Brand Page on 11:FS Pulse

Bonjour! Comment allez-vous? France’s fintech star is rising. With over 1100 of them based in the capital alone, junior minister Cédric O has promised that Paris will eclipse London as the fintech hotspot in Europe in the near-distant future.

VR & AR: Transforming the Fintech Landscape

Asking the wrong questions will only ever lead to the wrong solutions. That’s why we lean into Jobs to be Done at 11:FS. It’s based on the notion that there’s no use in asking what the customer wants, because they don’t actually know. This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

The forever banks - how private banks are still unfazed by disruption

11:FS has come a long way in a short time, and as the company has grown up, so must the branding. It's time to sit down, take stock of how we look and sound and fine-tune our identity.

The future of AI in finance doesn't look like ChatGPT

We were lucky enough to catch up with Ben Metz, Head of Digital at Jack Henry. Here, he predicts who’ll come out on top in the banking war: the traditional players or the challengers, and what will decide who wins and loses.

Fintech will unlock the true essence of Islamic finance

Fintech has a big part to play in the fight against climate change and can help solve financial exclusion for millions worldwide. This article is the first in a trilogy on fintech for good. You can find the link to the second at the bottom of this one.

PSD3 is an innovation red herring

Take a peek behind the scenes of 11:FS Pulse. Keep reading to learn about the process 11:FS designers use to keep the Pulse product relevant, user friendly and ahead of the curve with a run through of the latest application of our design process.

Your product is only 20% unique (but that’s where you win)

I'm going to start with an unpopular opinion that we proposition design purists like to convince ourselves isn't true: sometimes it's ok to launch a clone.

It’s time to make year-end reviews more human

Hot on the heels of Revolut’s mega funding round and newly minted unicorn status two weeks ago comes another piece of good news for the European fintech industry — Swedish commerce platform iZettle is set to IPO.

What does legacy really mean?

One notable group of firms are missing from the initial Libra founding members: banks. So what could Libra mean for them?

How the financial services sector can win the war for tech talent

So you’re looking to scale agile Agile has become the status quo for most organisations delivering digital services. In recent years, conversation in the enterprise agile community has shifted to scaling agile.

Your community has to be at the heart of everything you do

I don’t know if I think about the Roman Empire every day, but awards submissions? I can’t seem to escape them.

Why every business should care about FedNow

The Federal Reserve hasn’t changed its payment system in more than 50 years. And while it’s operated with relative stability for that duration, the needs of businesses and their customers have evolved.

The rise of the NeoTrust: making dying less expensive

In a landscape where it’s so easy for people to switch between digital products and services, brands are having to work harder to get into the customer’s mind, and more importantly - to stay there. Standing out from the crowd is as important as ever. So why do fintechs look increasingly similar?

Where's the retail banking revolution?

We were promised that fintech disruptors were going to revolutionise banking and sweep away the legacy players forever. So, what happened?

How crypto can change SMB banking, now

Months after the UK entered a coronavirus-induced lockdown and financial services firms are struggling to service their customers. Building a digital first approach now can alleviate immediate issues and set firms up for sustained customer success.

262

262. Insights: Live from BBVA Open Summit!

On today's show, we're live at the BBVA Open Summit in Madrid. Simon Taylor takes a look at ecosystems, platforms and marketplaces in relation to the new digital transformation.

68

68. Tether the unstable coin plus a fireside chat with Blythe Masters

We. Are. Here. Simon and Sara are joined by our great guest Hugh Karp, to discuss the latest and greatest news in blockchain.

26

Insurtech Insider Episode 26: More news you need to know

On the latest episode of Insurtech Insider, Sarah and Nigel sit down with Dylan Bourguignon, shaking up our usual topic-based format we take a look at all the insurtech news that's happened in the past week.

261

261. News: Reinventing retail

On this week's episode, Simon and Ross sit down with Bill Gajda and Sian Lewin to discuss the latest and greatest news in fintech.

260

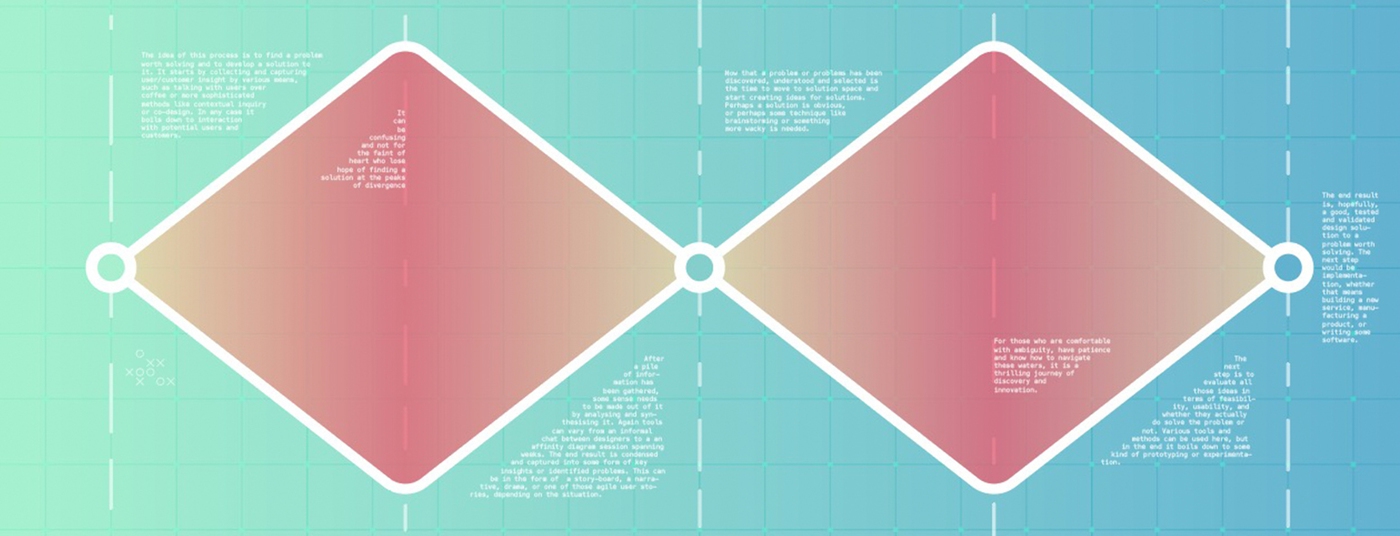

260. Insights: Product Design in fintech and banking

On today’s show, our host Jason Bates is going to take a bit of a deep dive into the world of product design for digital products in fintech and banking. We're using the classic double diamond of design to explain just what matters most in designing products and how to deliver products that matter to customers.

67

67. The CEO of Binance is [so] hot right now

We. Are. Here. Simon's joined by three great guests: Joon Ian Wong, Claire Wells and Aman Kohli to discuss the latest and greatest news in blockchain.

259

259. News: We are the news

On this week's episode, Simon and Ross sit down with Nina Mohanty, Lianna Brinded and Lesley-Ann Vaughan to discuss the latest and greatest news in fintech.

258

258. Insights: Healthtech

On today's show, David and Simon are with a great roundtable of health experts to take a look at what's happening in Healthtech.

66

66. Blockchain Live: Interviews (featuring Blockchain.com & Chorum)

We. Are. Here. Live from Olympia London at Blockchain Live! We were actually there last week. But we interviewed so many great people we're releasing a bumper episode filled with great insights. We interview Garrick Hileman and Xen Baynham-Herd from Blockchain as well as many more great guests.

25

Insurtech Insider Episode 25: Art Insurance

On the latest episode of Insurtech Insider, Sarah sits down with James Garthwaite and Luke Mullett to discuss all things Art Insurance.

65

65. Blockchain Live

We. Are. Here. Live from Olympia London at Blockchain Live! Simon and Colin are joined by a great guest, Teana Baker-Taylor to discuss the latest and greatest news in blockchain in front of a great live audience. We also have an exclusive interview with Dan and Brendan from Block.one.

256

256. Insights: PensionBee takeover

On this special episode, we're buzzing to be taken over by PensionBee. At their offices on Southwark street, we're with some of the top tier of PensionBee's team to bring you an insight into pensions.

255

255. News: Really great at charts

On this week's episode, David, Sam and Simon are sit down with Ahmed Zaidi and Kathryn Harris to discuss the latest and greatest news in fintech.

254

254. Interviews: Shamir Karkal, Co-Founder of Simple Bank

Sarah Kocianski interviews Co-Founder of Simple Bank, Shamir Karkal. They take a look at what it means to create a product that actually helps customers achieve their goals.

24

Insurtech Insider Episode 24: The news you need to know

On the latest episode of Insurtech Insider, Sarah and David sit down with Lea Nonninger and James York, shaking up our usual topic-based format we take a look at all the Insurtech news that's happened in the past week.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)