Global

Avoka's Derek Corcoran on banking pain points and best practices

Derek Corcoran, CEO (Chief Experience Officer, not Chief Executive) at Avoka, paid a flying visit to 11:FS, straight off the plane from Colorado, for a Fintech Insider interview with Simon Taylor. Listen to the interview in full here, stream it below or read on for the highlights.

The Tao of Rob Frohwein

We’re halfway through our list of the best and most popular blog posts of 2019, which begs the question: what will take the number one spot?

Are Autonomous Vehicles Driving Change for Insurance Models?

Want to know more about insurtech, insurance and the changes within this ripe-for-disruption industry? We have the show for you.

UX strategy in banking & financial services in 2018 - time to walk the walk!

In this guest blog, Vadim Toader, CEO and co-founder of Proportunity, examines how predictive technology and lending innovation can prevent home buying from becoming a fantasy.

Fintech Insider News: Banking's Kodak Moment and other stories

It’s a bank holiday so none of you should even be reading this but if you are kudos on being as dedicated to fintech as 11:FS. You can catch the full Fintech Insider take on the news today at 4pm on the podcast here. We’re doing something a little different in today’s blog. Let us know what you think in comments below or at Fintech Insider News. Fintech Insider hosts Ross and Sarah sat down with Sameer Gulati, Head of Policy and Regulation at Innovate Finance, Kathryn Harris, Innovation Lead at Lloyds, and James Hurley, Enterprise Editor at The Times to discuss the news, including one worrying report.

Digital asset management and crypto funds - how has the model changed?

Banks that take deposits and make loans have been around for over 600 years, which pretty much makes it as mature an industry as you can get. Surely banking is more like 99% complete than 1% done?

'Tis the Season for Open Banking

Kicking off 2018 in style on Fintech Insider David and Simon were joined by colleagues Andra Sonea and Benedict Shegog to tackle the latest news for the week, and look ahead to what 2018 has in store. And what does it have? Regulation, mostly. Listen to the episode in full here or play and read below

Anticipatory Design in Financial Services

What is anticipatory design? In 2015, Aaron Shapiro the CEO of Huge coined the phrase ‘Anticipatory Design’ to describe how the next big evolution in design and technology will be the creation of predictive, pro-active multi-channel user experiences. It is the perfect marriage of design, data and technology to simplify complex decisions and in some instances, even eliminate some tasks and decisions from our lives entirely. The word anticipatory comes from the Latin anticipare, which means “taking care of ahead of time”. Think of it as personalisation 2.0 – a system which interprets users’ past behaviours and choices, in order to automatically make informed decisions on the user’s behalf, by utilising machine learning algorithms.

11:FS Pulse Best of 2017 Awards

The 11:FS Pulse analysts spend all their time immersed in the world of fintech. Over the past year, we’ve seen hundreds of different products, features, and brands pass through our screens. With the fintech space moving so fast, there’s been a lot to love (and hate). For anyone working in the space that doesn’t currently have a Pulse license, we wanted to share the 2017 roundup we hashed out over a couple of beers in the Aldgate WeWork. Without further ado, here are the 11 brands that deserve recognition for 2017…

2018 Blockchain Predictions - Are YOU Ready?

TL;DR 2017 was the year that Bitcoin entered mainstream consciousness, from prime time news slots to wall to wall coverage on business networks. Bitcoin was the story in financial services and fintech this year. 2018 will be the year crypto has to grow up; it’s make-or-break time. Are you positioned to take advantage if it continues to grow?

Our 2018 Predictions

TL;DR The rollercoaster won’t stop anytime soon, we’re going to focus much more on cryptography and far less on the “currency” part (for now…).

Best of the blog 2017

As 2017 draws to a close we take a look back at our most popular blog posts from the last year written by our team or guest authors. Maybe we should have done 11…

Fintech Insider: After Dark III - The Christmas Special, 2017 Round-up

This week’s Fintech Insider News show was a departure from tradition. Instead of recording in our WeWork offices we took the team on tour, specifically on a pub crawl round London Bridge and Bermondsey and recorded the news show as we went! Listen to the episode in full here, stream it below or read on for the highlights.

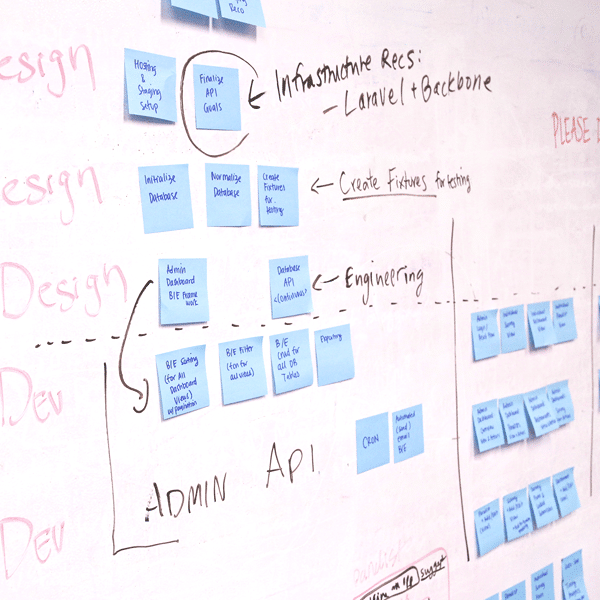

Risk management for agile and ecosystems

Jason Bates interviewed Ritu Liu, Head of EMEA at Alipay at Money20/20 Europe. They spoke about Alipay’s European expansion and her view of Chinese advancements in fintech that are influencing the rest of the world.

Amber Baldet on Quorum, JPMorgan and when to use a blockchain

While at Money 20/20 in Las Vegas, Sam Maule, our Managing Partner of 11FS North America caught up with Amber Baldet, an Executive Director at JP Morgan, and the Programme Lead for Blockchain Centre of Excellence.

637

637. Insights: What can crypto learn from TradFi?

David M. Bear is joined by some great guests, from Fintech Business Weekly and Railsr to ask what can the crypto industry learn from traditional finance?

635

635. Insights: How can payments companies compete?

David M. Brear is joined by some great guests, from Truelayer, Binance and Banking Circle, live from Money 20/20 to discuss how payments companies are adding more to their offerings to stay ahead of the competition!

163

163. Insights: Getting familiar with real world use cases

We. Are. Here. Today we bring you: a deep dive into real world use cases. We'll take a look at what real life use cases really means, cover some fantastic case studies and discuss what the role of wallets is within all of this. All this and much more on today's Blockchain Insider!

634

634. News: Alloy and Nova Credit partner to help migrants and green fintech initiative launched

Gwera Kiwana and Sim Rai are joined by some great guests to talk about the most interesting stories in financial services over the last 7 days, including: Nova Credit Teams with Alloy on inclusive business lending, world's first green fintech taxonomy launched, and Sex Pistols launch God Save the Queen coin and NFT collection.

633

633. Insights: Will embedded finance make or break the fintech industry?

Gwera Kiwana is joined by some great guests, from NovoPayment, Treasury Prime and Anthemis, to find out who are the winners and losers of the embedded finance revolution.

Bonus. Diving deeper into Terra

Mauricio Magaldi and Simon Taylor take a deep dive into the Terra/LUNA story for this very special bonus episode of Blockchain Insider.

632

632. News: Klarna announces big layoffs while Chase bags UK customers

Benjamin Ensor and Sim Rai are joined by some great guests, from Tranch and Anthemis, to talk about the most interesting stories in financial services over the last 7 days, including: Klarna lays off 10% of its workforce via video message, Chase marks 500,000 UK customers, and our panel answers your questions!

Bonus: The metaverse is 1% finished

David M. Brear and Jason Bates are podcasting from the metaverse!

148

148. Insights: Understanding the Metaverse and Play to Earn

We. Are. Here. Today we bring you: an in depth conversation about all things Play To Earn and Metaverse. We’re going to be looking at the why, the what, and the how – with the help of some great expert guests in the Play to Earn space. All this and much more on today's Blockchain Insider!

559

559. Insights: Ask us anything!

David Brear, Simon Taylor and Jason Bates are here to answer all of your questions on our new Ask Me Anything episode. Tune in to hear more!

8

8. Roundtable: How do fintechs use performance marketing for growth? ft FNBO, Minna

In the fourth roundtable episode of Fintech Marketing Podcast, your host Mariette Ferreira takes a look at how fintechs use performance marketing for growth. Mariette is joined by a great panel of guests to help unpack this and dive a bit deeper into- wide array of tools and tactics, and every company will have its own flavour, from SEO, to PPC, to paid social, to affiliates. Some call it growth marketing, paid marketing, even (sadly) digital marketing.

5

5. First Direct: Understanding your brand ft Chris Pitt

In this week's episode of the Fintech Marketing Podcast, your host Eric Fulwiler is joined by Chris Pitt, CEO at First Direct - to discuss all things marketing - what makes it good, what makes it bad, and what every marketer needs to know to keep levelling up.

4

4. Roundtable: What does it really take to build a finance brand? ft Wise, Habito, Pensionbee

In the second roundtable episode of Fintech Marketing Podcast, your host Mariette Ferreira takes a look at what it really takes to build a finance brand. Mariette is joined by a great panel of guests to help unpick this and dive a bit deeper into trust - the core to brands in financial services, how to maintain your customer connection and your brand identity through a rebrand, building an impactful but lean brand, and much much more.

3

3. Citi: Working for the customer is critical ft Carla Zakhem-Hassan

In this week's episode of the Fintech Marketing Podcast, your host Eric Fulwiler is joined by Carla Zakhem-Hassan, CMO at Citi - to discuss all things marketing, and find out what inspires and motivates her.

2

2. Roundtable: What does good content marketing look like? ft Pleo, Freetrade

In the first roundtable episode of Fintech Marketing Podcast, your host Mariette Ferreira takes a look at what good content marketing looks like. Mariette is joined by a great panel of guests to help unpick this and dive a bit deeper in the quality, quantity, and growing trends.

Banks are losing the loyalty game | 11:FS Explores

Hey, banks! This might sting a bit. You’re getting loyalty all wrong - and it’s costing you customers. But all is not lost!

3 ways AI is shaking up UX in financial services | 11:FS Explores

The entire world is buzzing about AI, and that ain't changing anytime soon. But as AI becomes more integrated into our daily lives, what impact will it have on financial services and how people interact with them?

What are fintechs? - Decoding: Banks

Ever wanted to know what’s going on behind the scenes every time we make a payment?

How does banking regulation work? - Decoding: Banks

Regulation is essential. It stops banks from going bust or behaving badly.

How has software evolution influenced banking? - Decoding: Banks

The invention of the computer revolutionised banking in the 1950s.

How does lending work? - Decoding: Banks

Lending has been around for thousands of years and is one of the cornerstones of banking.

How can traditional banks win on the banking battlefield? - Decoding: Banks

They're down, but they're not certainly not out.

How do card networks operate? - Decoding: Banks

Mastercard and Visa are the two biggest credit card networks in the world.

How has the banking battlefield evolved? - Decoding: Banks

We kick off our Decoding: Banks series with a look at the banking landscape today and how we got here.

11:FS Explores: Legacy banking systems ft. David M. Brear

David M. Brear, our 11:FS CEO, takes us through legacy technology within banks - but of course, with a really cool Lightboard.

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

The UK banking battlefield has never been more competitive. Customers expectfinancial apps that are personalised, seamless, and that genuinely make a differenc...

960

Insights: The future of Revolut with UKCEO Francesca Carlesi

960

.svg)

.svg)